Affirm (AFRM) stock closed nearly 12% higher on Dec. 16 after the financial technology company said Amazon (AMZN) has renewed its partnership with it for five more years.

The announcement marks a crucial victory for AFRM as the e-commerce giant serves as one of its most important distribution channels and revenue resources.

Despite the rally, Affirm stock is down some 20% versus its year-to-date high set in August.

Significance of Amazon Partnership for Affirm Stock

Investors cheered the Amazon news on Tuesday mostly because it enhances visibility into Affirm’s future revenue and validates its position in the increasingly competitive fintech landscape.

The renewed partnership signals confidence in AFRM’s technology platform and risk management capabilities, factors that have become increasingly scrutinized in the lending space.

It positions Affirm to steal market share and improve its unit economics to better rival competition from traditional financial institutions as well as emerging fintech names like Klarna (KLAR).

In its latest reported quarter, Affirm came in ahead of Street estimates, maintaining strong credit performance as users demonstrated payment discipline.

This makes AFRM shares all the more attractive to own heading into 2026.

What Makes AFRM Shares Worth Owning for 2026

Affirm shares remain appealing as a long-term holding also because the buy-now-pay-later (BNPL) industry more broadly is growing at a fast clip.

In 2025, the holiday season spending through these platforms is expected to reach a record $20.2 billion, up sharply from $18.2 billion last year.

In fact, recent data confirms BNPL usage hit an all-time high on Cyber Monday, driving more than $1.0 billion in online spending, indicating strong consumer adoption.

On Tuesday, Affirm’s chief of finance, Rob O’Hare said the company is “performing in line with expectations” this quarter as well, offering another reason for investors to own the fintech stock.

From a technical perspective, AFRM stock looks headed to challenge its 100-day moving average (MA) at the $75 level. A decisive break above that price in the days ahead could accelerate bullish momentum.

What’s the Consensus Rating on Affirm Holdings?

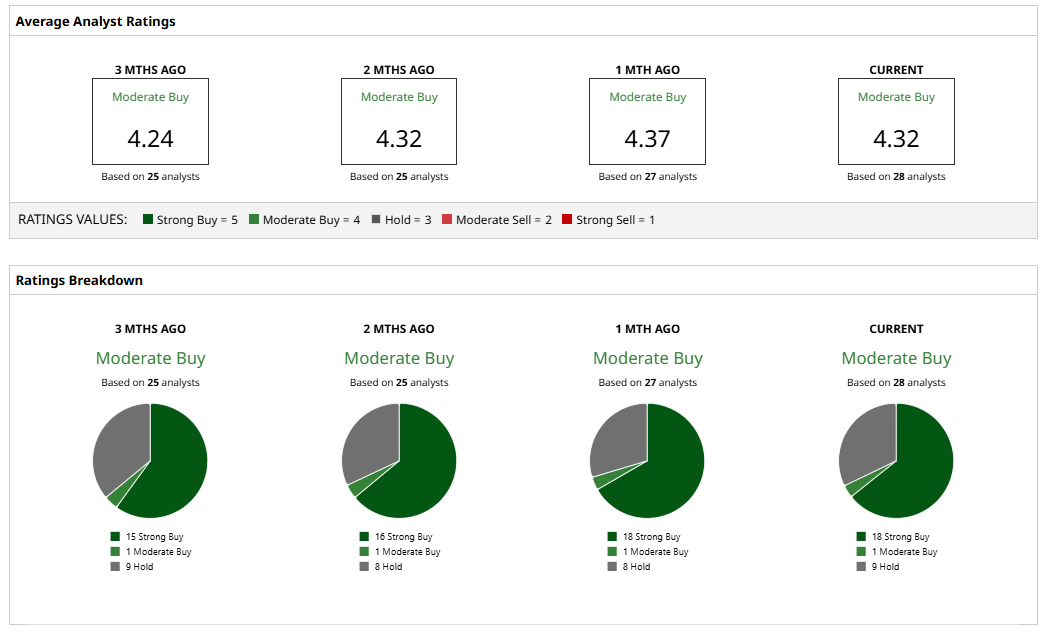

Wall Street analysts also believe Affirm stock could push meaningfully higher from here in 2026.

The consensus rating on AFRM shares currently sits at “Moderate Buy” with the mean target of about $95 indicating potential upside of nearly 30% from here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)