/AI%20(artificial%20intelligence)/Artificial%20intelligence%20and%20machine%20learning%20concept%20-%20by%20amgun%20via%20iStock.jpg)

After trading at new highs towards the end of 2024, Salesforce (CRM) stock has corrected by 22% year-to-date (YTD). However, there has been a Santa rally for CRM stock with returns of 15% in the last month. The upside has been driven by impressive Q3 results and a positive growth outlook. It therefore might be the right time to look at CRM stock as one of the picks for 2026.

As a matter of fact, Evercore has named Salesforce as one of the top enterprise software stocks for 2026. The potential reasons are “momentum related to its AI strategy” and “the possibility of revenue re-accelerating.” Evercore further believes that the company’s low free cash flow multiple skews its risk-reward “materially higher.”

Earlier this month, Mizuho analyst Gregg Moskowitz opined that Salesforce is “systematically addressing” challenges related to broader Agentforce adoption. This is likely to translate into growth acceleration.

About Salesforce Stock

Salesforce, headquartered in San Francisco, provides support to organizations to transform into agentic enterprises. This involves integrating humans, agents, apps, and data on a unified platform.

The company’s offerings include Agentforce, Data Cloud, Industries AI, Salesforce Starter, Slack, and Tableau. For Q3 2026, Salesforce reported revenue of $10.3 billion. For the same period, the company reported a GAAP operating margin of 21.3%.

It’s worth noting that CRM stock has remained sideways in the past six months. However, with the potential for growth acceleration, it seems like a good time to consider CRM stock.

Positives From Q3 Results

Besides the headline numbers, there are multiple positives from the company’s Q3 2025 results. The first point to note is that since launch, Agentforce has closed more than 18,500 deals, including 9,500 paid. It’s worth mentioning here that since FY2024, Salesforce has incurred $10 billion in R&D expenses. The results are showing in the form of customer intake acceleration and are likely to translate into swelling recurring revenue.

The second point to note is that for Q3 2026, the company returned $4.2 billion to shareholders in the form of dividends and share repurchase. Considering the growth outlook, it’s likely that value creation will be sustained on this front.

In terms of regional revenue growth, Salesforce reported 8% and 7% year-on-year growth in the Americas and EMEA, respectively. However, APAC growth was 11% for the same period. There is ample scope for growth in the Asia-Pacific region that includes the major economies of China, India, and Southeast Asia. This will support the company’s overall growth momentum.

Ambitious Growth Outlook

For FY 2026, Salesforce has guided for revenue of $41.5 billion. For the same period, the company expects free cash flow of $14 billion. With the possibility of robust cash flows, Salesforce is looking at organic innovation coupled with selective inorganic growth opportunities. At the same time, the company intends to create value through incremental dividends and share repurchase.

Further, Salesforce has an ambitious growth target with potential revenue of $60 billion by 2030. This excludes the impact of the acquisition of Informatica. Overall, Salesforce expects to return to double-digit growth (organic CAGR). Coupled with steady growth, Salesforce expects margin expansion and cash flow upside.

It’s worth noting that Salesforce expects 40% of work at Fortune 1000 companies to be elevated by AI by 2029. This provides a big addressable market for growth considering the point that the company’s AI offering is applicable across the wide spectrum of industries.

What Analysts Say About CRM Stock

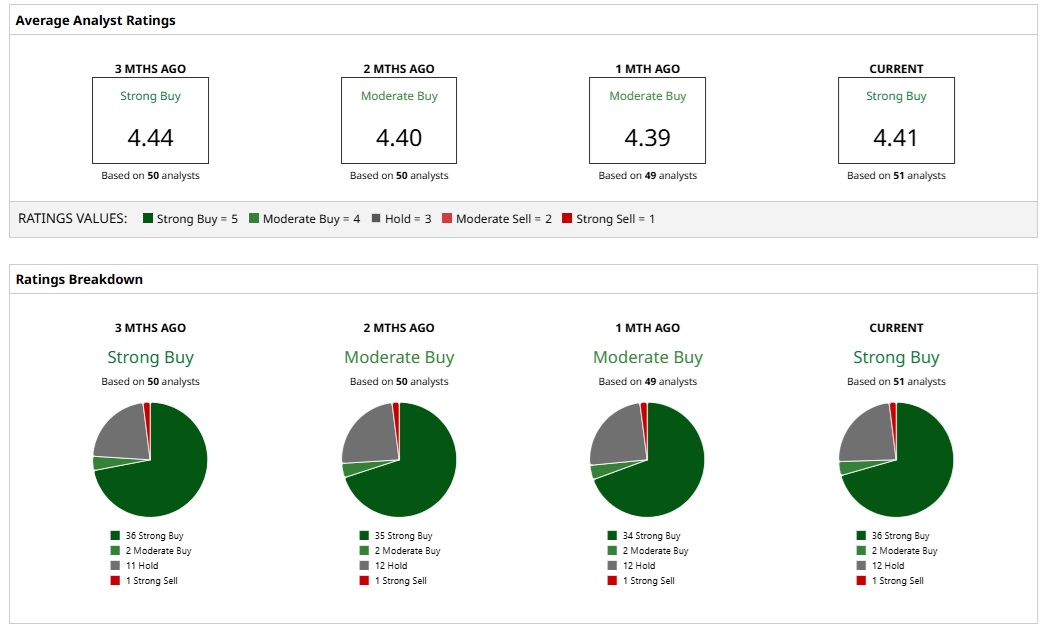

Based on the rating of 51 analysts, CRM stock is a consensus “Strong Buy.”

While 36 analysts have assigned a “Strong Buy” rating, two and 12 analysts have a “Moderate Buy” and “Hold” rating, respectively. Only one analyst has assigned a “Strong Sell” rating.

Based on these ratings, the analysts have a mean price target of $331.71. This would imply an upside potential of 27%. Furthermore, considering the most bullish price target of $475, the upside potential is 81%.

It’s worth noting that after a meaningful correction in 2025, CRM stock trades at a forward price-earnings ratio of 29.1. Valuations seem attractive and reaffirm the positive outlook from analysts.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Alphabet%20Inc_%20and%20Google%20logos%20seen%20displayed%20on%20a%20smartphone%20by%20IgorGolovniov%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)