FTAI Aviation (FTAI) rewrote its growth narrative on Tuesday, Dec. 30, when its shares surged to a record high following the launch of FTAI Power. The venture converts CFM56 aircraft engines into 25-megawatt power turbines, with plans to manufacture more than 100 units annually from 2026, monetizing existing assets into instant energy capacity.

Explosive demand from artificial intelligence (AI) hyperscalers has compressed timelines for reliable electricity. FTAI Aviation positions FTAI Power as a rapid-response partner for the AI economy, which demands massive power volumes delivered faster and with greater flexibility. This strategy expands FTAI’s relevance from aviation cycles into structural digital infrastructure demand.

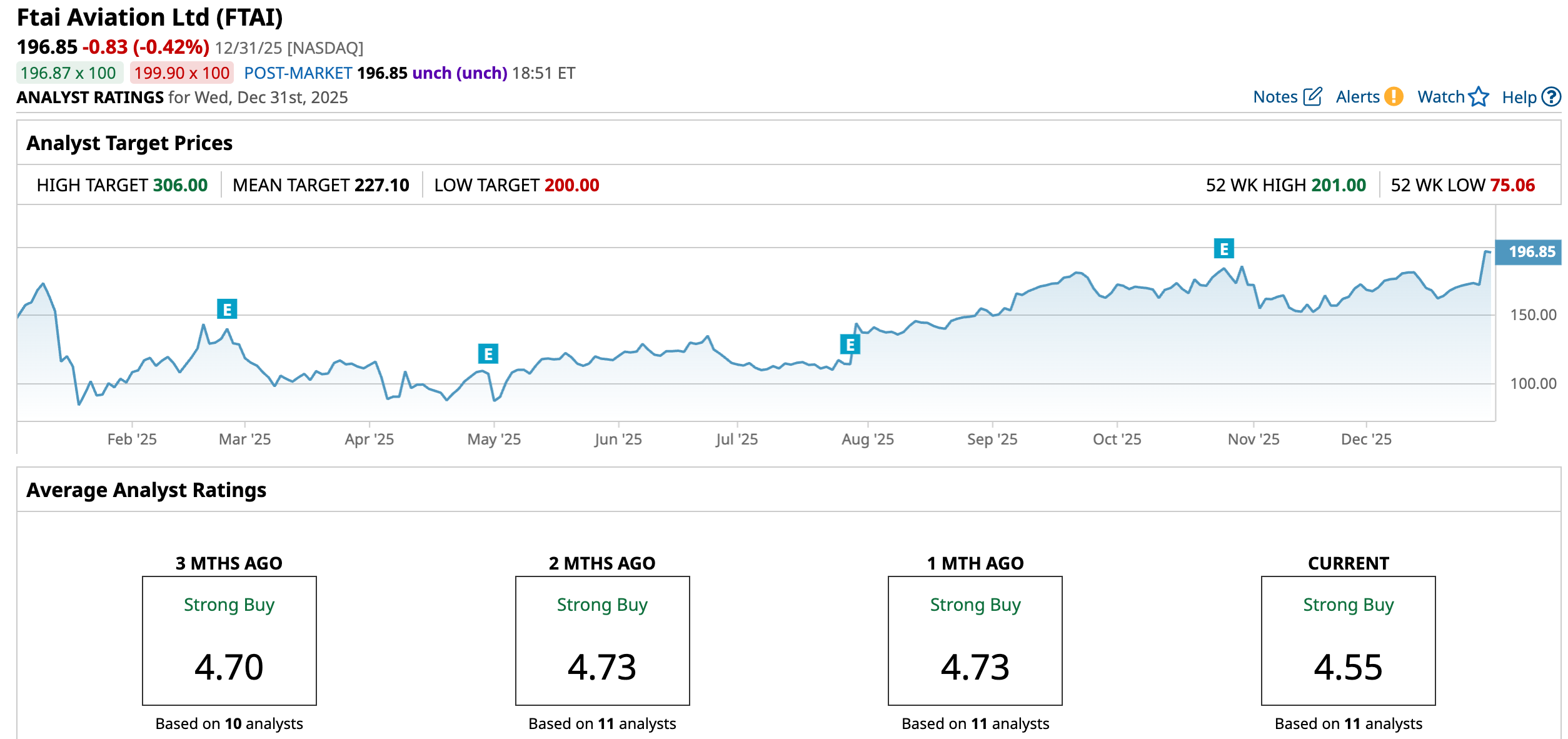

Markets responded swiftly to this incremental revenue lever, which deploys FTAI’s maintenance expertise against a global power shortfall. Shares touched a 52-week high of $199.88, rising roughly 14.4% in a single session. Against this backdrop, let us explore how investors can position themselves as the company’s growth narrative broadens.

About FTAI Aviation Stock

Headquartered in New York, FTAI owns, leases, and sells commercial aircraft and engines worldwide through its Aviation Leasing and Aerospace Products segments. The company also refurbishes aftermarket engine components and runs an offshore energy business supporting oil and gas operations.

With a market cap of nearly $20.18 billion, FTAI Aviation has rewarded shareholders handsomely. Its stock climbed 55.61% over the past 52 weeks, surged 71.11% in six months, and added another 13.63% in the past month, reflecting accelerating momentum and growing confidence in execution depth.

On valuation, FTAI currently trades at 7.9 times sales, a level that sits well above the industry average and its own five-year norm. The premium signals that the market has already priced in strong execution and sustained growth.

Income investors also received a tangible signal of strength. FTAI Aviation raised its quarterly dividend to $0.35 per share from $0.30, supported by strong free cash flow. The latest $0.35 cash dividend was paid on Nov. 19 to shareholders on record as of Nov. 10.

A Closer Look at FTAI Aviation’s Q3 Earnings

On Oct. 27, FTAI Aviation reported its Q3 fiscal 2025 results, delivering revenue in line with expectations but softer-than-anticipated profitability. Total revenue increased 43.2% year-over-year (YOY) to $667.1 million, closely matching analyst estimates of $665.5 million.

EPS increased 44.7% from the year-ago period to $1.10, yet fell short of the $1.24 consensus estimate. The earnings miss briefly dominated investor focus, but it masked several operational strengths that continued to reinforce the company’s longer-term growth trajectory and execution capability.

Net income climbed 45.9% YOY to $114 million. Also, the balance sheet strengthened materially, with cash and cash equivalents surging to $509.9 million at quarter-end, compared with $115.1 million on Dec. 31, 2024.

Looking forward, management has struck a confident tone by raising its 2026 adjusted EBITDA guidance from $1.4 billion to $1.525 billion. The outlook includes approximately $1 billion from Aerospace Products and $525 million from Aviation Leasing, underscoring balanced, multi-engine growth across the portfolio.

On the other hand, analysts call for Q4 fiscal 2025 EPS growth of 45.2% YOY to $1.22, while full-year fiscal 2025 earnings are expected to surge 116.4% to $4.76. Fiscal 2026 bottom line is projected to rise another 41.8% to $6.75.

What Do Analysts Expect for FTAI Aviation Stock?

FTAI stock received a fresh reaffirmation of confidence as BTIG analyst Andre Madrid reiterated a “Buy” rating and maintained its $230 price target, consistent with prior views.

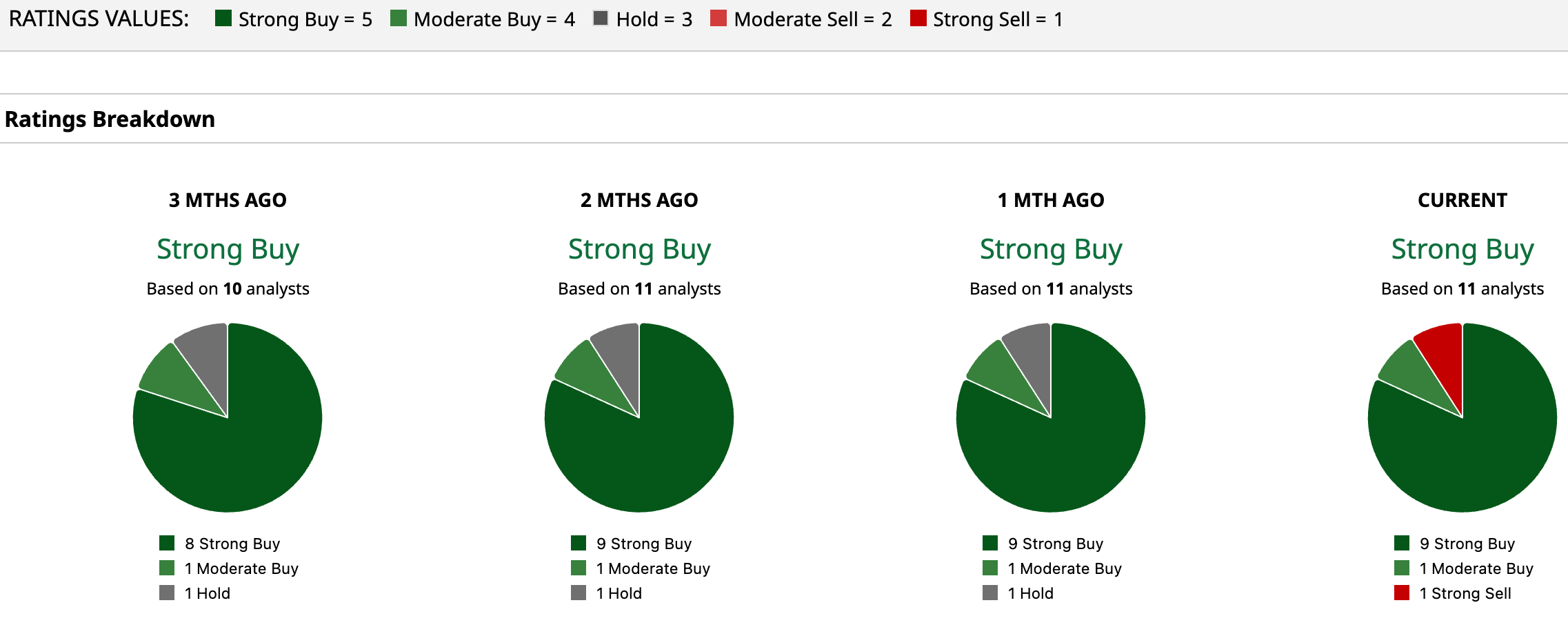

The view aligns with broader Wall Street sentiment, which remains constructive and anchored by a “Strong Buy” consensus rating across the analyst community. Among 11 analysts tracking the stock, nine recommend a “Strong Buy,” one suggests a “Moderate Buy,” and only one flags a “Strong Sell.”

FTAI’s average price target of $227.10 implies a gain of 15.37%, while the Street-high target of $306 suggests potential upside of 55.49% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/AI%20software%20engineering%20by%20Tapati%20Rinchumrus%20via%20Shutterstock.jpg)