WW International (WW), more commonly known as Weight Watchers, is fully embracing GLP-1 weight-loss drugs, such as Ozempic and Wegovy, following its restructuring. The company recently introduced a platform that integrates GLP-1 medications with its personalized nutrition, behavioral support, coaching, and community offerings.

In addition, the digital experience within the new platform includes Weight Health Score, a weight-scoring system, and a new artificial intelligence (AI)-powered body scanner that tracks changes in fat and muscle. WW’s stock gained 12.1% intraday on Dec. 16 on this news.

Therefore, should you consider buying the stock now?

About WW International Stock

Headquartered in New York, WW operates as a global leader in weight management and wellness support. The company provides science-backed programs that help people build healthy habits through personalized coaching, community connections, and practical tools for better eating and active living. By blending digital apps, workshops, and expert guidance, WW International empowers users to achieve their goals in a supportive environment. The company has a market capitalization of $263.85 million.

Earlier this year, Weight Watchers filed for bankruptcy to eliminate $1.15 billion in debt and transition into a telehealth service provider. The company had been struggling amid the rise of weight loss drugs. WW entered the prescription-weight-loss drug business through an acquisition, but its financial performance has struggled to keep up.

Over the past three months, the stock declined by 13.09% amid an uncertain backdrop. However, over the past five days, it has gained 0.77%, suggesting its GLP-1 pitch may be driving better days.

WW’s stock is trading at a discount to its peers. Its price-to-earnings ratio sits at 1.50x, considerably lower than the industry average of 20.25x.

WW International’s Third-Quarter Results Drew A Mixed Picture

On Nov. 6, WW reported its third-quarter results for fiscal 2025. The company’s revenues declined by 10.8% year-over-year (YOY) to $172.09 million. However, this was higher than the $161.40 million that Wall Street analysts had expected.

On the other hand, the company’s bottom line loss deepened from $0.58 per share in the prior-year period to $5.76 per share in Q3 2025. This also missed the consensus analyst estimate of a $ 0.10-per-share loss by a significant margin.

By contrast, WW is in a better position than before the restructuring, with total debt reduced by more than 70%. By the end of Q3, the company had $177.57 million in cash, cash equivalents, and restricted cash. WW’s Q3 adjusted EBITDA margin was 24.9%.

WW has also raised the lower end of its guidance range based on these results. It updated its fiscal 2025 revenue guidance range from $685 million - $700 million to $695 million - $700 million, and its adjusted EBITDA range from $140 million - $150 million to $145 million - $150 million.

Wall Street analysts are not optimistic about WW’s bottom line growth trajectory. For Q4, analysts expect the company to report a loss per share of $0.94. For the current year, the company’s EPS is projected to be $12.61, followed by a 87.9% YOY decrease to $1.53 in the following year.

What Do Analysts Think About WW International Stock?

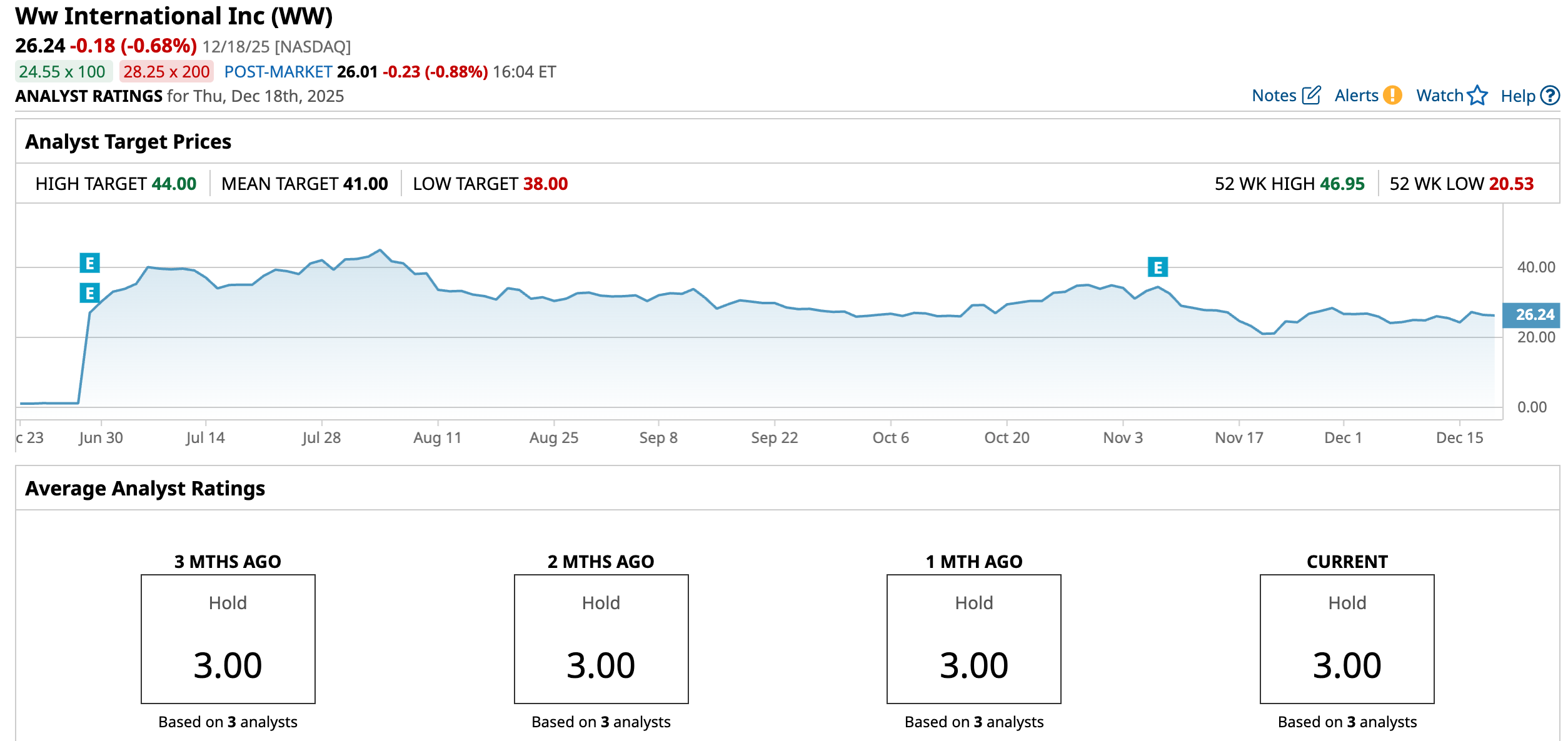

In August, Morgan Stanley analysts cut WW’s price target from $45 to $41 while maintaining an “Equalweight” rating on its shares. After the company’s Q2 results, Morgan Stanley analysts noted that while the results came ahead of expectations, the company is facing “worsening core trends” into the second half of this year.

Additionally, analysts noted that clinic subscriptions are temporarily declining due to ongoing reductions, making it crucial to identify the baseline and the expected normalized expansion going forward.

On the other hand, in July, Lucid Capital analyst Alex Fuhrman initiated coverage of the stock post its reorganization with a “Buy” rating and a $60 price target. Fuhrman believes that the company emerged from its bankruptcy “in its strongest position in years,” with a manageable net debt-to-EBITDA ratio.

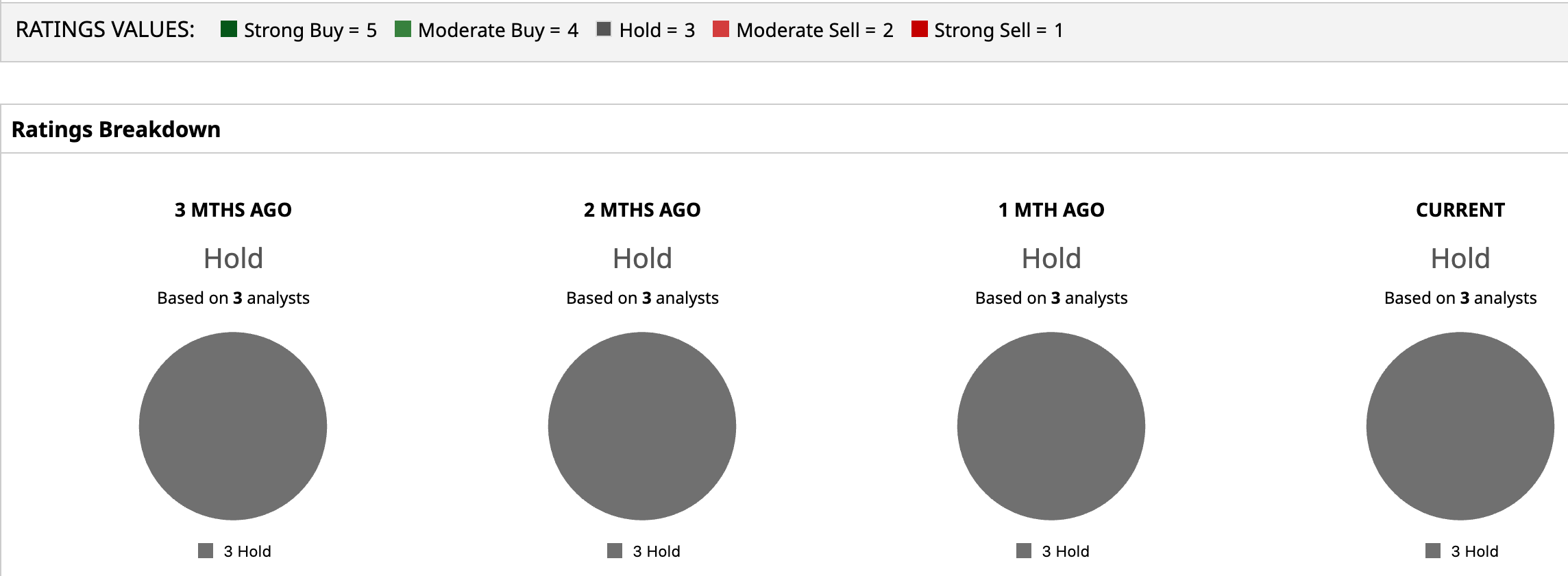

Wall Street analysts are taking a cautious stance on WW International’s stock now, with a consensus “Hold” rating overall. All three analysts rating the stock are playing it safe with a “Hold” rating. The consensus price target of $41 represents a 56.25% upside from current levels. The Street-high price target of $44 indicates a 67.68% upside from current levels.

Key Takeaways

While Weight Watchers is finding its footing after its bankruptcy and subsequent restructure, its financials are seemingly not out of the woods yet. As Wall Street analysts are generally tepid on the stock, it may be prudent to hold off for now.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/Apple%20products%20arranged%20on%20desk%20by%20tashka2000%20via%20iStock.jpg)