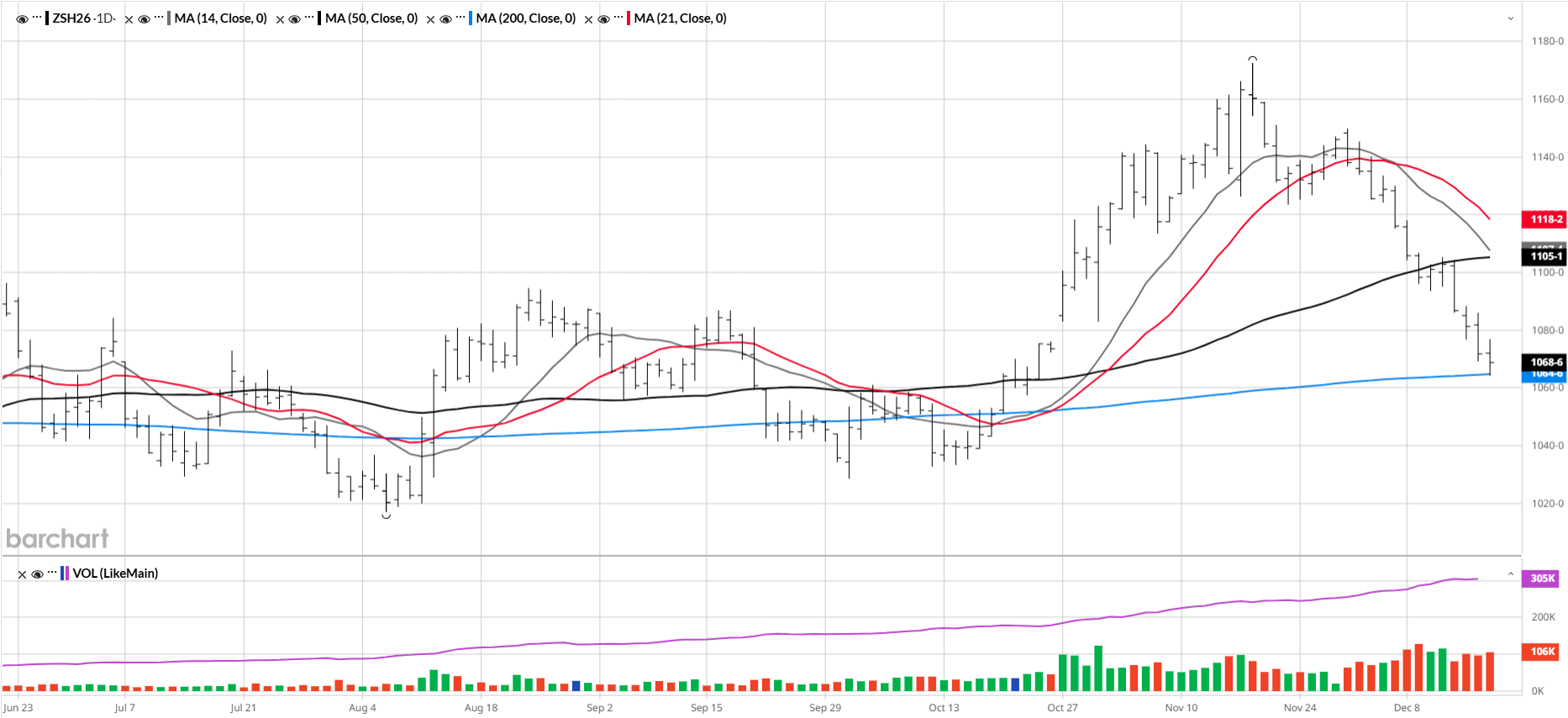

March soybeans closed at 1069, down -2 3/4 cents. Soybeans have had a rough start to December after making a high at 1172 1/2 in the March contract in mid-November. Soybeans filled the gap from October 27 yesterday. March soybeans are trading below the 14, 21, 50, and 100-day moving averages but above the 200-day. The next resistance is the 100-day at 1082. I still feel soybeans can move lower from here, but 1050 looks like a strong level of support if soybeans lose the 200-day moving average at 1064 3/4. The March-May spread gives a reading on Brazil’s 2025/26 crop, which CONAB estimates at a new record 177.1 mmt, up 3% from 2024/25. CONAB’s estimate for Brazil’s new crop in November was slightly higher at 177.6 mmt. The rally in mid-November moved the March-May spread to -7 cents at its tightest point at 23% of full carry. That spread has now widened to -11.5 cents at 36% of full carry, which indicates new commercial selling. The CFTC is still catching up from the government shutdown, but the latest Commitment of Traders report (data as of 11/25/2025) shows managed money unwinding 15k contracts of their 214k long position in soybeans. Soybeans tend to respond better to changes in fund positioning than a lot of other markets, and it looks like funds are continuing to liquidate their long positions or add to their short positions given the sell-off late last week and the entire week this week.

If you would like to open an account or receive more information on the commodity markets, please use the link below:

Consider the following:

.

Soybeans – N/A

.

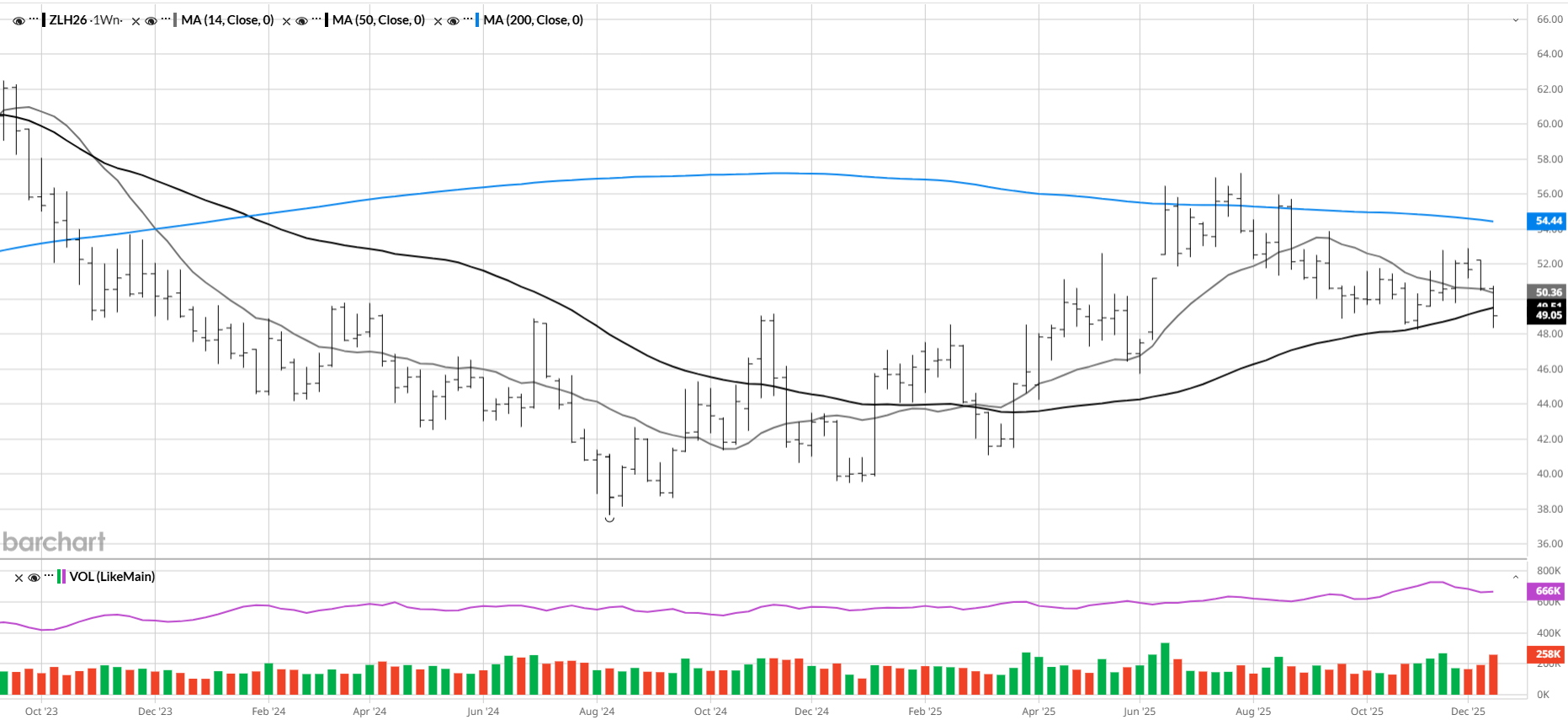

July ’26 SOYBEAN OIL

BUY 1 JULY ’26 54 CALL 2.030

SELL 1 JULY ’26 59 CALL .95

SELL 1 JULY’26 50 PUT 3.385

BUY 1 JULY 45 PUT 1.265

Price: 1.04 CREDIT Cost: $624 CREDIT/TRADE PACKAGE, PLUS FEES AND COMMISSIONS.

JULY’26 SOYBEAN OIL OPTIONS EXPIRE 6/26/26 (191 DAYS)

MAXIMUM LOSS: LIMITED

POTENTIAL GAIN: $4,272/TRADE PACKAGE

MAXIMUM GAIN: $3,000.00 FROM CALL SPREAD AND $1,272 FROM SOLD PUT SPREAD

This is a longer-term trade, looking for soybean oil to trade 64.00-66.00. By entering this trade, you collect a credit of 1.04 or $624/Trade Package. Soybean oil has been weaker recently due to uncertainty from the EPA in regard to 2026 biofuel blending rates. The EPA the final rule will not be confirmed until Q1 ’26. I’m still bullish, here’s why: Biofuel percentages are set to increase in Brazil, Indonesia, and Malaysia. Sunflower oil supplies are tight, and production estimates are lower in the EU and the Black Sea. In addition, Brazil has sold most of its beans to China already which will limit their crushing.

If you would like to open an account or receive more information on the commodity markets, please use the link below:

Hans Schmit

Broker, Pure Hedge Division

312-765-7311

hschmit@walshtrading.com

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

/AI%20(artificial%20intelligence)/Data%20Center%20by%20Caureem%20via%20Shutterstock%20(2).jpg)

/PayPal%20Holdings%20Inc%20HQ%20photo-by%20bennymarty%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)