/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)

Micron Technology (MU) opened the fiscal year on a strong note, reporting an impressive set of first-quarter results that reflected the company’s improving fundamentals. Revenue reached record levels across all of Micron’s business segments, highlighting broad-based demand for its memory and storage products. Meanwhile, margins soared. The market reacted positively to the earnings release, with Micron shares jumping roughly 9.6% in pre-market trading as investors welcomed the upbeat performance and strong guidance.

Micron has delivered consistently strong quarterly financial results, and current industry trends suggest this momentum could continue. One of the most important drivers is the expansion of artificial intelligence (AI) data centers, which is fueling demand for the company’s high-performance, high-capacity memory solutions.

In addition to demand growth, the industry is benefiting from tighter supply conditions, which are supporting higher memory pricing. This pricing environment is particularly important for Micron, as it tends to have a meaningful impact on profitability. Higher average selling prices are translating into expanding margins and stronger earnings growth.

With demand from AI-driven infrastructure spending and a constructive pricing backdrop, Micron appears well-positioned to sustain revenue growth and improve profitability.

Micron’s Earnings to More than Double

Micron Technology is entering fiscal 2026 with solid momentum, driven by surging demand, tight industry supply, and favorable pricing and costs.

In the first quarter of fiscal 2026, Micron reported revenue of $13.6 billion, up 21% sequentially and a 57% jump from the prior year. This growth was led by DRAM, which delivered record revenue of $10.8 billion, up 69% year-over-year and 20% sequentially. While bit shipments rose modestly, average selling prices climbed by roughly 20%, supported by tight industry supply, pricing execution, and a favorable product mix.

NAND also posted a record quarter, with revenue reaching $2.7 billion, up 22% year-over-year. Sequential growth was equally strong at 22%, as NAND bit shipments increased in the mid- to high-single-digit range and pricing improved in the mid-teens. Similar to DRAM, constrained supply conditions and improved mix played a meaningful role in lifting results.

The combination of higher volumes, rising prices, and strong cost control led to a sharp increase in profitability. Micron’s gross margin climbed to 56.8% in the first quarter, reflecting a 11 percentage point jump from the previous quarter. Operating margin was 47%, up 12 percentage points sequentially and 20 percentage points compared with the same period last year.

Micron has strengthened its long-term growth outlook through its leadership in High Bandwidth Memory (HBM). The company has already secured agreements covering price and volume for its entire calendar 2026 HBM supply, including its next-generation HBM4 products. Management now forecasts the total addressable market for HBM to grow at a CAGR of approximately 40% through calendar 2028, expanding from about $35 billion in 2025 to roughly $100 billion in 2028.

Looking ahead, Micron sees demand exceeding supply across both DRAM and NAND, which will continue to support prices. This will drive its top and bottom lines at a solid pace in fiscal 2026 and beyond.

Management believes that the current tight market conditions, driven by sustained demand and supply constraints, are likely to persist beyond calendar 2026. This environment provides a strong foundation for pricing and earnings growth over multiple quarters.

Thanks to these favorable trends, analysts expect Micron’s earnings per share (EPS) to more than double in fiscal 2026, with projected year-over-year growth of 149.4%. Given the company’s strong start to the year and supportive industry dynamics, the consensus earnings estimate could rise further.

Is Micron Stock a Buy?

Despite the rally in Micron stock, its valuation looks compelling relative to the expected earnings growth, suggesting the rally has not fully priced in the company’s improving fundamentals. The company is well-positioned to deliver robust earnings and free cash flow over the coming quarters, supported by strong end-market demand and favorable pricing across its memory products.

Micron trades at 13.3 times forward earnings, which is attractive given its projected growth trajectory. Analysts expect its EPS to surge 149.4% in fiscal 2026, followed by additional growth of more than 27% in fiscal 2027. This creates room for further share price appreciation.

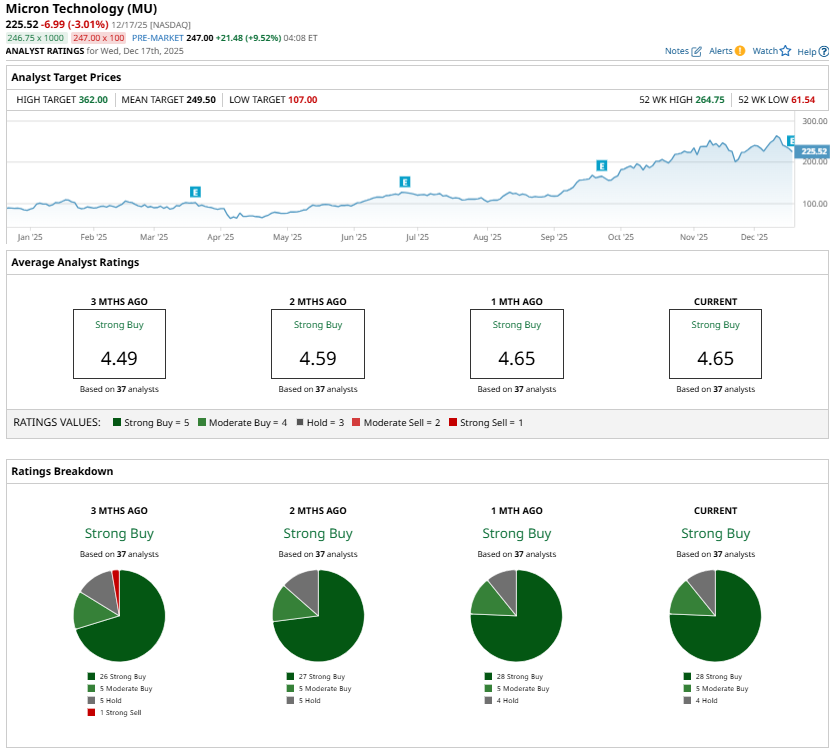

Adding to the bullish case, Wall Street sentiment toward Micron remains positive. Analysts continue to hold a “Strong Buy” consensus rating on the stock.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)