/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)

It looks like after Nvidia (NVDA), Advanced Micro Devices (AMD) is next in line to rehash a deal to resume the sales of its chips to China. After CEO Lisa Su had a meeting with China's Commerce Minister Wang Wentao in Beijing last week, reports have emerged that the country's tech giant Alibaba (BABA) is mulling ordering some of AMD's MI308 GPUs. According to this report, Alibaba could order between 40,000 and 50,000 of these GPUs. This could imply a revenue windfall in the range of $600 million to $1.25 billion for AMD.

But, before one jumps the gun over here, there are some unpleasant facts that one must consider. Firstly, though the U.S. has approved the sale of Nvidia's H200 chips to China, the Chinese regulators have not yet given their approval. So, the chances of AMD getting approval are also low at this point. Secondly, Alibaba is itself a chipmaker, although its chips are more of the ASIC kind rather than AMD's general-purpose chips. This means the latter has broader use cases than Alibaba's chips, which are optimized for its native cloud ecosystems and inference workloads.

However, amid this development, where does AMD stand as an investment option now? It should be pretty high. Let's find out why.

AMD's Robust Financials

With a market cap of about $350 billion, AMD seems like a minnow in front of its larger peer, Nvidia. However, on the basis of share price performance, the AMD stock, with a rally of nearly 78%, has outperformed Nvidia's uptick of 37.1% this year by a considerable margin. But AMD is not just a short-term phenomenon; the company has been growing its revenue and earnings at a healthy clip for a while now.

AMD has strung together a good five-year run, pushing revenue and earnings higher at compound rates of 29.94% and 28.93%. Notably, the most recent quarter fit right into that pattern, coming in stronger than Wall Street figures.

Q3 sales hit $9.25 billion, 36% above the year-earlier mark. The core data center segment reported sales of $4.3 billion, implying a 22% growth from last year. Client and gaming put up the biggest jump, however, rising 73% on an annual basis to $4 billion.

Meanwhile, EPS moved up by 30% in the same period to $1.20, outpacing the $1.17 consensus and stretching the company's run of beats to four quarters straight.

Cash flow stood out as well. Operating cash flow shot up to $1.8 billion, almost three times the $628 million posted in the same quarter last year. Overall, AMD wrapped up September with $4.81 billion in cash, easily topping the $873 million in short-term debt and $2.35 billion in longer-term debt.

However, AMD continues to trade at heady valuations when compared to the industry averages. Its forward P/E, P/S, and P/CF of 54.21, 10.30, and 54.12 are all higher than the sector medians of 24.37, 3.40, and 20.36, respectively.

Optimism Abounds

Since my previous analysis on AMD, previewing the company's Financial Analyst Day event on Nov. 11, the company's stock is down 10.3%. However, the case for investing in it may have only gotten stronger amid all the ambitious targets the management aims to hit in the coming years. First up is CEO Lisa Su's assertion that the data center market is set to reach a trillion dollars by 2030, an increase from her earlier projection of a $500 billion market by 2028.

Meanwhile, on a company-specific basis, AMD has targeted a revenue CAGR of >35%, operating margins of >35%, and an annual EPS of $20 in the next 3-5 years, with data center AI revenue exceeding 80% CAGR in the same period. The targets may seem a bit steep, but Lisa Su has walked the walk on many occasions for more than a decade now, with the share price jumping by more than 80 times in her tenure, creating enormous wealth for shareholders.

Moreover, AMD's GPUs aren't the only thing picking up speed; the full stack around them is growing fast, heading toward complete rack-level setups like Helios, MI400, and MI450. Software is keeping pace, too, with ROCm 7 making it easier to move workloads between systems. Notably, the MI500 lineup is already slated for 2027, so the roadmap looks loaded for years.

Outside pure accelerators, the upcoming “Venice” CPUs and AMD's networking gear open up fresh growth lanes inside data centers.

In the bigger picture, what really matters is how AMD has spread its bets across platforms. CPUs, GPUs, adaptive chips, and networking all connect like parts of one machine, where nothing stands alone. That setup cuts the risk from any single trend swinging and lets the company shift gears quickly as AI designs change.

Analyst Opinion on AMD Stock

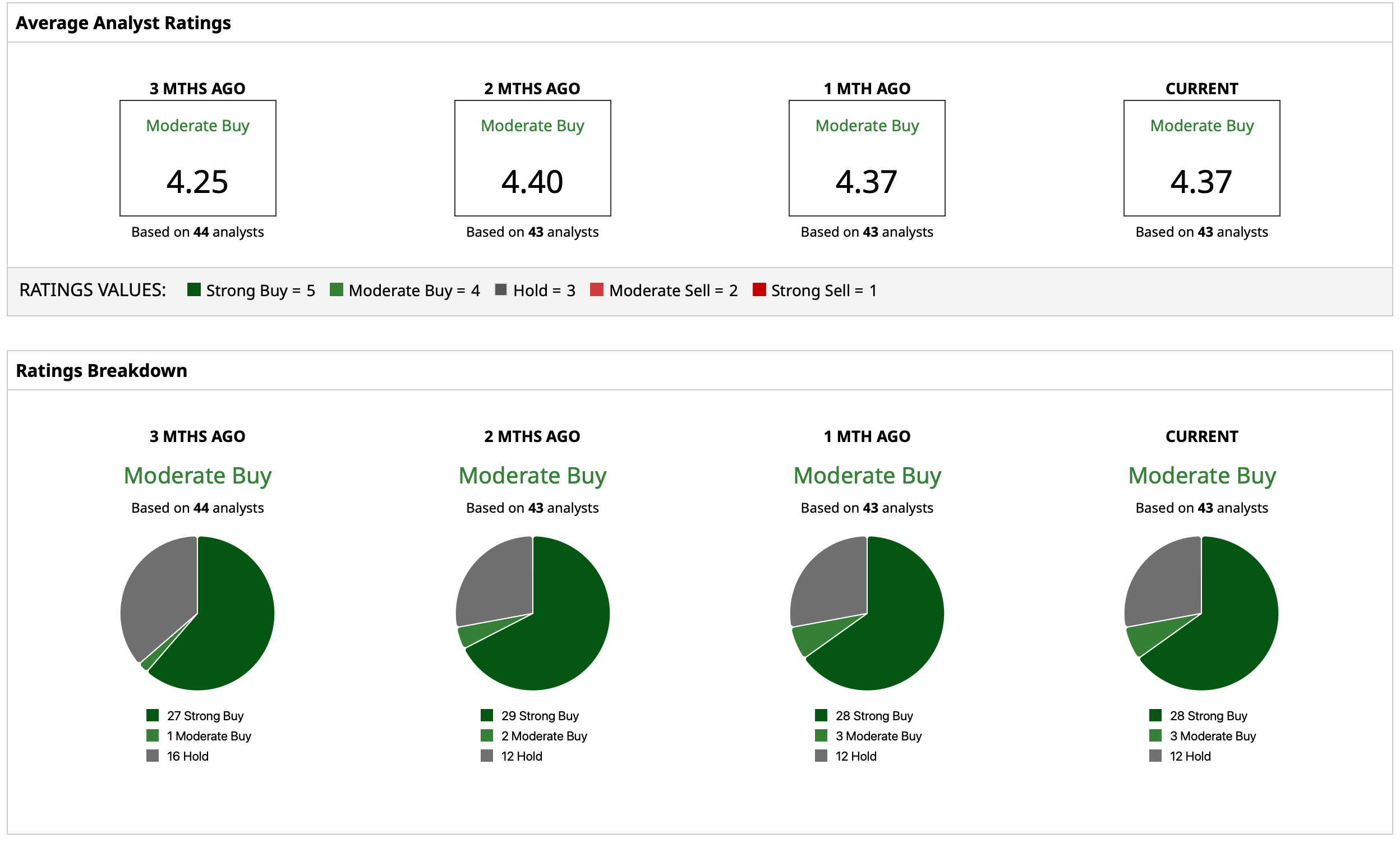

Thus, analysts have deemed the stock to be a consensus “Moderate Buy,” with a mean target price of $288.87. This indicates an upside potential of about 34.2% from current levels. Out of 43 analysts covering the stock, 28 have a “Strong Buy” rating, three have a “Moderate Buy” rating, and 12 have a “Hold” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)