/Concept%20business%20illustration%20stock%20market%20finance%20diagram%20by%20alexaldo%20via%20Shutterstock.jpg)

Financial-software names have become favorite plays for investors chasing steady subscription cash and fresh payment revenue. Traders now reward platforms that turn routine transactions into sticky services and higher margins.

Intuit (INTU) just took a bold step into that playbook by partnering with Circle (CRCL) to put USDC and Circle’s stablecoin infrastructure across its products. The deal could let QuickBooks, TurboTax, and Credit Karma move money faster, trim settlement costs, and open doors to new services built on instant, programmable payments.

For investors, the Circle tie-up is a promising strategic pivot, but its payoff depends on execution and the evolving policy backdrop, factors to weigh before you buy, sell, or hold.

About Intuit Stock

Intuit, founded in 1983, is a global financial technology company. It helps consumers, small businesses, and accountants manage taxes, books, credit, and spending, serving about 100 million users. The company emphasizes AI-driven “expert” experiences to simplify financial tasks.

Last month, Intuit partnered with OpenAI in a multi-year deal worth over $100 million. The partnership lets users ask ChatGPT for financial advice and take actions through Intuit apps. CEO Sasan Goodarzi called it a “massive step forward to fuel financial success.”

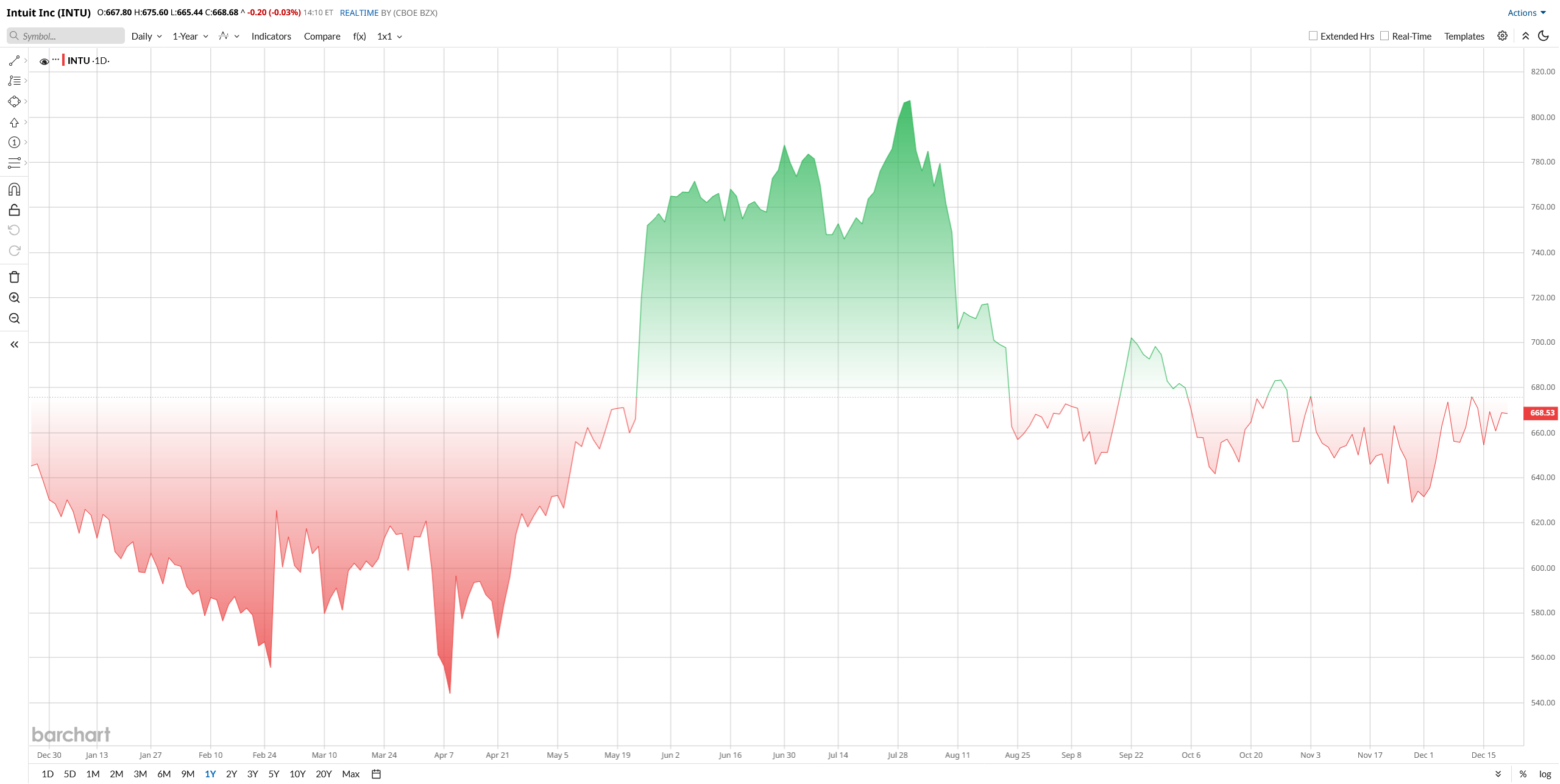

Valued at $184 billion by market cap, INTU stock climbed early in 2025 on strong tax-season results and AI growth, then eased later as tech cooled. However, the stock is still up 6% year to date (YTD). Investors remain focused on valuation, while AI tools and new payment options support the long-term outlook.

Despite underperforming, INTU shares still trade at premium levels. Its price-to-sales ratio is 9.66, significantly above the sector median of 3.47, indicating the stock might be overpriced compared to its peers. These lofty multiples imply Intuit must sustain strong growth to justify current levels.

Stablecoin Partnership

The Circle announcement was the signal of a significant new transaction by Intuit. The innovation aspect was well-received by investors as CRCL stock rose 3% and INTU stock increased approximately 1.5%.

According to market watchers, the stablecoin transaction supports Intuit's platform positioning, which may expedite refunds and business transactions. Analysts noted that Intuit's capabilities to move money in a lower-friction state are likely to drive user interactions and potentially generate new fees or interest.

In the multi-year agreement, instant tax refunds, payments, and remittances can be made in USDC within the Intuit ecosystem, where it can be used to ensure 24/7 low-cost financial rails. CEO Sasan Goodarzi said in a statement that the tie-up would allow the companies to add more layers of stablecoins to the Intuit-tested platform as we make money the center of everything we do.

Overall, the stablecoin partnership was seen as a positive catalyst, enhancing Intuit’s “moat” by cutting costs for customers and modernizing its payment infrastructure.

Intuit Beats Q1 Earnings Estimate

Intuit just wrapped up another strong quarter, and the numbers show the business is still growing rapidly.

For Q1 fiscal 2026, Intuit posted revenue of about $3.88 billion, up roughly 18% from a year ago. Earnings also came in ahead of expectations, with EPS of about $3.34, compared with $2.50 last year. Subscription growth did the heavy lifting, helped by solid TurboTax demand and steady gains across its business platforms.

TurboTax Live remained a standout, with usage up sharply, while Global Business Solutions continued to grow at a healthy pace. Credit Karma also delivered strong momentum, posting double-digit growth. Higher scale and operating leverage pushed profits higher, and adjusted earnings rose more than 20%.

Intuit’s balance sheet looks solid. Free cash flow topped $6 billion over the past year, giving the company plenty of room for buybacks and continued investment in AI and new products.

Looking ahead, management expects growth to continue. For Q2, Intuit guided for mid-teens revenue growth and higher earnings. Full-year fiscal 2026 guidance points to steady sales growth and improving profitability, which should keep long-term investors engaged.

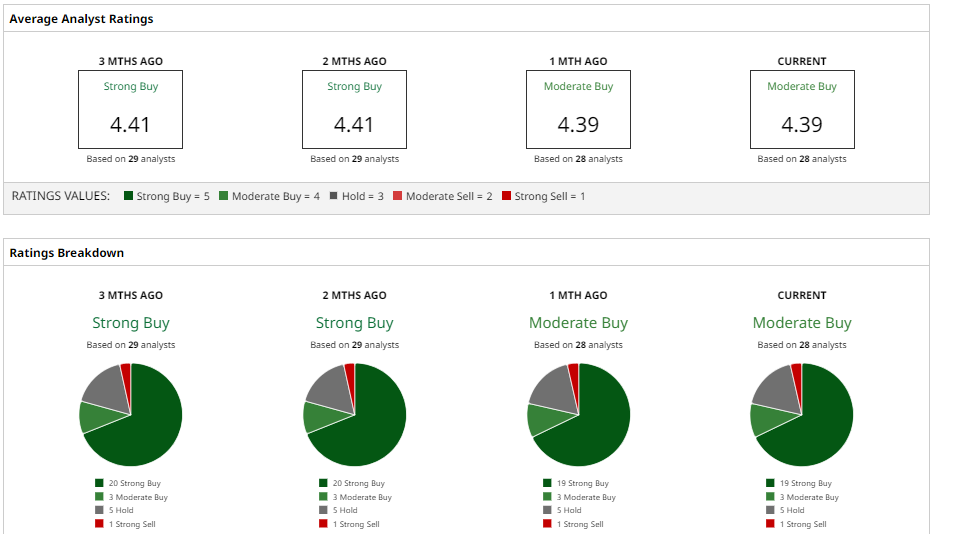

What Analysts Say About INTU Stock

Analysts remain upbeat on INTU stock prospects. Recently, Morgan Stanley’s Keith Weiss rated the stock “Overweight” with an $880 target, citing its AI and automation runway and market share gains.

RBC Capital’s Rishi Jaluria likewise maintains an Outperform with an $850 target, noting Intuit’s “exceptional profit margins” and recurring revenues from TurboTax and Enterprise Suite. BMO Capital recently reiterated an “Outperform” with an $810 price target after Intuit’s strong results.

By contrast, J.P. Morgan’s Mark Murphy has a more conservative $750 target, which reflects analysts' concerns about valuation.

In aggregate, the consensus among 28 analysts is “Moderate Buy,” and the average price target sits at $829.62, which suggests around 24% upside potential from current levels.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)