/AI%20(artificial%20intelligence)/AI%20software%20engineering%20by%20Tapati%20Rinchumrus%20via%20Shutterstock.jpg)

As we head into the new year, Wedbush analysts, led by Dan Ives, made it clear that cybersecurity giant CrowdStrike Holdings (CRWD) is one of their favorite tech names for 2026.

While artificial intelligence (AI) remains a Wall Street keyword, CrowdStrike is expected to continue benefiting from the “AI cybersecurity trend” due to the popularity and “stickiness” of the company’s Falcon platform.

Also, they noted CrowdStrike's strategic steps to integrate AI into its platform as the threat landscape evolves. Wedbush analysts maintained an “Outperform” rating on CrowdStrike’s stock and a $600 price target, implying 24.7% upside from current levels.

Furthermore, Jim Cramer believes the stock might be one of the “best of breed” in that market. Hence, it might be a cybersecurity stock to invest in now.

About CrowdStrike Stock

Headquartered in Austin, Texas, CrowdStrike leads in cybersecurity through its cloud-based endpoint security and threat intelligence services. The firm operates a unified Falcon platform that combines endpoint detection, analytics, and response capabilities to shield enterprises from evolving cyber risks.

The company harnesses AI and cloud technology to enable swift threat identification and mitigation. This scalable approach minimizes breach response times and supports clients across industries. The company has a market capitalization of $121.31 billion.

Robust demand for cybersecurity tools drove the stock surge, as businesses ramped up spending amid escalating cyber risks. CrowdStrike’s Falcon platform grew through feature additions, driving higher subscription revenue.

Over the past 52 weeks, the stock has gained 34.23%, while over the past six months it has declined 4.57%. CrowdStrike’s shares had reached a 52-week high of $566.90 in November, but are down 18.7% from that level.

CrowdStrike’s stock is trading at a stretched valuation. Its price-to-non-GAAP earnings multiple is 114.76x, considerably higher than the industry average of 24.55X.

CrowdStrike’s Q3 FY2026 Results Were Better Than Expected

On Dec. 2, CrowdStrike reported its third-quarter results for fiscal 2026 (quarter ended Oct. 31), which exceeded expectations. The company’s revenue increased 22.2% year-over-year (YOY) to $1.23 billion. This was higher than the $1.21 billion that Wall Street analysts had expected.

The top line increase was primarily due to subscription revenue rising by 21.4% from the prior year’s period to $1.17 billion. CrowdStrike’s annual recurring revenue (ARR) increased 23% YOY to $4.92 billion as of the end of the third quarter. Out of this, $265.30 million was net new ARR added during the quarter.

This quarter also marked steps that bolstered CrowdStrike’s operations. The company acquired Pangea, an AI security firm, and its Charlotte AI offering received Federal Risk and Authorization Management Program (FedRAMP) High Authorization. Additionally, the company highlighted notable partnerships with Amazon Web Services (AWS) (AMZN), Intel (INTC), Meta (META), NVIDIA (NVDA), and Salesforce (CRM) to secure the future of enterprise AI.

As of Oct. 31, CrowdStrike observed module adoption rates of 49%, 34%, and 24% among customers using six-plus, seven-plus, and eight-plus modules, respectively. CrowdStrike’s profitability also grew. Its non-GAAP EPS was $0.96 for the quarter, up 26.3% from $0.76 in the year-ago quarter and above the $0.94 Wall Street analysts expected.

Expecting to further capitalize on the AI-driven demand, the company raised its fiscal 2026 guidance. CrowdStrike anticipates at least 50% YOY net new ARR growth in the second half of fiscal 2026 and remains optimistic about achieving 20% net new ARR expansion for fiscal 2027, building on the heightened projections. CrowdStrike expects its fiscal 2026 revenue to be in the range of $4.80 billion - $4.81 billion.

Wall Street analysts have a mixed view about CrowdStrike’s bottom-line trajectory. For the current fiscal year, its EPS is expected to drop by 57.1% YOY to $0.21. On the other hand, for fiscal 2027, the company’s EPS is projected to increase by 295.2% annually to $0.83.

What Do Analysts Think About CrowdStrike Stock?

In addition to Wedbush analysts, Wall Street analysts have generally been bullish on CrowdStrike’s stock. In December, Morgan Stanley analyst Keith Weiss raised the stock price target from $515 to $537 despite maintaining an “Equal-Weight” rating. Stephens & Co. analyst Todd Weller reiterated an “Overweight” rating on CrowdStrike and reaffirmed a $590 price target.

In the same month, analysts at Freedom Capital Markets raised the stock rating from “Hold” to “Buy” amid strong demand in the cybersecurity sector, particularly for comprehensive platform-based solutions. They also raised the stock’s price target from $430 to $550.

Following the company’s Q3 earnings report, Citigroup analyst Fatima Boolani maintained a “Buy” rating and raised the price target from $575 to $595. Noting product momentum, Goldman Sachs analysts raised the price target from $535 to $564 after the Q3 results, while maintaining their “Buy” rating.

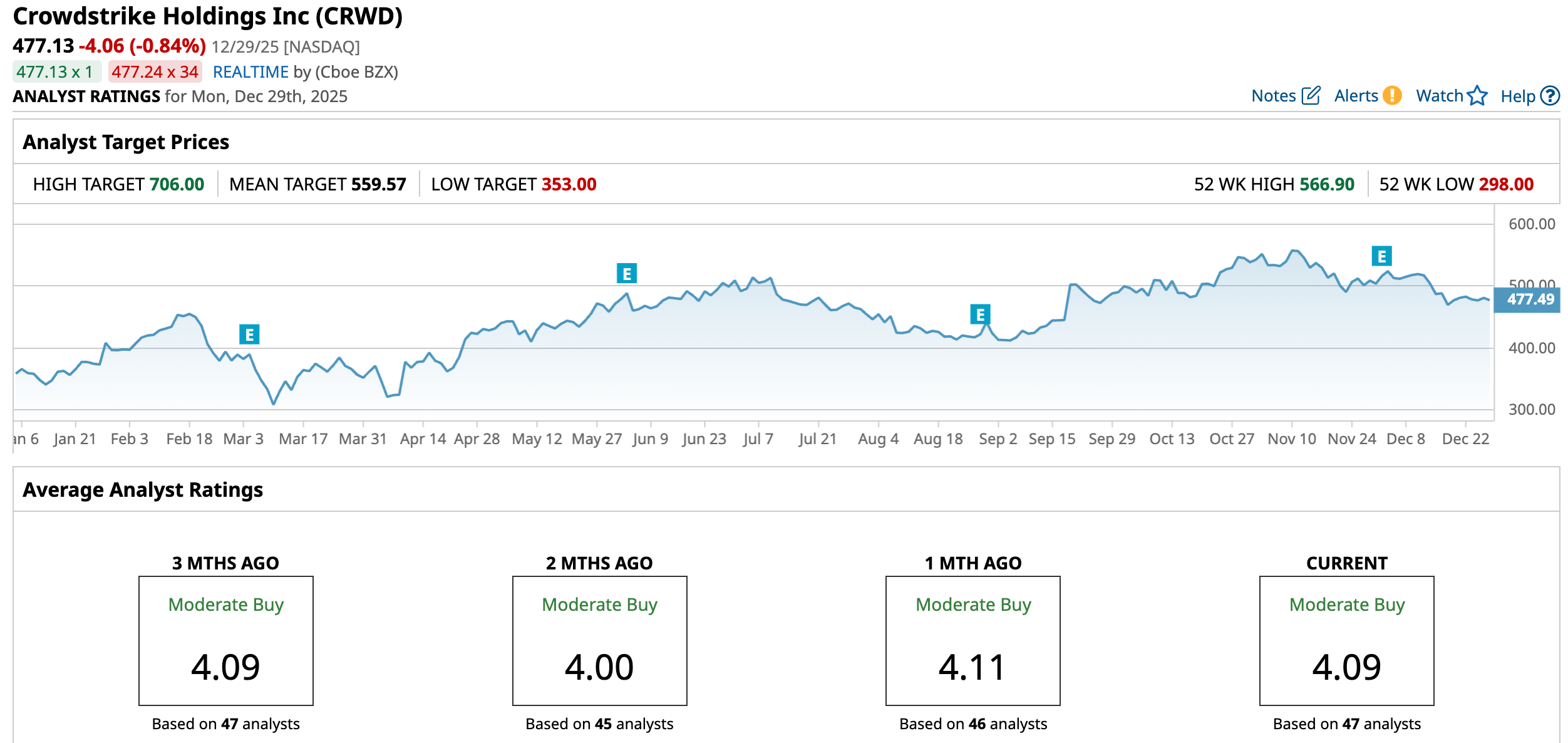

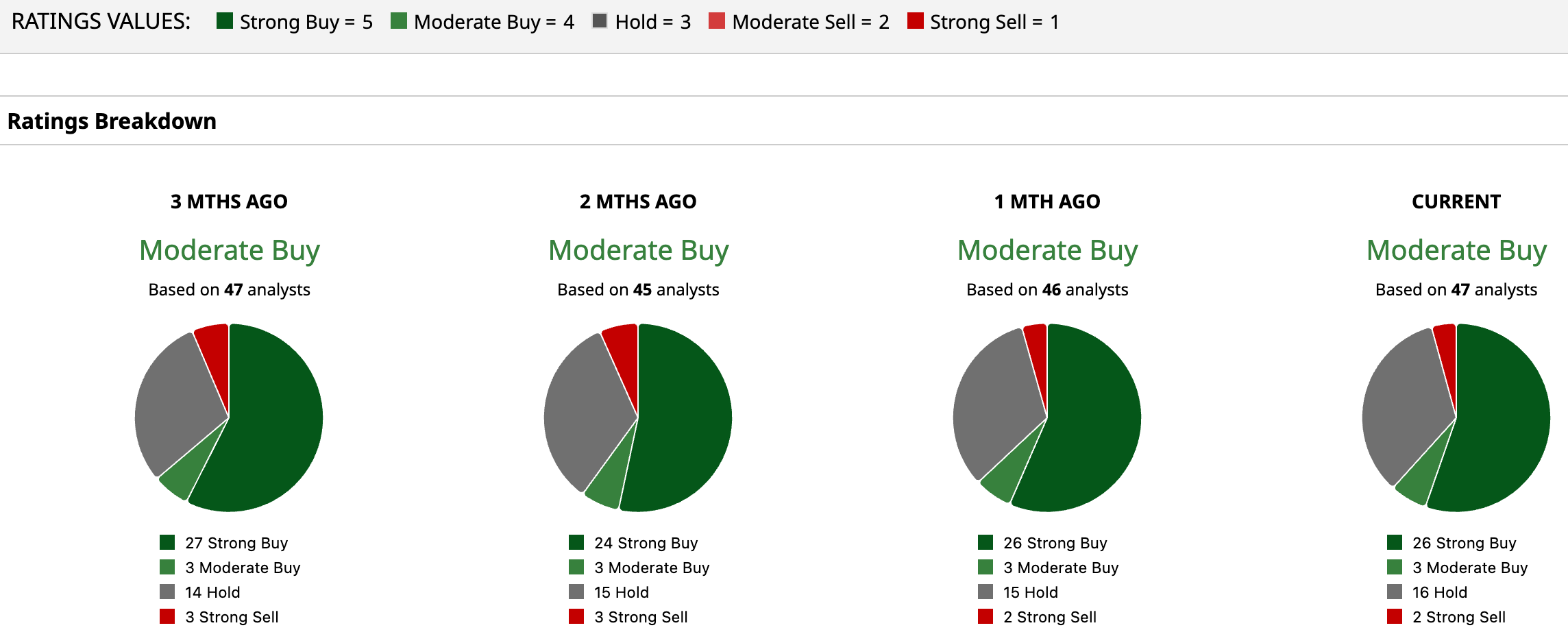

CrowdStrike is a well-known name on Wall Street, with analysts awarding it a consensus “Moderate Buy” rating. Of the 47 analysts rating the stock, 26 rate it a “Strong Buy,” three rate it a “Moderate Buy,” 16 rate it a “Hold,” and two rate it a “Strong Sell.” The consensus price target of $559.57 represents a 17.28% upside from current levels. The Street-high price target of $706 indicates a 47.97% upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)