Michael Burry, the hedge fund manager made famous by “The Big Short,” has built a reputation for spotting asymmetric, misunderstood bets. Now that same contrarian lens is focused on government‑sponsored mortgage giants, with Burry stating that he owns both Freddie Mac (FMCC) and Fannie Mae (FNMA). He believes a relisting of their stocks could be coming sooner than many expect.

This renewed interest arrives as the mortgage backdrop quietly improves. Freddie Mac’s latest Primary Mortgage Market Survey shows the 15‑year fixed rate eased to 5.44% from 5.51%. That's also lower than last year's 5.96%, giving the housing market a modest but meaningful rate tailwind.

With a high‑profile contrarian leaning into Freddie Mac just as borrowing costs edge lower and talk of relisting heats up, the setup is hard to ignore. Michael Burry is betting big on Freddie Mac stock ahead of a potential relisting, but should you? Let’s dive into what Freddie Mac really brings to the table.

Freddie Mac’s Numbers Behind Burry’s Bet

Freddie Mac is a U.S. government‑sponsored enterprise that buys mortgages, packages them into securities, and supports liquidity in the housing market.

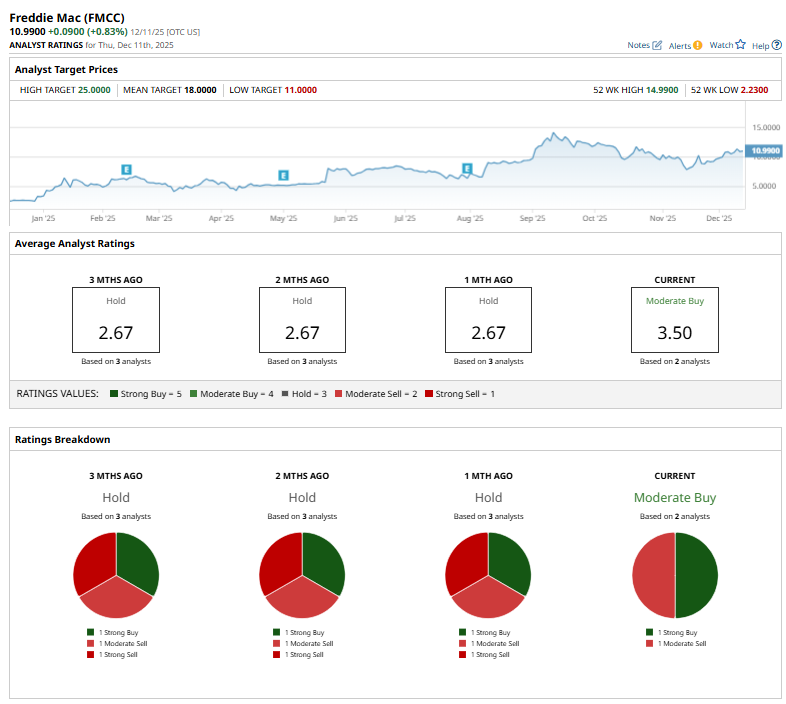

FMCC trades around $11, up 236% year-to-date and 317% over the past 52 weeks, putting Burry’s timing squarely in the context of a powerful recovery move.

Its equity now reflects a market capitalization of about $7 billion, while trading at just 0.06x price-to-sales versus a sector median of 3.02x. It also trades at 0.54x price-to-cash-flow versus a sector median of 9.69x, leaving Freddie Mac priced well below financial peers despite the rally.

The latest snapshot from September 2025 showed sales of $33 billion with sales growth of 1.82% from the previous quarter, signaling top‑line expansion even at this mature stage. It also reports net income of $2.7 billion, up 16.17% quarter-over-quarter, which points to stronger profitability and better operating leverage than the modest revenue growth alone would suggest. FMCC posted diluted earnings per share from continuing operations of $0.86, giving investors a clearer sense of what current earnings power looks like against that low price‑to‑cash‑flow multiple.

That same September 2025 update highlights operating cash flow of $16.7 billion, which reinforces the idea that cash generation is accelerating faster than accounting earnings. Its net cash flow figure remains negative, but a 28.18% improvement in net cash flow suggests pressure is easing as capital flows stabilize.

Freddie Mac’s Quiet De‑Risking

Freddie Mac is actively reshaping its risk profile and loan‑quality infrastructure. On Oct. 21, the company revealed that it sold about 2,201 deeply delinquent first‑lien mortgages via auction. The pool carried roughly $438 million in unpaid principal balance and was sold through its Standard Pool Offerings program, with settlement scheduled for December.

This kind of non‑performing loan sale speaks to one of the biggest concerns about a mortgage guarantor. The transaction helps strip some of that risk off the balance sheet.

That balance‑sheet work is being paired with a push to tighten loan quality at the front end. Freddie Mac has announced a next‑generation automation platform for its single‑family quality control process called Quality Control Advisor Plus. The tool is built to enhance loan quality, boost efficiency, and reduce costs by automating the quality control review and the remedy process on delivered loans.

These are two of the most labor‑intensive and error‑prone parts of the mortgage pipeline. A phased onboarding of Quality Control Advisor Plus is already underway, as Freddie Mac expects it to be available to all lenders by year‑end.

What Wall Street Thinks About FMCC

One quirk of Freddie Mac is that there are currently no formal earnings estimates posted for FMCC on key platforms. There are no forward EPS or revenue consensus numbers to anchor valuation debates in the usual way.

Between now and that update, the Street’s view is cautious rather than euphoric. FMCC currently has coverage from three surveyed analysts, and the overall consensus rating sits at “Hold.” Its average analyst price target sits at $18, implying upside from current levels.

In Conclusion

FMCC remains a bold, speculative swing rather than a sleep‑well‑at‑night holding. For portfolios that can handle policy risk, long timelines, and a small high‑beta position, tagging along with Burry’s thesis can make sense. More conservative approaches, focused on cleaner stories and predictable cash flows, are likely better off watching from the sidelines. In the near term, the share price will probably move sideways with sharp moves on any relisting headlines. Over time, the bias leans higher if fundamentals keep improving and Washington finally nudges the story forward.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)

/Quantum%20Computing/A%20concept%20image%20of%20a%20green%20and%20yellow%20motherboard_%20Image%20by%20Gorodenkoff%20via%20Shutterstock_.jpg)