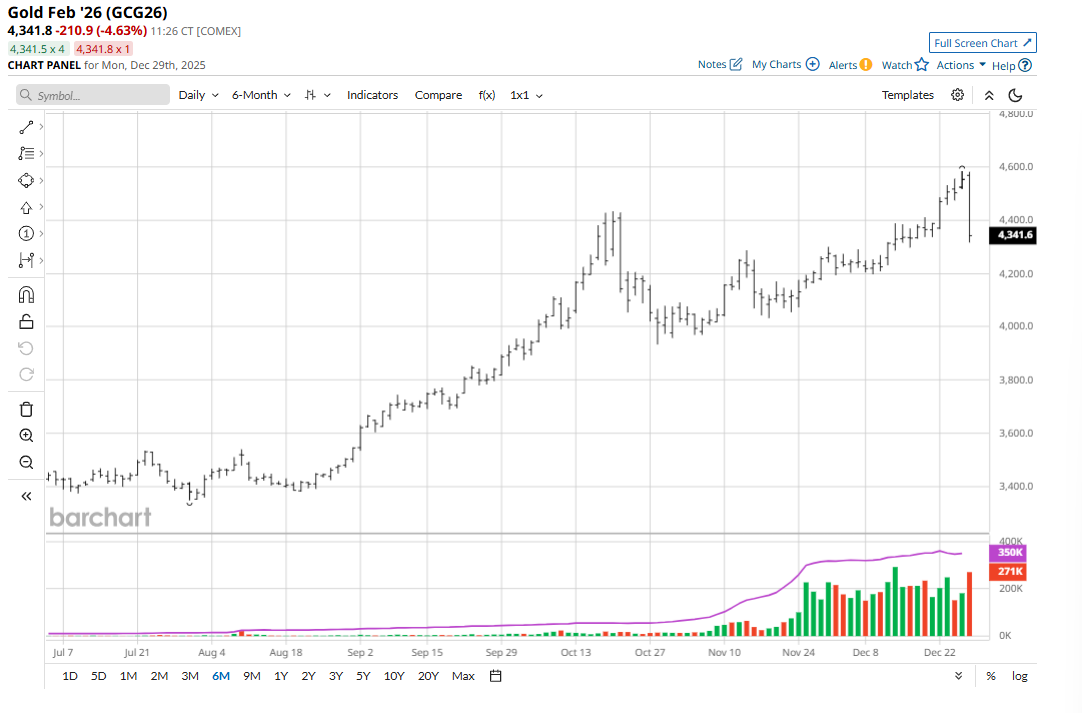

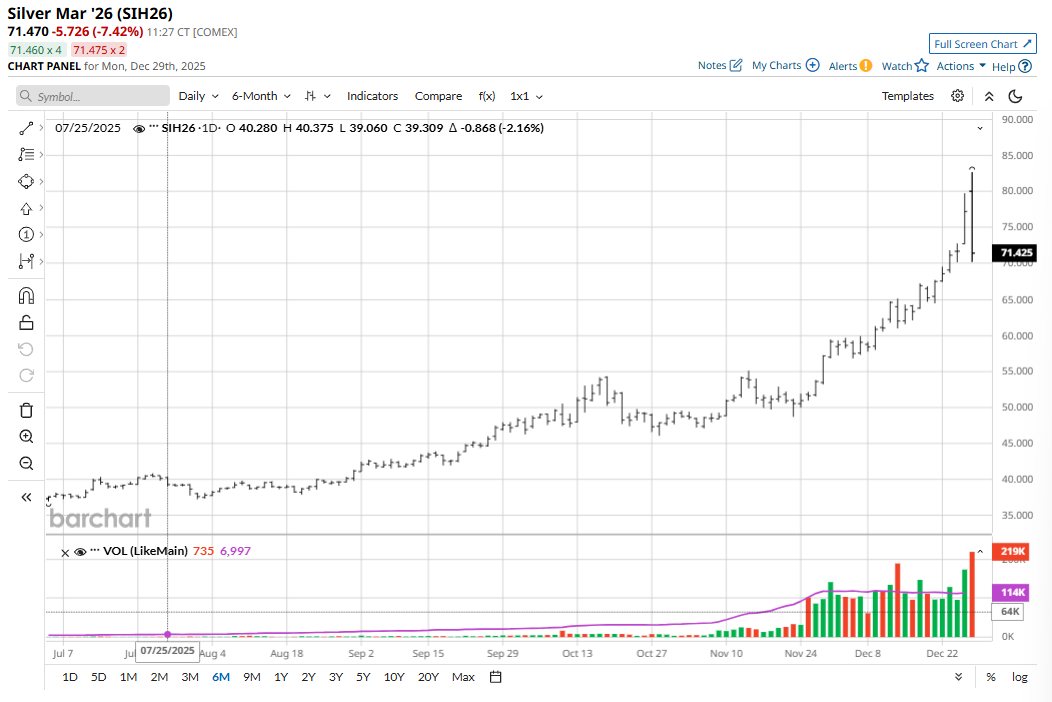

February Comex gold (GCG26) futures Friday hit another record high of $4,584.00 an ounce. March Comex silver (SIH26) prices today hit a new record high of $82.67 an ounce. The price moves in silver over the past few sessions are stunning. Friday’s daily price gains in silver (up over $7.00 on the day) are more than what the price of the silver market traded at in the mid-1980s, when I started covering the metals. Following are some observations from this 40-plus years participating in the metals market.

Silver has gone parabolic in market parlance. That means prices are moving nearly straight up on the daily bar chart. This price action is not sustainable and suggests that a near- to intermediate-term market top is close at hand — from a time perspective but not from a price perspective.

The popular Relative Strength Index for silver, when overlaid on a monthly continuation chart for nearby silver futures dating back to 1973, shows the present RSI reading of 93.86 at its highest (most overbought) reading since January 1980, when the RSI hit its record high reading of 98.77. Any RSI reading over 70.0 suggests the market is overdone on the upside and due for a corrective pullback. For perspective, in January 1980, silver futures hit a then-record high of $50.36. By March 1980 the price of silver dropped to a low of $15.10 an ounce.

The RSI for Comex gold futures this week hit a record high of 95.94. The second-highest RSI reading ever for gold was in January 1980, when the gold RSI hit 94.69. In January 1980, gold futures prices hit a then-record high of $875.00 an ounce. By March 1980, gold traded at a low of $453.00 — losing around half of its total value in less than three months.

History repeats itself in human nature and particularly in raw commodity markets. The Relative Strength Index numbers are shooting a major shot across the bow of the gold and silver market bulls.

I was fortunate enough to spend my early career working on the futures exchanges trading floors in Chicago and New York. It was a great learning experience, especially listening to the floor traders dole out sage wisdom. One of the things the veteran traders told me was that when the general media and the public catch wind of a markets development that has been playing out for some time — that’s a solid signal that the market event is close to climaxing. Earlier this week I was contacted by ABC News and National Public Radio regarding the strong price gains being posted in gold and silver. Indeed, it appears a whole lot of gold and silver traders are on one side of the boat — and especially the retail trading public.

The Bottom Line

The above bullet points are bearish warning signals for gold and silver traders. Here is a bullish element that has likely occurred: Gold and silver prices have moved to new plateaus that will act as price floors for many months or even many years to come.

Of course, nobody knows, but I’m suggesting the new major price floor for gold is $3,000. Just one year ago, in December 2024, the price of gold was around $2,700.00. I’m suggesting the new major price floor for silver is $45.00-$50.00. One year ago, the price for silver futures was around $30.00 an ounce.

Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock.jpg)

/Salesforce%20Inc%20logo%20on%20building-by%20Sundry%20Photography%20via%20Shutterstock.jpg)