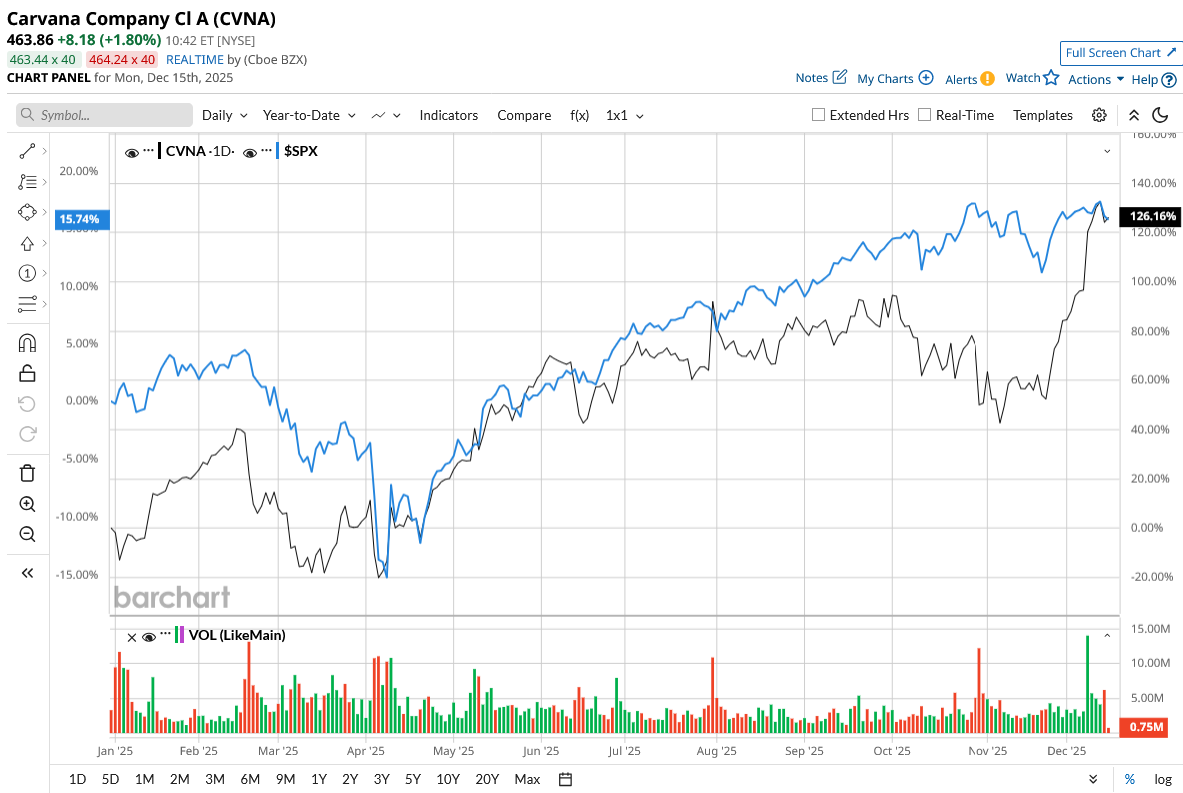

Carvana (CVNA) stock has staged a stunning comeback in 2025, soaring about 125% year-to-date (YTD) and grabbing investors’ attention. Once viewed as a high-risk turnaround story, the online auto retailer is now delivering rapid growth, expanding margins, and record profitability.

What’s in store for Carvana stock in 2026? Let’s find out.

About Carvana

Valued at $99.1 billion, Carvana is an online automotive retailer that lets customers buy, sell, and finance used cars entirely online. It allows customers to browse a large inventory of used vehicles online and enables them to purchase or sell a car in minutes with transparent pricing. It also offers in-house financing, trade-ins, and home delivery or pickup. Caravan aims to replace the traditional dealership experience with a speedier, more convenient, and data-driven digital car-buying process.

A Business Getting Better as It Gets Bigger

In the third quarter, retail units sold reached 150,941, up 44% year-over-year (YoY), while revenue surged 55% to $5.65 billion. For the first time in its history, Carvana’s annual revenue run rate exceeded $20 billion, highlighting the scale the business is now achieving. Net income increased to $263 million, with adjusted EBITDA reaching a new high of $637 million. Importantly, Carvana converted nearly 87% of adjusted EBITDA into GAAP operating income, highlighting the exceptional quality of its earnings.

Management stressed that the "feedback flywheel is spinning" with rapidly rising data enhancing pricing, inventory management, logistics, and customer experience. These structural advantages enable Carvana to achieve its long-term aim of selling 3 million cars per year at a 13.5% adjusted EBITDA margin over the next five to ten years. Another factor driving investor enthusiasm is Carvana’s increasing automation and vertical integration. More than 30% of retail buyers now go through the whole shopping process without speaking with a customer representative until delivery or pickup.

This level of automation necessitates closely connected systems, real-time data availability, deterministic decision-making, and clearly defined workflows. Management sees this as a major long-term advantage that streamlines the client experience while lowering operating costs. Carvana’s improving financial position has also impressed investors. The company has retired significant amounts of corporate debt, bringing total debt retired in 2024 and 2025 to $1.2 billion. It also had $2.1 billion in cash on the balance sheet at the end of the third quarter.

Looking ahead, management anticipates retail units sold to exceed 150,000 in Q4. Adjusted EBITDA could be at or above the high end of the previously disclosed $2 billion to $2.2 billion range for the full year 2025, assuming a steady environment. Longer term, Caravan is convinced that it can sell 3 million cars per year at favorable margins. Caravan is no longer just a high-growth disruptor. It is a profitable, scalable auto retailer with improving margins, strong operating leverage, and a rapidly strengthening balance sheet. Carvana is convincing investors that its business model can deliver durable, profitable growth for years to come.

Analysts expect very strong profit momentum to continue over the next two years. Analysts project earnings to increase by 73.5% for the full year to $5.46 per share before increasing by 36% in 2026 to $7.42 per share. Currently, CVNA stock is trading at a premium of 61x forward 2026 earnings, implying the market expects Carvana to hit or exceed those earnings projections.

What Does Wall Street Say About CVNA Stock?

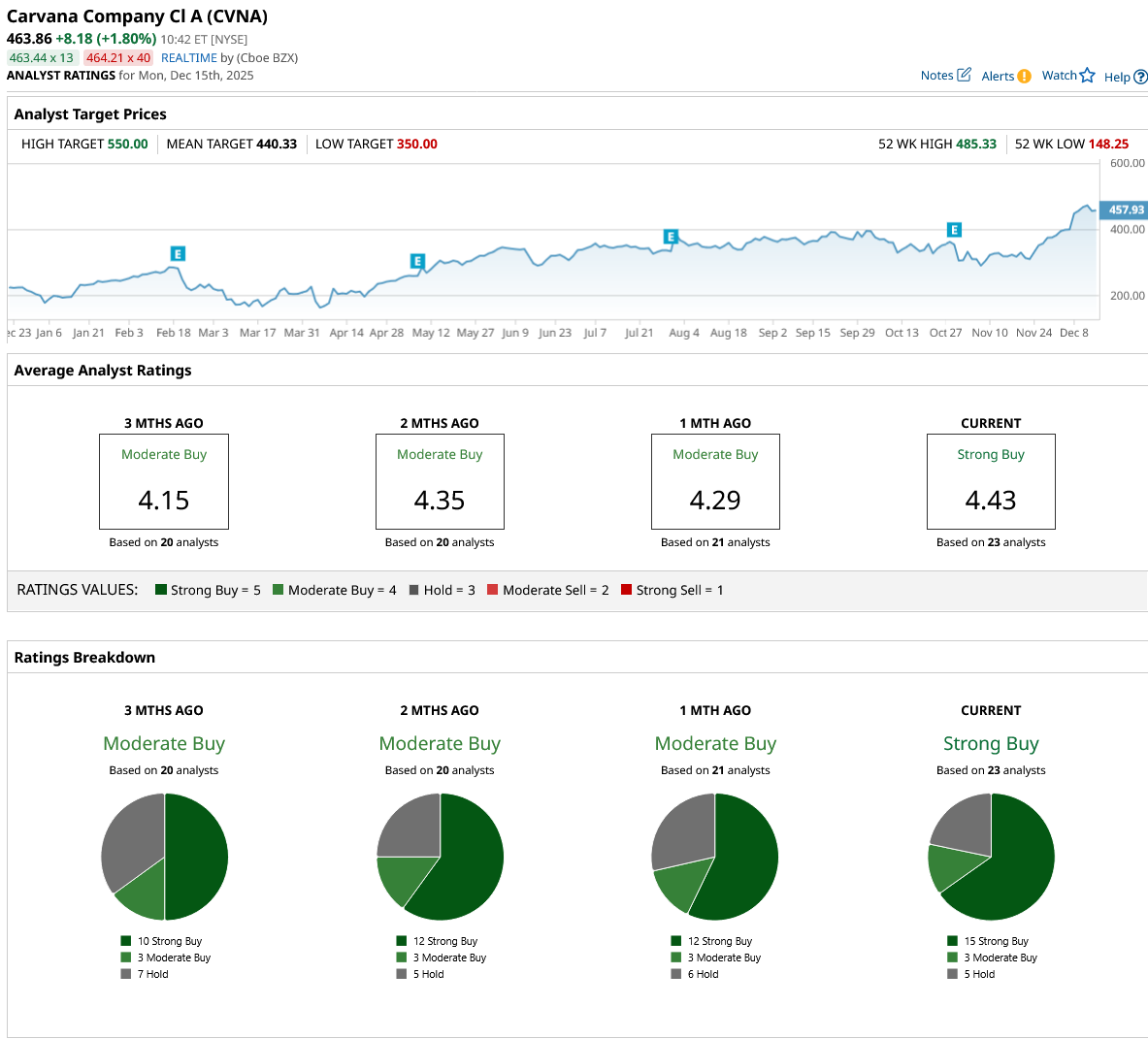

Overall, Wall Street remains strongly bullish about CVNA stock. Out of the 23 analysts that cover the stock, 15 rate it a “Strong Buy,” three say it is a “Moderate Buy,” and five rate it a “Hold.” The stock has surpassed its average price target of $440.33. However, its high target price of $550 implies potential upside of 19% in the next 12 months.

If Carvana continues delivering earnings growth anywhere close to current projections, the valuation can be justified over time, and the stock may still have upside despite its strong run this year.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/A%20photo%20of%20a%20Sandisk%20Solid%20State%20Drive%20by%20Top%20Popular%20Vector%20by%20Shutterstock.jpg)

/Tesla%20dealership%20with%20cars%20in%20lot%20by%20Jetcityimage%20via%20iStock.jpg)