Exactly. The dynamic is different than it used to be.

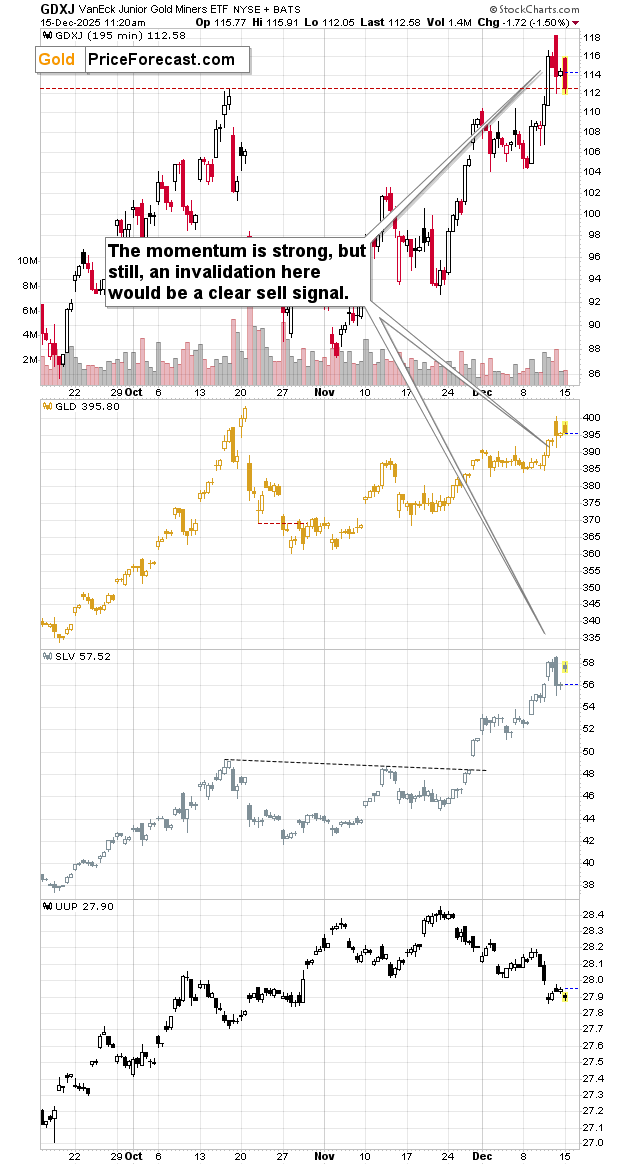

Silver is up by rallied by over 2%. Gold is flat. And miners? The GDXJ is down by 1.50% and it was just trading even lower.

It looks like miners really wanted to invalidate their breakout but the declining USD prevented that.

Silver price, on the other hand, is attacking its previous all-time highs, and it looks like it just might succeed and move even higher. Consequently, my silver price forecast is currently bullish… But… A lot will depend on other market. I’m writing more on that in my premium Gold Trading Alerts.

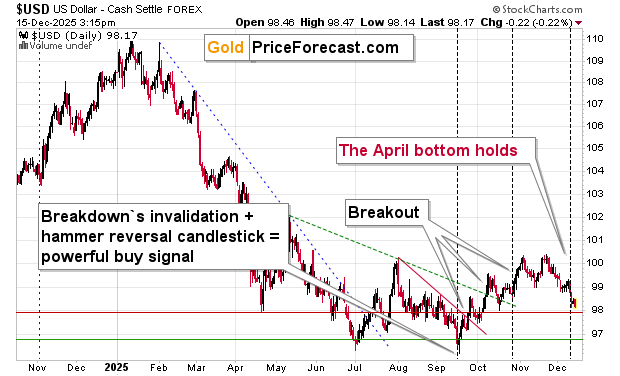

The USD Index is how trading sideways close to its April low. It had already reversed in September and right now it appears to be forming the right shoulder of the inverse head-and-shoulders pattern with a broad (July-September) head.

But it’s not USD’s performance itself that is most important – it’s the way miners and silver react to it.

And – again – silver is strong today (the white metal appears to be disconnecting due to the 100 reasons supporting it) and miners declined.

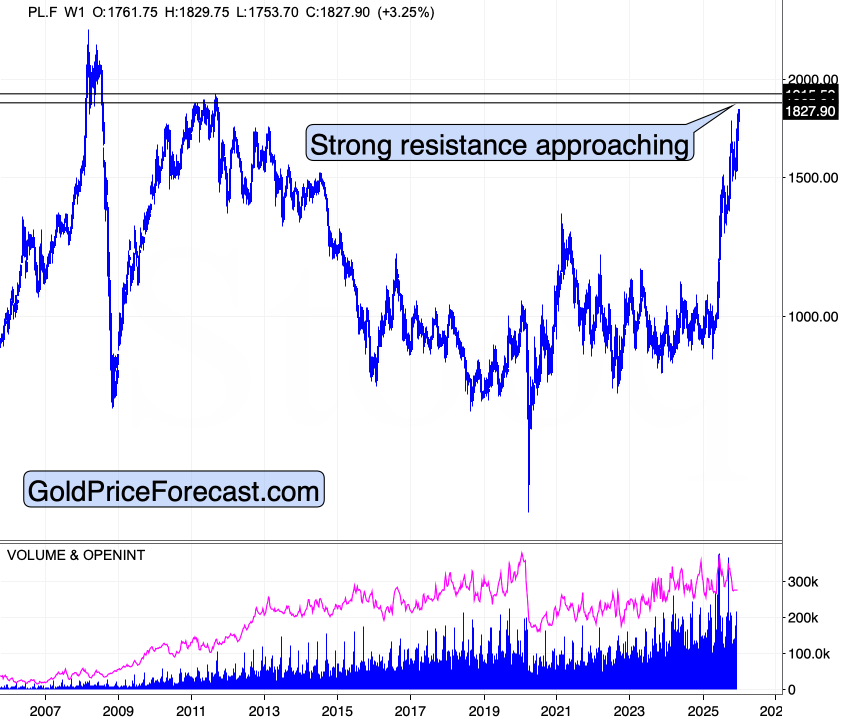

Interestingly, platinum soared today, but this could be based on how near its resistance ls.

The 2011 highs are just ahead, and many traders might have expected platinum to go to at least there, creating a self-fulfilling prophecy.

To balance the technical signs, we have a sell signal from the flagship anti-dollar asset – bitcoin.

The ‘king of cryptos’ moved below its rising support line.

Why is this important? Because this ends the monthly flag pattern, and bitcoin appears ready to slide once again.

Our short position in bitcoin is likely to benefit from that move – in a big way. The reason is the fact that flag patterns tend to be followed by price patterns that are similar to the ones that preceded them, and the thing is that…

The move that preceded the flag was a decline from above $120k to almost $80k. If bitcoin declines by over 35% again, it can slide all the way down to $60k – in perfect tune with my previous target area.

Bitcoin might be the canary in the gold mine – declining anti-USD asset, could be the sing that the real USD is about to move higher, which would also affect the precious metals sector.

Silver is on the roll, which might protect it for some time (perhaps until the rally burns itself out in the short term based on the targets discussed previously), but the rest of the sector is very vulnerable – and likely to decline without additional significant rallies. Our positions reflect that.

Thank you for reading today’s free analysis. We recently made major shifts in all parts of the portfolio. If you’d like to read more and stay up-to-date with the quick trades, intraday Alerts, and all the key details (trading position details, profit-take levels) that my subscribers are getting, I invite you to sign up for my Gold Trading Alerts or the Diamond Package that includes them. Alternatively, if you’re not ready to subscribe yet, I encourage you to sign up for my free silver newsletter today.

Przemyslaw K. Radomski, CFA

Founder

Golden Meadow®

/AI%20(artificial%20intelligence)/Businessman%20touching%20the%20brain%20working%20of%20Artificial%20Intelligence%20(AI)%20Automation%20by%20Suttiphong%20Chandaeng%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)