Gemini Space Station (GEMI) operates as a leading cryptocurrency exchange and custodian platform, enabling users to buy, sell, store, and trade digital assets like Bitcoin (BTCUSD), Ethereum (ETHUSD), and stablecoins. The platform offers advanced features, including derivatives trading, staking, OTC desks, NFT services, and a NYDFS-regulated stablecoin, bridging traditional finance with decentralized systems. The company serves approximately 523,000 monthly transacting users and 10,000 institutions across more than 60 countries worldwide, holding money transmission licenses in all 50 U.S. states and operating regulated entities abroad.

Established in 2014, Gemini Space Station is headquartered in New York City, USA.

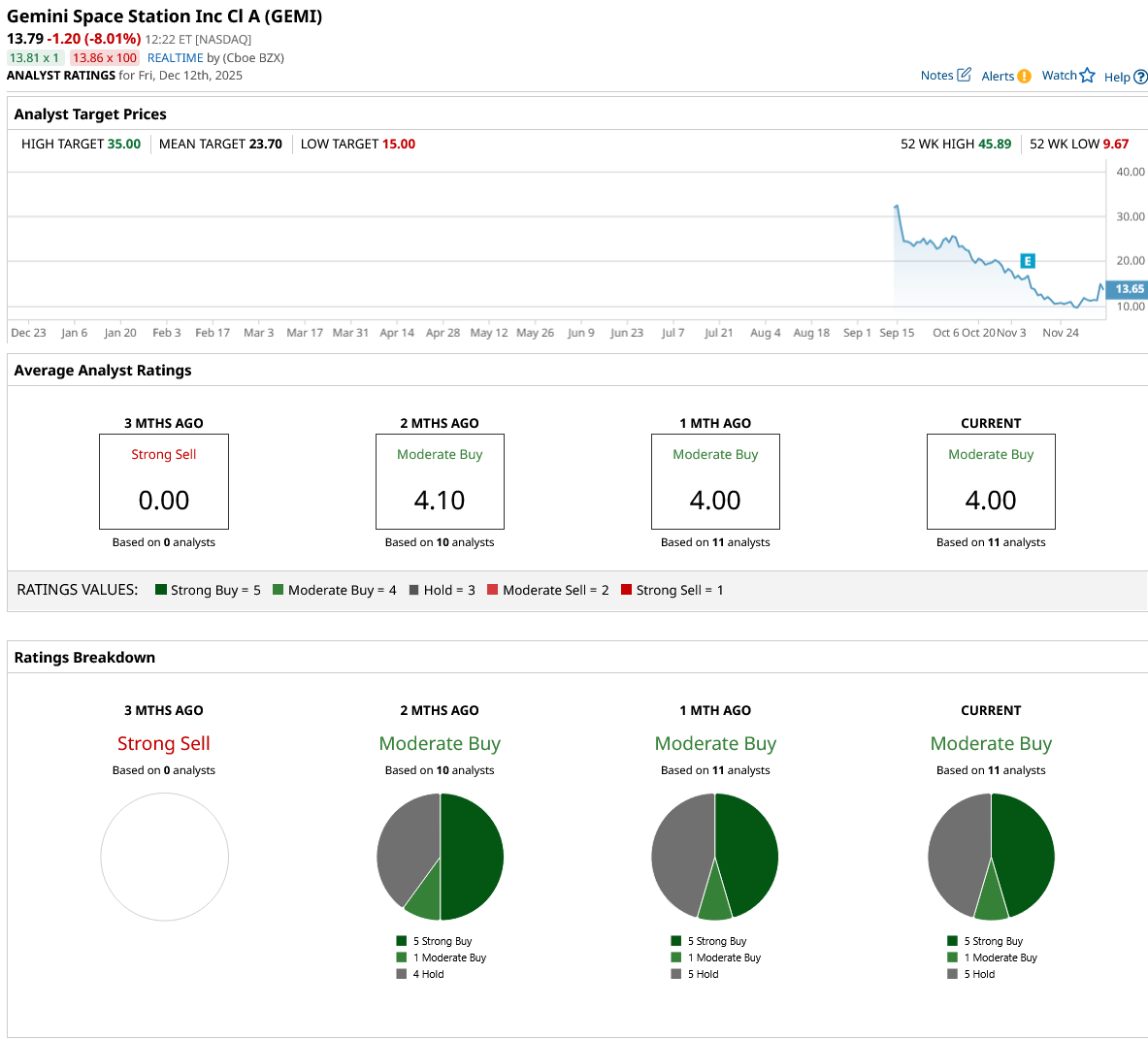

Gemini Stock Struggles Post IPO

Gemini Space Station trades near $14, versus a 52-week range of $9.67 to $45.89, leaving the stock down sharply from its post-IPO highs. Over the last five days, GEMI has jumped more than 19% but remains deeply negative since its September IPO, having lost over 60% from its early trading levels.

Compared with the broadly positive U.S. equity market, GEMI has dramatically underperformed while displaying much higher volatility.

Gemini Space's Mixed Results

Gemini Space Station reported Q3 FY2025 revenue of about $49.8–$50.6 million, more than doubling year over year and roughly 50%+ sequentially, modestly ahead of analyst expectations. Despite the top-line beat, the company posted a GAAP net loss of $159.5 million, translating into EPS of $6.67, which was significantly worse than the consensus loss of around $3.2 per share, leading to a sizable negative earnings surprise.

Operating performance showed strong growth but heavy cost intensity. Net revenue was up about 52% quarter-over-quarter (QoQ), driven by higher trading volumes, rapid adoption of its crypto credit card, and expanding staking and custody balances. However, operating expenses climbed to roughly $171 million, more than doubling year over year as IPO‑related stock-based compensation, marketing, and technology and compliance investments weighed on margins, pushing operating and net margins deep into negative territory and maintaining negative free cash flow.

For the remainder of FY2025 and into Q4, management guided services and interest revenue to a range of $60–$70 million, signaling continued growth in card spend, staking, and custody. The company also projected full‑year technology and G&A expenses of $140–$155 million and marketing spend of $45–$60 million, implying continued operating losses in the near term but targeting medium‑term monthly transacting user growth of 20–25% annually as key performance milestones.

Gemini Secures CFTC License

Gemini Space Station shares surged 20% on Thursday after its derivatives arm, Titan, secured a designated contract market (DCM) license from the CFTC. This approval enables Gemini to launch prediction markets for U.S. customers, offering event contracts (yes/no bets) on future outcomes like sports results or economic data via web and mobile apps.

Gemini President Cameron Winklevoss praised Acting Chairman Pham for fostering innovation, stating that prediction markets could rival traditional capital markets. Titan aims to expand into crypto futures, options, and perpetuals, advancing Gemini's vision of a comprehensive financial super app.

Competitors include Kalshi and Polymarket in prediction markets, while Robinhood (HOOD) integrates similar features alongside crypto trading.

Should You Buy GEMI Stock?

As the crypto company gains its CFTC license, Wall Street has GEMI stock at a “Moderate Buy” rating and a mean price target of $23.70, reflecting an upside potential of 72% from the market rate.

The stock has been rated “Strong Buy” by five analysts, “Moderate Buy” by one analyst, and “Hold” by five analysts.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)