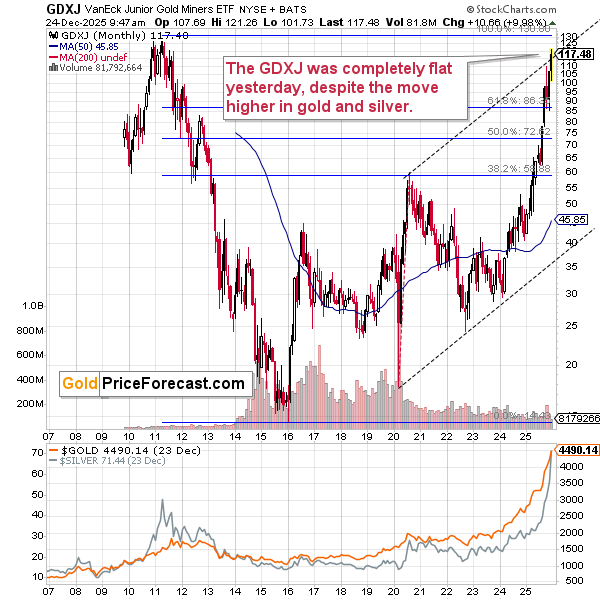

Gold moved somewhat higher yesterday, but silver and miners reacted differently. Silver soared but miners were flat.

Both were helped by the stock market that still hasn’t plunged, but they reacted differently. Silver has multiple other forces contributing to its ascent, that gold miners (about 80% of GDXJ’s performance is based on gold stocks and only 20% is based on silver stocks) are mostly not benefitting from.

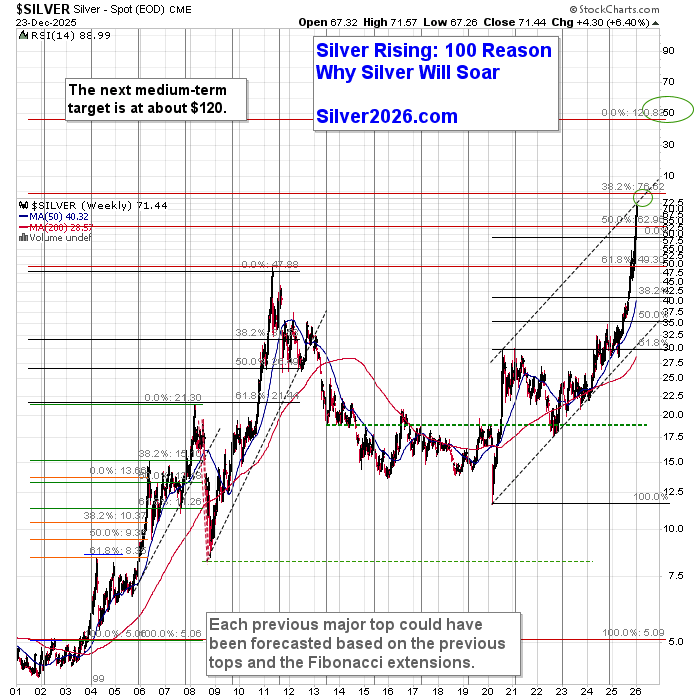

Silver just soared to almost $73, which is not that surprising given my yesterday’s comments:

“The upper border of the, rising, long-term trend channel provides further resistance. Right now this line is just below $74, so if silver keeps its explosive momentum that’s where it might turn around.

Again, given this momentum, it looks like we’re almost there – perhaps it’s a matter of hours and perhaps days.”

Consequently, this might have been it – also based on miners’ 0% move.

Our long-term investment and insurance positions which are heavily focused on silver greatly benefited from this rally, and so did the most recent profitable trade in silver.

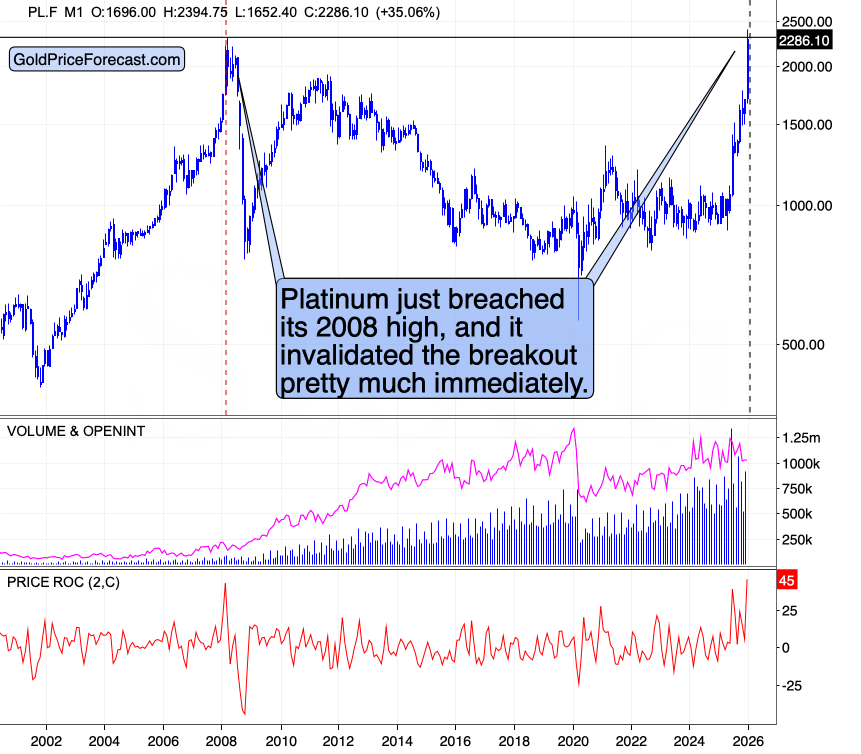

Yesterday, I wrote the following about platinum:

“Platinum is also about to encounter its final resistance – its 2008 high. This, plus the fact that the momentum is extreme (note the rate-of-change indicator at the bottom of the chart) suggest that we’re about to see a turnaround as the move is simply unsustainable.”

Platinum not only “encountered” its 2008 high – it actually moved slightly above it and then it invalidated this breakout, thus flashing a major sell signal.

Palladium reached its own resistance before reversing. It also invalidated the move above its 61.8% Fibonacci retracement level.

As I wrote earlier today, the GDXJ was completely flat yesterday, and its over 2% lower just 17 minutes into the session, while gold is pretty much flat.

And speaking of gold…

Gold closed higher yesterday (again, no corresponding move higher in the GDXJ) and it’s a bit lower today, which might not seem important until you noticed that it once invalidated its move above $4,500.

This is a sell signal, and the fact that we saw an overnight reversal makes it even stronger.

Various parts of the precious metals market reached very strong resistance levels at the same time while:

- Silver is clearly and strongly outperforming gold

- Miners are clearly underperforming gold

That’s how key tops look like.

Plus, as I wrote yesterday, bitcoin continues to lead the PMs lower.

With profits from the silver trade taken off the table, we’re now shorting mining stocks and bitcoin, with eyes wide open for the next buying opportunity in the white metal. We made money on the silver trade – and the one in bitcoin remains profitable – now it’s time for the mining stocks to generate value – through their move lower.

Thank you for reading today’s free analysis. We recently made major shifts in all parts of the portfolio. If you’d like to read more and stay up-to-date with the quick trades, intraday Alerts, and all the key details (trading position details, profit-take levels) that my subscribers are getting, I invite you to sign up for my Gold Trading Alerts or the Diamond Package that includes them.

Alternatively, if you’re not ready to subscribe yet, I encourage you to sign up for my free silver newsletter today.

Przemyslaw K. Radomski, CFA

Founder

Golden Meadow®

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)