Valued at $24.8 billion by market cap, Houston, Texas-based CenterPoint Energy, Inc. (CNP) operates as a public utility company. It operates through Electric and Natural Gas segments, serving nearly 7 million metered customers in Indiana, Minnesota, Ohio, and Texas.

Companies with a market cap of $10 billion or more are categorized as "large-cap stocks." CenterPoint fits this description perfectly, with its market cap exceeding this threshold, reflecting its substantial size and influence in the utility sector.

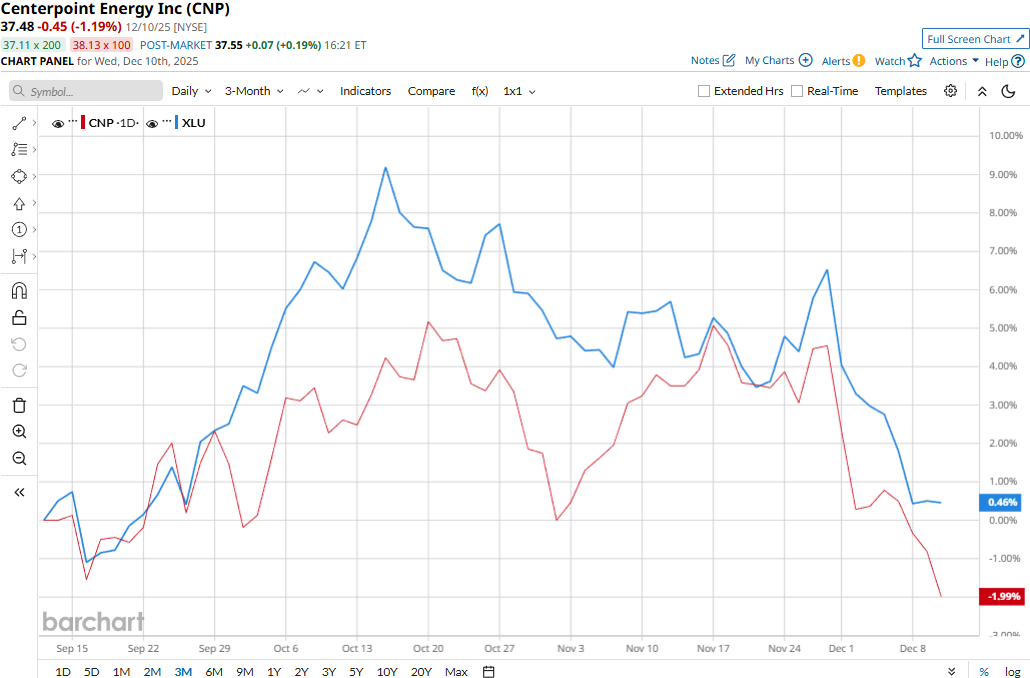

CenterPoint stock currently trades 7.5% below its all-time high of $40.50 touched on Sept. 29. Meanwhile, CNP stock prices have dipped 82 bps over the past three months, lagging behind the Utilities Select Sector SPDR Fund’s (XLU) 99 bps uptick during the same time frame.

Over the longer term, CNP stock has notably outperformed the utilities sector. CNP stock prices have soared 18.1% on a YTD basis and 19.4% over the past 52 weeks, compared to XLU’s 12.9% gains in 2025 and 9.4% returns over the past 52 weeks.

CNP stock has traded consistently above its 200-day moving average over the past year, but dropped below its 50-day moving average in early December, underscoring its previous bullish trend and recent downturn.

Despite reporting better-than-expected financials, CenterPoint Energy’s stock prices declined 1.1% in the trading session following the release of its Q3 results on Oct. 23. Driven by solid growth in its utility revenues, the company’s overall topline for the quarter surged 7.1% year-over-year to approximately $2 billion, beating the Street’s expectations by 1.9%. Meanwhile, its adjusted EPS soared by an even more impressive 61.3% year-over-year to $0.50, exceeding the consensus estimates by 8.7%. However, the company's 2026 guidance likely missed investors' expectations, leading to a dip in stock prices.

Meanwhile, CenterPoint has notably outperformed its peer Dominion Energy, Inc.’s (D) 7.8% gains on a YTD basis and 5.5% returns over the past 52 weeks.

Among the 17 analysts covering the CNP stock, the consensus rating is a “Moderate Buy.” Its mean price target of $42.93 suggests a 14.5% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Technology%20abstract%20by%20TU%20IS%20via%20iStock.jpg)

/Quantum%20Computing/A%20concept%20image%20with%20a%20brain%20on%20top%20of%20a%20blue%20circuit%20board_%20Image%20by%20Gorodenkoff%20via%20Shutterstock_.jpg)