Valued at a market cap of $11.7 billion, UDR, Inc. (UDR) is a multifamily residential real estate investment trust (REIT) that owns, operates, acquires, develops, and redevelops apartment communities across major U.S. metropolitan markets. The Highlands Ranch, Colorado-based company focuses on high-quality apartment homes in urban and suburban locations.

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and UDR fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the REIT - residential industry. The company benefits from its scale and operational efficiency, enabling disciplined capital allocation and cost control, while its strong balance sheet and conservative financial strategy support consistent dividend payments and long-term value creation for shareholders.

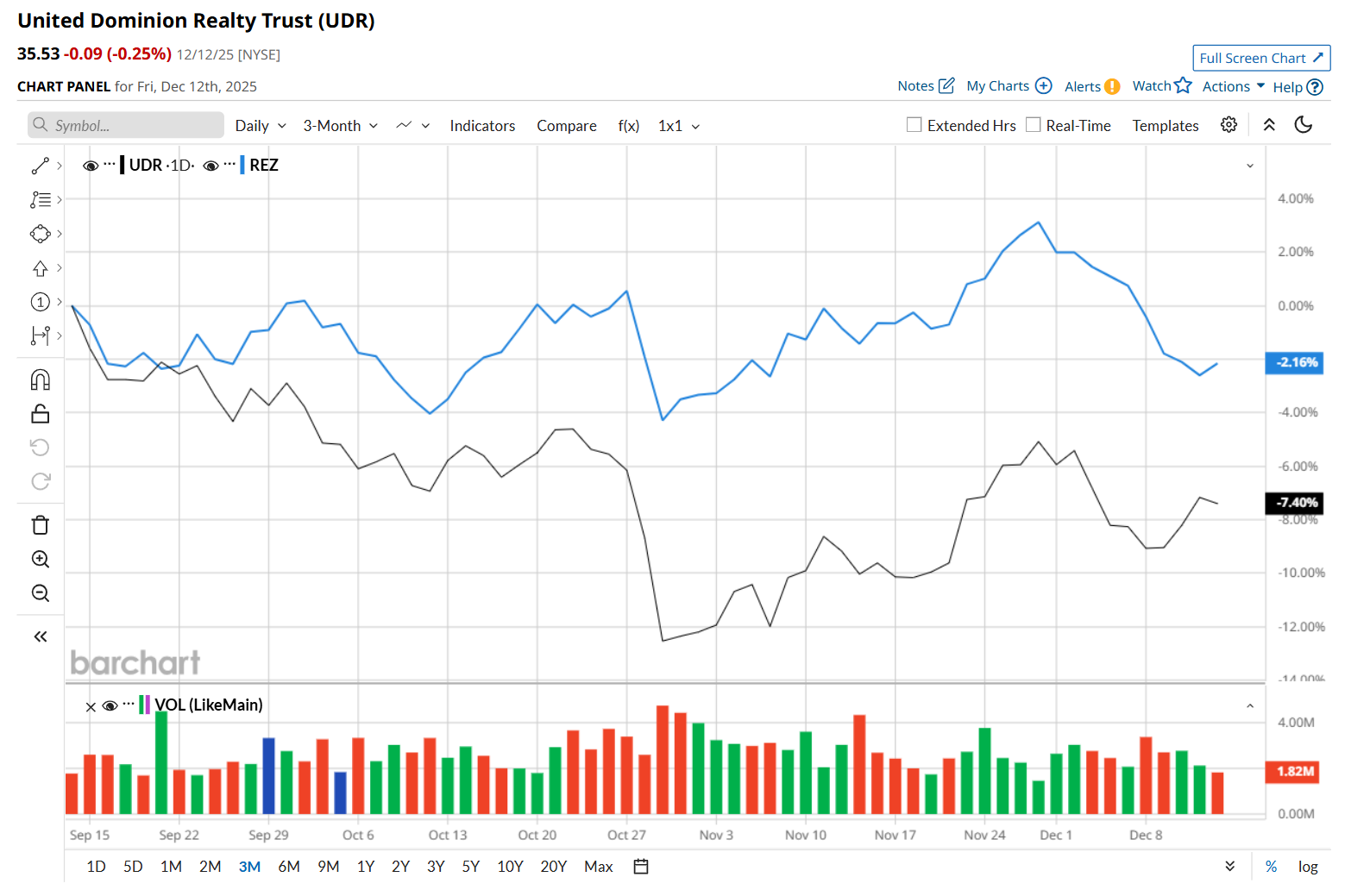

This residential REIT has slipped 23.5% from its 52-week high of $46.47, reached on Mar. 4. Shares of UDR have declined 7.4% over the past three months, underperforming the iShares Residential and Multisector Real Estate ETF’s (REZ) 2.2% drop during the same time frame.

In the longer term, UDR has fallen 20.7% over the past 52 weeks, considerably lagging behind REZ’s 1.5% downtick over the same time frame. Moreover, on a YTD basis, shares of UDR are down 18.2%, compared to REZ’s 2.5% return.

To confirm its bearish trend, UDR has been trading below its 200-day and 50-day moving averages since early April, with minor fluctuations.

On Oct. 29, shares of UDR plunged 4.2% after reporting mixed Q3 results. On the upside, the company’s FFO per share of $0.65 improved 4.8% year-over-year and surpassed analyst expectations of $0.63. Moreover, its total revenue increased 2.8% from the year-ago quarter to $431.9 million on the back of higher revenue from same-store communities and completed developments. However, its rental income of $429.3 million climbed 2.7% from the same period last year, but missed consensus estimates by a slight margin, which might have weighed on investor sentiment.

UDR has outpaced its rival, AvalonBay Communities, Inc. (AVB), which declined 22.4% over the past 52 weeks and 19.6% on a YTD basis.

Despite UDR’s recent underperformance, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of "Moderate Buy” from the 25 analysts covering it, and the mean price target of $40.47 suggests a 13.9% premium to its current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

/The%20CrowdStrike%20logo%20on%20an%20office%20building%20by%20bluestork%20via%20Shutterstock.jpg)