/Computer%20memory%20by%20Zoomik%20via%20Shutterstock.jpg)

The quantum computing sector has been one of the most exciting areas of the market to watch in recent years. Many top companies in this space, from Rigetti Computing (RGTI) to IonQ (IONQ) and D-Wave Quantum (QBTS), are once again in focus, as key developments in the sector and increasing investment produce long-term growth potential.

With differing business models but the same underlying growth drivers, these three quantum computing names are now in the spotlight. New coverage from analysts at Jefferies has been issued for these three companies, and it's not a clean sweep across the board. Rigetti Computing earned a “Hold” rating, while Jefferies put a “Buy" rating on both IonQ and D-Wave Quantum.

Let's dive specifically into D-Wave Quantum and its price target of $45 per share.

What's Driving High Expectations for D-Wave Quantum?

Analysts at Jefferies believe that the company's “ecosystem tailwinds and usage increase across quantum architectures” could lead to significant growth over time, particularly as the company ramps up its Advantage2 product.

Additionally, analysts noted that D-Wave's "two‑pronged roadmap, consisting of annealing for optimization and gate‑model for simulation/chemistry/linear algebra, leverages a shared superconducting stack and targets ~100,000 annealing qubits via multi‑chip fabrics, while fluxonium + cryo‑control build toward logical qubits over 5–10 years. A full‑stack platform lowers adoption friction and converts pilots to production. Commercial stickiness is evidenced by 100+ organizations running production workloads across manufacturing, logistics, public safety, telecom, pharma, and U.S. mission applications. Financially, D‑Wave enters C26 with $836.2M cash, ~$32M debt, and a cleaned‑up equity stack post warrant redemption, enabling disciplined investment.”

That's a solid endorsement of D-Wave's underlying business model and could lead to strong fundamentals in the future.

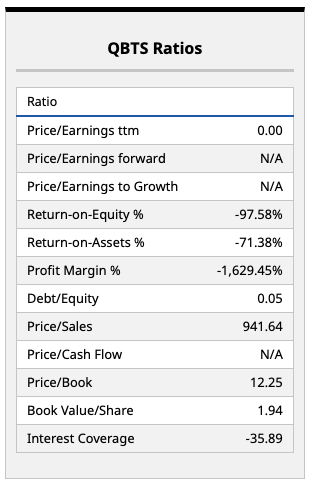

Looking at D-Wave's current fundamentals, there are several large negative numbers. This is a stock that's basically impossible to value on the basis of its past performance, as D-Wave and its competitors are all in a race to deploy capital most efficiently and effectively, to lay the groundwork for future growth.

Revolutionary technologies (and the jury is still out on whether quantum computing will be such a technology) often require these long periods of investment to get off the ground. For investors trying to value an individual company's potential in a nascent sector such as quantum, the difficult task of measuring the size of the end market (and a particular company's future market share potential) is really what it's all about.

Notably, D-Wave is trading right around 2x book value, which is probably the most relevant metric here. That's not cheap, but it's not expensive either, particularly when we line up D-Wave and measure it compared to its peers.

What Do Other Analysts Think?

Jefferies is now one of 14 firms covering D-Wave (up from 11 just a month ago), so there's clearly more interest in this stock among Wall Street firms attempting to value the future potential of this technology and the leaders in this space.

A consensus price target of $39 per share does imply some very healthy upside of around 60% from here. If investors can generate a 60% return from a single stock holding, that's one to hold onto.

As mentioned above, Jefferies is certainly on the higher end of the analysts covering this stock, with its $45 price target. Given the recency of this target, and the fact that this firm's analyst team is covering the three key players in the quantum race, investors may place a higher weighting on such a target.

We'll have to see how this rollout progresses and what sort of technological advancements ultimately come from D-Wave and its peers. Rest assured, this stock will remain on my radar as a potential big mover in 2026 and beyond.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/AI%20microchip%20by%20DesignKingBD360%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)