/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)

Nvidia (NVDA) is back in the news as it is reported that the company is planning to resume the shipment of its H200 AI chips as early as the middle of February, subject to approval by the U.S. government. As reported by Reuters, Nvidia has informed its customers in China of its plan to ship between 5,000 and 10,000 units of its H200 modules, comprising between 40,000 and 80,000 chips, before the Lunar New Year festival.

This would represent the first significant opening of U.S. exports of advanced AI chips to China since the restrictions were enacted under the previous administration. The trigger for this development came courtesy of the current administration’s move by President Donald Trump, announcing the possibility of allowing exports on payment of a 25% charge, pending an inter-agency review that may take place in the coming weeks. However, nothing is certain at this point, and delays are always possible.

For investors, the important thing isn’t whether H200 shipment volumes will register meaningfully this quarter, which they probably won’t, but rather whether this is a sign of a return toward normalcy regarding Nvidia’s China exposure.

About Nvidia Stock

Nvidia develops leading-class GPUs and comprehensive AI computing solutions that range from data centers to gaming, autonomous cars, and visualization technologies. Founded in Santa Clara, California, Nvidia has evolved as the most critical infrastructure player within the AI ecosystem worldwide, boasting a market capitalization of approximately $4.46 trillion.

Within the previous 12 months, the NVDA stock has been very elusive yet upward-trending, fluctuating between a 52-week low of $86.62 and a high of $212.19. The stock is recently trending around $187, having surpassed the S&P 500 ($SPX) by over 40% within the previous year.

Valuations remain high but not completely decoupled from fundamentals. Nvidia is now trading around 41 times forward price-earnings multiples, with a price-sales multiple of around 33.7 times. These are levels that are completely unprecedented for most companies, but Nvidia can command this premium on an underlying basis of 55.9% profit margins, 99% return on equity, and a structurally scarce supply of AI hardware.

This is one of the few mega-cap stocks where earnings growth has consistently outstripped valuation multiples.

Nvidia Beats on Earnings as Blackwell Takes Over

The latest quarter from Nvidia has further solidified the investment community's willingness to pay a premium. The company posted a record revenue of $57 billion for the third quarter ended Oct. 26, which grew 22% from the previous quarter and a whopping 62% from the same period a year ago. The Data Center segment itself amassed a revenue of 51.2 billion dollars, a 66% jump from a year ago.

Adjusted earnings per share were at $1.30, and gross margins held strong above 73%, an impressive figure for a business operating at this scale. The team not only pointed out the high demand for the Blackwell GPUs but also confirmed they were sold out.

As described by CEO Jensen Huang, the market is in a virtuous cycle of AI that builds on itself through further applications, new model developers, and global adoption. This kind of cycle relation specifically applies to China considerations, as H200 chips are based on last-gen Hopper technology, and manufacturing attention has already moved on to Blackwell and upcoming Rubin architecture. This not only means China's imports would fill their pipeline but also not source Nvidia's strategic capacity.

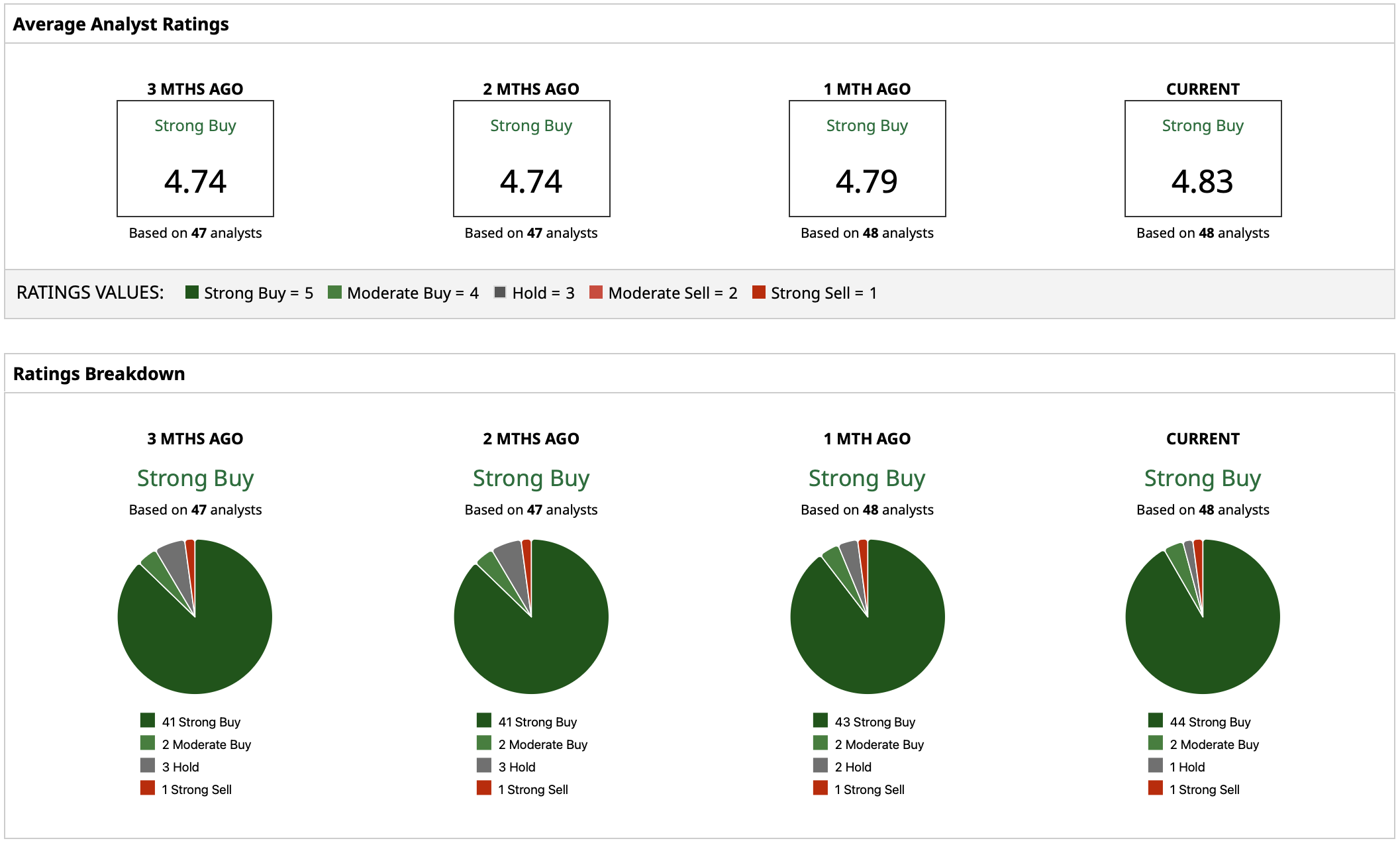

What Do Analysts Expect for NVDA Stock?

Wall Street analysts are still very positive about NVDA, with a “Strong Buy” rating consensus. The average price target is now $256, and the highest and lowest targets on the Street are $352 and $140, respectively. Considering the levels at which the stock is now, the consensus price target indicates a potential upside of about 37%. Crucially, analyst optimism has not been predicated on China’s reopening. The vast majority of models assume positive performance from U.S. hyperscalers and sovereign AI initiatives. H200 shipment news would thus impact more in terms of sentiment and optionality rather than earnings for drivers.

On the date of publication, Yiannis Zourmpanos had a position in: NVDA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/ServiceNow%20Inc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)