Silver (SIH26) has always lived in the shadows of its lustrous cousin gold (GCG26), but this year it has stepped decisively into the spotlight. The non-ferrous metal has surged past the $80 mark for the first time ever, rewriting price history as investors search for refuge and relevance in a volatile world. Part safe haven, part industrial workhorse, silver now sits at the intersection of monetary anxiety and technological ambition. From solar panels and AI-driven data centers to electrification and energy storage, demand is no longer cyclical – it is structural.

This year’s rally has been historic, and recent gains have placed the metal on track for its strongest annual performance since 1979. Spot silver (SIY00) recently jumped to an all-time high near $86.45 briefly today before slipping below $72 again – a pullback driven by profit-taking after a parabolic run. Such swings are typical for silver, which often cool after sharp advances, even as analysts argue the broader uptrend remains supported by economic uncertainty, inflation pressures, and resilient demand heading into the new year.

But it’s up 147.57% year-to-date (YTD). Supply deficits, its designation as a U.S. critical mineral, strong institutional inflows, and a wave of retail interest – reported by The Wall Street Journal – have all added fuel. Expectations of easier U.S. monetary policy, a softer dollar, and ongoing geopolitical strain have only reinforced the trend.

This backdrop matters for investors looking beyond bullion. It brings Wheaton Precious Metals (WPM) into clear focus. As a leading precious-metals streaming company, Wheaton provides upfront capital to miners in exchange for long-term metal supply, avoiding many operational risks. After delivering stellar returns in 2025 and with analysts upbeat on WPM, the stock could be a smart way to play silver’s historic run. The stock increasingly looks like a buy now.

About Wheaton Precious Metals Stock

Founded in 2004 as Silver Wheaton and rebranded in 2017, Wheaton Precious Metals is a Vancouver-based streaming giant that profits from metals without digging them up. Instead of operating mines, it funds producers upfront in return for long-term metal supply at fixed, below-market prices. The model delivers leverage to rising precious-metal prices while sidestepping operational risk. Today, Wheaton carries a market capitalization of roughly $56.4 billion.

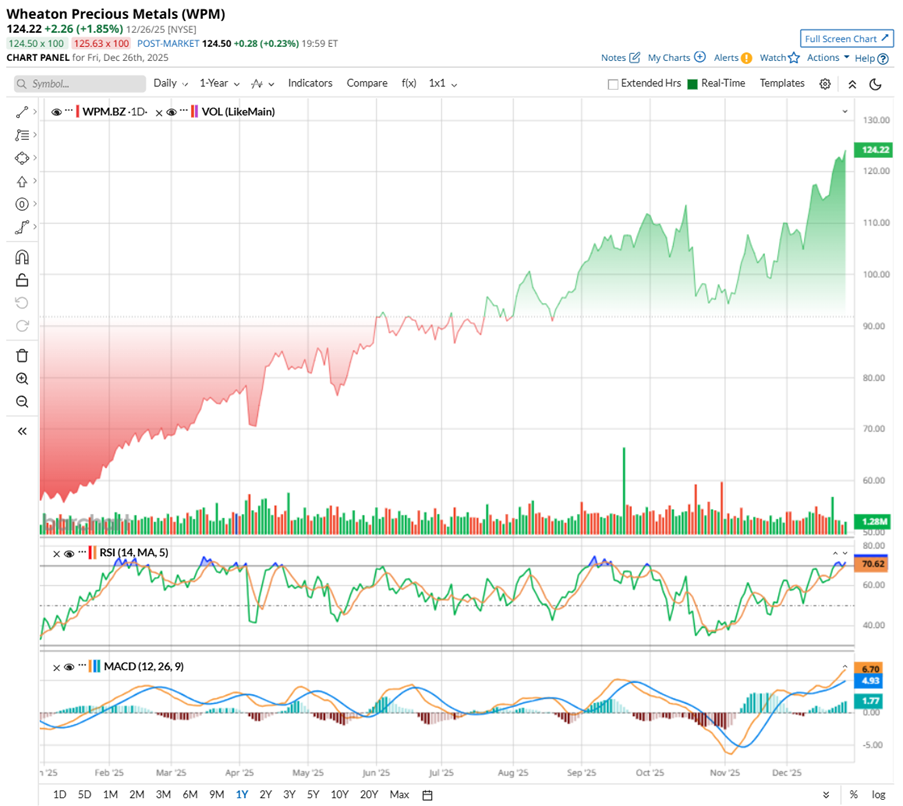

Shares of Wheaton have staged a powerful advance over the past year, climbing 144.14% over the past 52 weeks, and recently carving out a fresh all-time high of $124.30 on Dec. 26.

Technically, the 14-day RSI has shown signs of overbought territory in mid-December, hinting that a near-term pause or mild pullback would be healthy rather than alarming. But the current RSI stands at 56.47. Beneath the surface, momentum remains constructive – the MACD line has turned decisively higher and crossed above the signal line, while the histogram has flipped positive.

WPM stock does not sit in the bargain bin, and the current valuation reflects that reality. Priced at about 46.26 times forward adjusted earnings and 26.3 times forward sales, the stock commands a premium to both its peers and its own historical median, a reminder that the market is pricing in durability rather than optionality.

However, investors are not left empty-handed while they wait. Wheaton has built a 14-year record of uninterrupted dividends, quietly compounding trust along the way. Its latest quarterly payout of $0.165 per share lifts the annual dividend to $0.66 per share, offering a modest 0.53% yield. With a conservative payout ratio near 29%, the dividend story feels less stretched and more sustainable, leaving room for growth as cash flows expand.

Wheaton Precious Metals Surpasses Q3 Numbers

On Nov. 6, Wheaton Precious Metals unveiled its Q3 fiscal 2025 results, and the numbers told a story of disciplined execution and strategic growth. The company’s focus on accretive opportunities and high-quality assets paid off, delivering record revenue, earnings, and cash flow for the first nine months.

Revenue jumped 54.5% year-over-year (YOY) to $476.3 million, aligning with Wall Street expectations, while for the nine-month period, the top line soared 60.4% annually to $1.4 billion. Adjusted earnings climbed nearly 84% to $281 million, with EPS at $0.62, beating forecasts by 5.1%.

Gold production rose 15.3% to 100,090 ounces, while total gold equivalent ounces (GEOs) sold hit 137,563, up 12.5% YOY. Overall, GEO production reached 173,415, versus 142,716 a year ago. Silver also shone, with attributable output up 32.2% to 5,999 thousand ounces.

Cash reserves ended the quarter at $1.16 billion, up from $818 million at 2024’s end, while operating cash flow climbed to $382.9 million, bringing the nine-month total to $1.2 billion, up 63.6% YoY. Wheaton remained debt-free, backed by a $2-billion undrawn revolving credit facility.

Operationally, Antamina led silver gains, producing 1.7 million ounces, up 86% YOY, followed by Peñasquito with 2.1 million ounces, Constancia at 0.6 million, and Blackwater at 0.1 million ounces. The company advanced its near-term growth strategy with production ramp-ups at Blackwater and Goose, plus ongoing construction across six development projects set to come online over the next 24 months.

These strong results put Wheaton on track to meet its 2025 production guidance, highlighting the streaming model’s power to generate predictable, levered cash flows amid rising precious metals prices. The quarter also brought a gold stream on the Hemlo Mine, underscoring Wheaton’s commitment to investing in geologically robust assets with long-term value and responsible stewardship.

Wheaton is cruising toward a strong production ramp. In 2025, management estimates annual production to be between 600,000 GEOs and 670,000 GEOs, with silver expected to be between 20.5 million and 22.5 million ounces. By 2029, annual production could jump 40% to 870,000 GEOs, and through 2030 to 2034, averages may top 950,000 GEOs. With the Hemlo acquisition and recent updates in play, the company plans to share refreshed long-term guidance in early 2026, keeping growth on investors’ radars.

Analysts tracking the company anticipate Wheaton’s fiscal 2025 EPS to rise 87.2% YOY to $2.64, before rising by another 24.2% annually to $3.28 in fiscal 2026.

What Do Analysts Expect for Wheaton Precious Metals Stock?

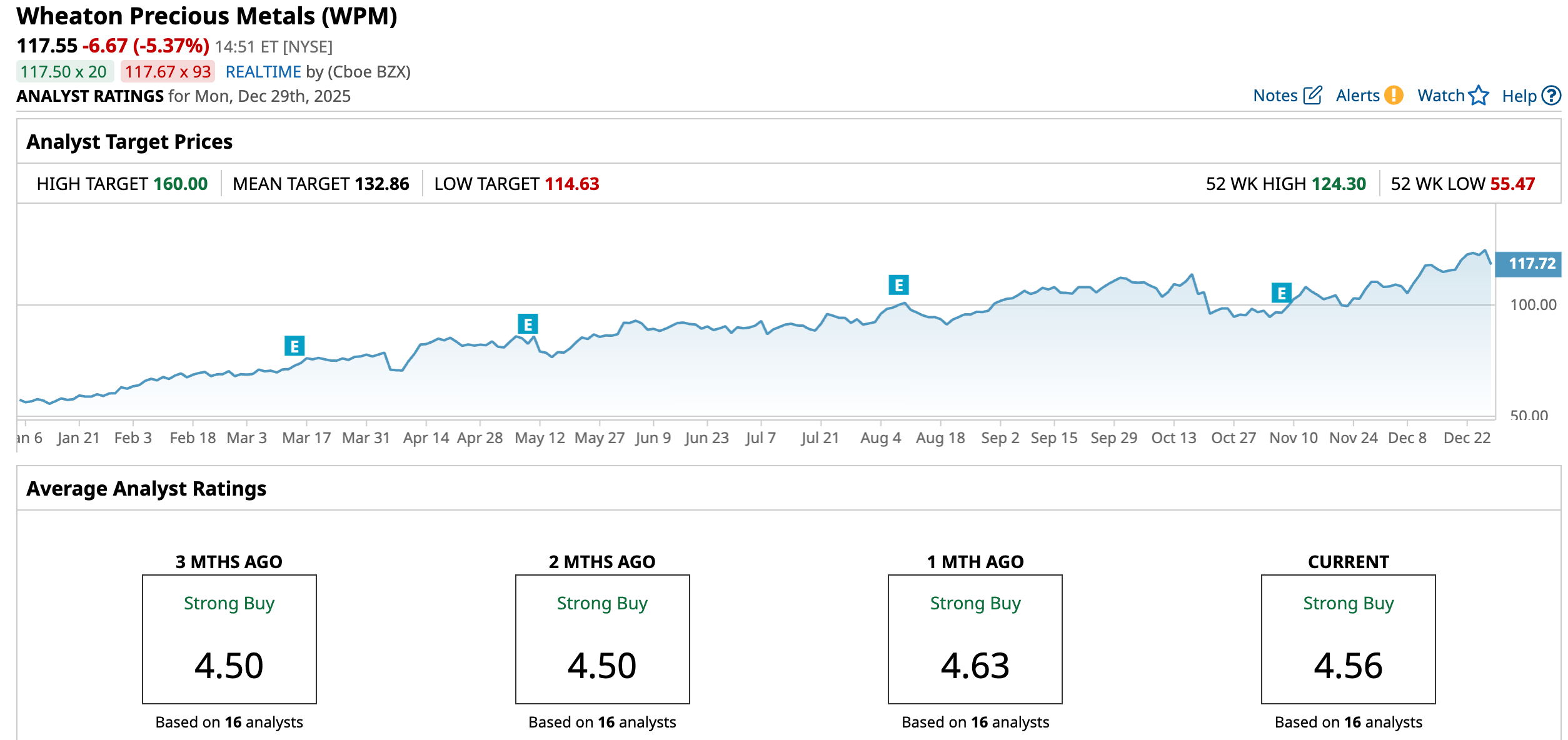

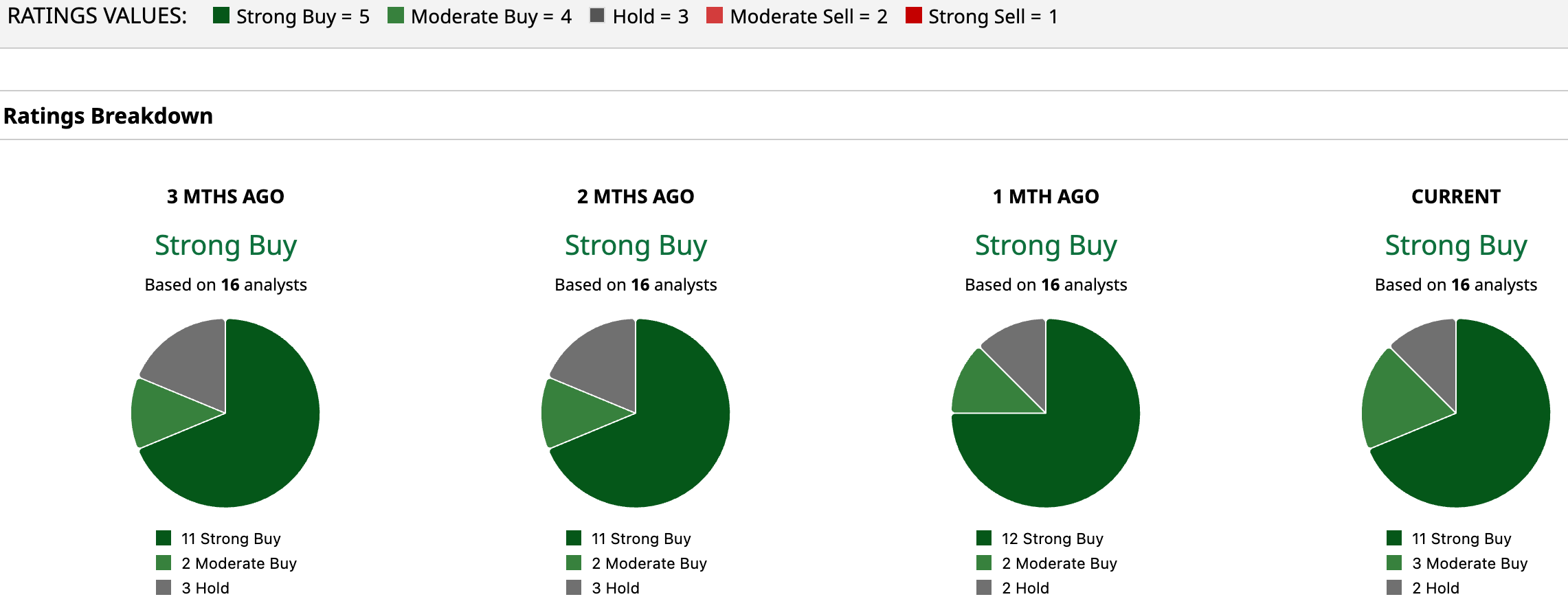

Overall, analysts are bullish about WPM’s growth prospects, giving the stock a consensus rating of “Strong Buy.” Of the 16 analysts covering the stock, 11 advise a “Strong Buy,” three suggest “Moderate Buy,” and the remaining two advise a “Hold.”

The average analyst price target for WPM is $132.86, indicating potential upside of 13%. The Street-high target price of $160 suggests that the stock could rally as much as 36% from here.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Cisco%20Systems%2C%20Inc_%20HQ-by%20Sundry%20Photography%20via%20iStock.jpg)

/Pfizer%20Inc_%20logo%20sign-by%20JHVEPhoto%20via%20iStock.jpg)