Often, stories that are in the limelight tend to achieve fair valuation or are overvalued. On the other hand, there are quality under-the-radar stocks that can surprise.

Genius Sports (GENI) stock seems like a hidden gem that’s positioned to create value in 2026. In the last 12 months, GENI stock has trended higher by 27%. With an impending growth acceleration, the price action is likely to be meaningful.

Recently, Benchmark named the sports data stock as its top pick for 2026 in the enterprise data management sector. The Benchmark analyst believes that the bullish view is backed by “accelerating media monetization” and “structurally improving data-driven engagement.” Further, operating leverage is likely to translate into sustained cash flows.

About Genius Sports Stock

Genius Sports is a developer and seller of technology-driven products and services to the sports and sports betting industry. The company has a presence in 150 countries globally with partnerships with more than 400 leagues & federations, 650 sportsbook partners, 250 brands & advertisers, and more than 50 broadcasters.

For FY 2025, Genius Sports expects revenue of $655 million and an adjusted EBITDA of $136 million. This implies an adjusted EBITDA margin of 21%.

While the growth outlook is positive for FY 2026 and beyond, GENI stock has traded marginally higher by 6% in the past six months. This seems like a good accumulation opportunity.

Ambitious Growth Targets

At the Investors Day event on Dec. 3, Genius Sports unveiled aggressive growth targets. From revenue of $655 million in 2025, the company expects to deliver revenue of $1.2 billion by 2028. This would imply a CAGR of 22%.

Further, adjusted EBITDA is expected at $365 million and would imply an adjusted EBITDA margin of 30%. Therefore, in the next three years, EBITDA margin expansion is likely at 900 basis points.

Genius Sports also has an attractive free cash flow target of $220 million by 2028. One factor that supports cash flow visibility is its long-term contracts. As a matter of fact, 70% to 80% of the company’s revenue comes from fixed fees.

With the prospect of robust cash flows, the company is also targeting M&A opportunities that would strengthen the technology platform and boost the company’s monetization capabilities. In September 2025, Genius Sports acquired Sports Innovation Lab. With a focus on data, analytics, and insights, the acquisition will fast-track the expansion of Genius Sports’ media business.

It’s worth noting that the global regulated online sports betting market was worth $69 billion in 2025. The market is expected to swell to $118 billion by 2030. Additionally, the sports- or fan-focused global digital ad market is worth $100 billion. In November, a B. Riley analyst opined that once “regulatory clarity emerges,” prediction markets can be another growth catalyst for Genius Sports.

Therefore, a big addressable market supports the company’s ambitious target for the next few years. The growth target is also supported by the company’s diversified geographical presence. For the year ended December 2024, Genius Sports derived 50% of its revenue from Europe and 44% from the Americas. There is ample scope for growth in other emerging markets globally.

What Analysts Say About GENI Stock

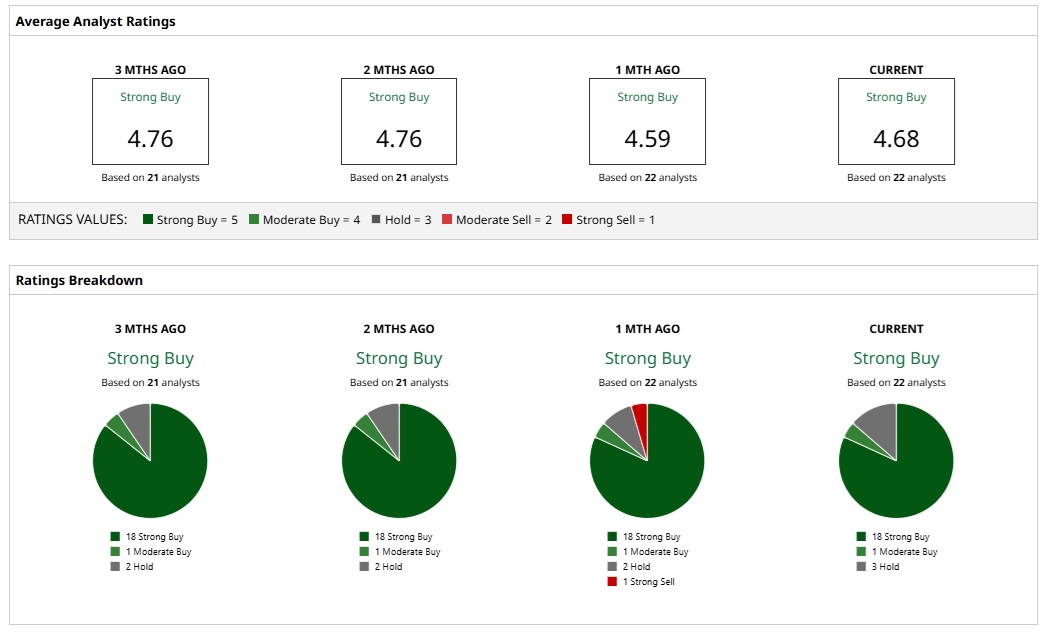

Based on the ratings of 22 analysts, GENI stock is a consensus “Strong Buy.” While 18 analysts assign a “Strong Buy” rating to GENI, one analyst has a “Moderate Buy” rating, and three analysts have a “Hold” rating.

Based on these ratings, analysts have a mean price target of $15.21 currently, which would imply an upside potential of 41%. Further, with the most bullish price target of $17, the upside potential for GENI stock is 58%.

For fiscal year 2026, analysts expect earnings growth of 112.9% for Genius Sports. The potential for significant growth acceleration underscores the “Strong Buy” view of an overwhelming majority of analysts.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

/The%20CrowdStrike%20logo%20on%20an%20office%20building%20by%20bluestork%20via%20Shutterstock.jpg)