Arm Holdings (ARM) shares lost another 3.8% on Dec. 11 as Oracle’s (ORCL) raised outlook for artificial intelligence (AI) spending despite muted Q2 revenue renewed bubble concerns.

ARM fellow below its major support coinciding with the 200-day moving average (MA) at the $137 level. A sustained break below this price could accelerate downward momentum.

Arm stock has lost nearly 25% since late October as valuation concerns continue to make investors rotate away from high-growth tech names.

How to Play Arm Stock Here?

Oracle’s capex guidance coupled with debt financing raises red flags about both profitability timelines and spending efficiency across the AI ecosystem.

And exposure to this dynamic is concerning for ARM shares as the firm’s licensing model depends heavily on demand for artificial intelligence chips from major tech companies.

Plus, the chip designer is trading at north of 160 times forward earnings, which makes it especially vulnerable to a massive selloff should the AI demand normalize in 2026.

Note that Arm’s long-term relative strength index (100-day) sits at 49 currently, indicating that the bearish momentum may not exhaust anytime soon.

Fed Poses Another Risk to ARM Shares

While Arm shares’ technicals sure warrant caution, the firm’s strong position in chip architecture, serving nearly every major technology company from Apple (AAPL) to Qualcomm (QCOM) offer some fundamental support.

Still, caution is warranted in playing them here since Federal Reserve chair Jerome Powell signaled a pause on further easing this week, which means the easy money environment may be ending.

And for an artificial intelligence company like Arm Holdings that relies heavily on cheap capital to drive innovation, it’s a big deal.

All in all, the combination of sector headwinds, valuation concerns, and technical weakness signals it may not be prudent buying ARM stock on the recent pullback.

How Wall Street Recommends Playing Arm Holdings

Despite aforementioned challenges, Wall Street remains bullish on Arm stock heading into 2026.

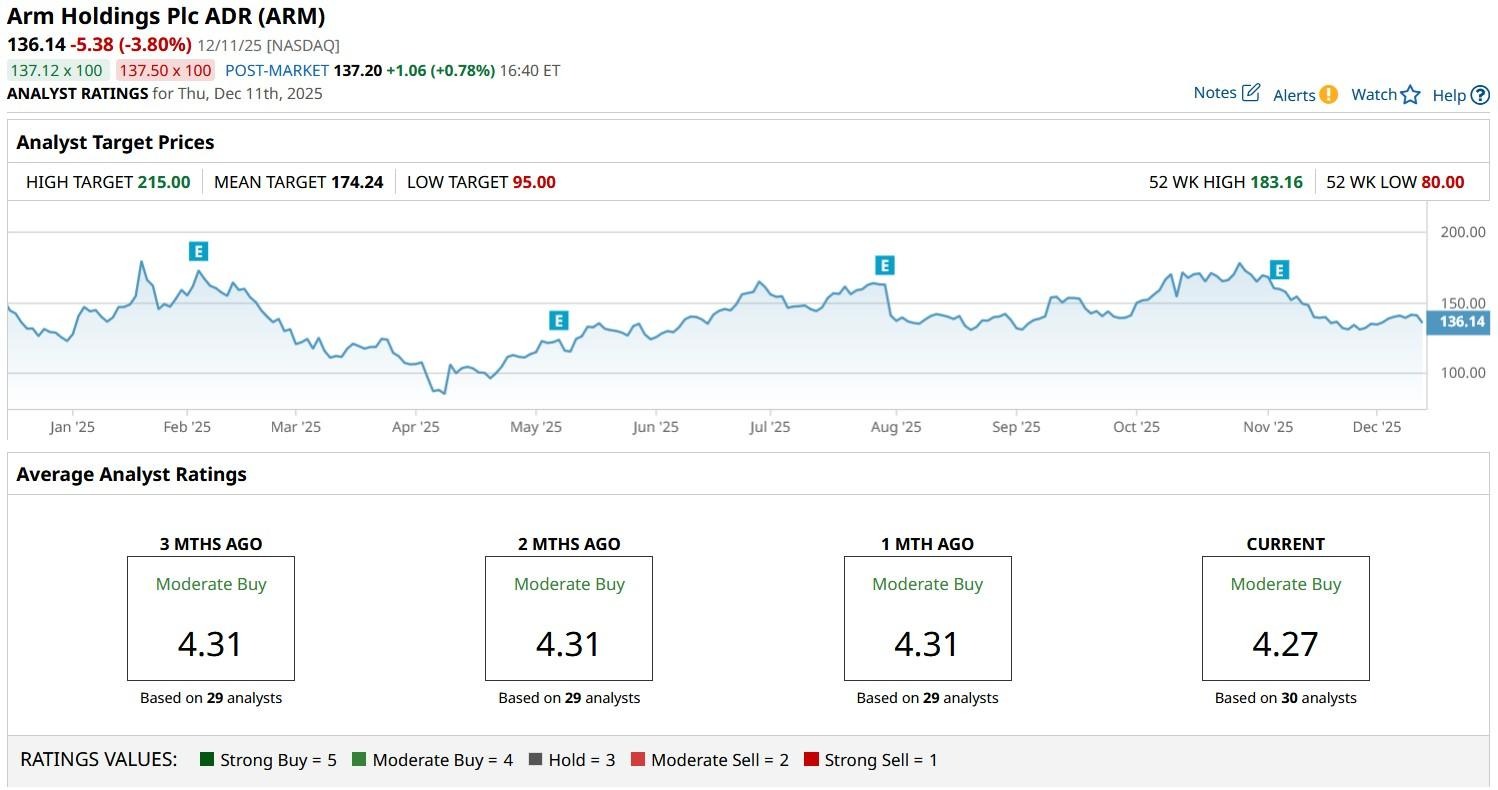

According to Barchart, the consensus rating on ARM shares remains at “Moderate Buy” with the mean target of about $174 indicating potential upside of a massive 30% from current levels.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

/Cloud%20Computing%20diagram%20Network%20Data%20Storage%20Technology%20Service%20by%20onephoto%20via%20Shutterstock.jpg)

/AI%20(artificial%20intelligence)/AI%20software%20engineering%20by%20Tapati%20Rinchumrus%20via%20Shutterstock.jpg)