/NVIDIA%20Corp%20video%20chip-by%20Antonio%20Bordunovi%20via%20iStock.jpg)

President Donald Trump recently announced he will allow Nvidia (NVDA) to export its advanced H200 AI chips to China. The recent development indicates a shift in U.S. technology policy, as the move will give Chinese companies access to computing power that was previously blocked. Nvidia can now ship the H200 to approved customers in China, provided the U.S. government receives a 25% cut of sales, up from the 15% rate negotiated last summer.

The policy reversal has sparked debate among analysts and policymakers about whether the benefits to American companies outweigh potential national security concerns. Critics argue the decision hands China an advantage in the global AI race, given that Chinese firms like DeepSeek have shown they can build competitive AI models despite restrictions.

Beijing has spent years pushing tech companies toward homegrown chips from Huawei and other domestic suppliers as part of its self-sufficiency drive. The government previously discouraged purchases of Nvidia's less powerful H20 chip, raising questions about whether Chinese firms will be permitted to buy the H200.

Yet the H200 offers significantly better performance than current Chinese alternatives, and major tech companies such as Alibaba (BABA) and Baidu (BIDU) are facing ongoing chip shortages. Notably, Nvidia has not built major China sales into its forecasts given the uncertain regulatory environment.

Analysts at BNP Paribas called the development positive over the medium term but noted uncertainties around available supply, Chinese demand, and Beijing's ultimate stance on allowing purchases. The tight global supply of AI chips in 2026 may limit how many H200 units Nvidia can actually ship to China, even with export approval.

Is Nvidia Stock Still a Good Buy Right Now?

Valued at a market cap of $4.5 trillion, Nvidia stock has returned a staggering 22,400% to shareholders over the past decade. Nvidia CFO Colette Kress pushed back hard against concerns about an AI bubble during a recent investor conference, arguing the chipmaker is in the early stages of multiple transformational shifts.

She pointed to the ongoing transition from CPU-based computing to GPU acceleration as representing roughly half of the projected $3 trillion to $4 trillion data center infrastructure market by decade's end.

Kress also dismissed worries that Nvidia's lead is shrinking. She emphasized that the company's full-stack approach goes far beyond individual chips, incorporating seven different processors working together at rack scale.

This co-design philosophy makes Nvidia fundamentally different from fixed-function ASICs that competitors are developing. The CUDA software platform remains a critical moat, with backward and forward compatibility allowing customers to improve performance on existing hardware through software updates alone.

Kress noted that Blackwell systems already show 10 to 15 times the improvement over prior generations, with 2 times that gain coming purely from software enhancements.

What Is the NVDA Stock Price Target?

Nvidia ended the recent quarter with a $25 billion increase in combined inventory and purchase commitments, which indicates robust demand. The $500 billion Blackwell and Vera Rubin revenue projection through calendar 2026 doesn't include potential new deals, such as the OpenAI framework agreement or the recent Anthropic partnership.

Nvidia’s gross margins remain steady, which indicates pricing power amid rising competition and higher memory costs. Management believes continued improvements in cycle times, yields, and manufacturing efficiency can offset component price increases.

Nearly all current shipments represent net additions to the installed base rather than replacements, with even older Ampere architecture GPUs remaining in active use for model fine-tuning and internal research. The company expects to maintain its mid-70% margin profile into next year as Vera Rubin ramps up in the second half.

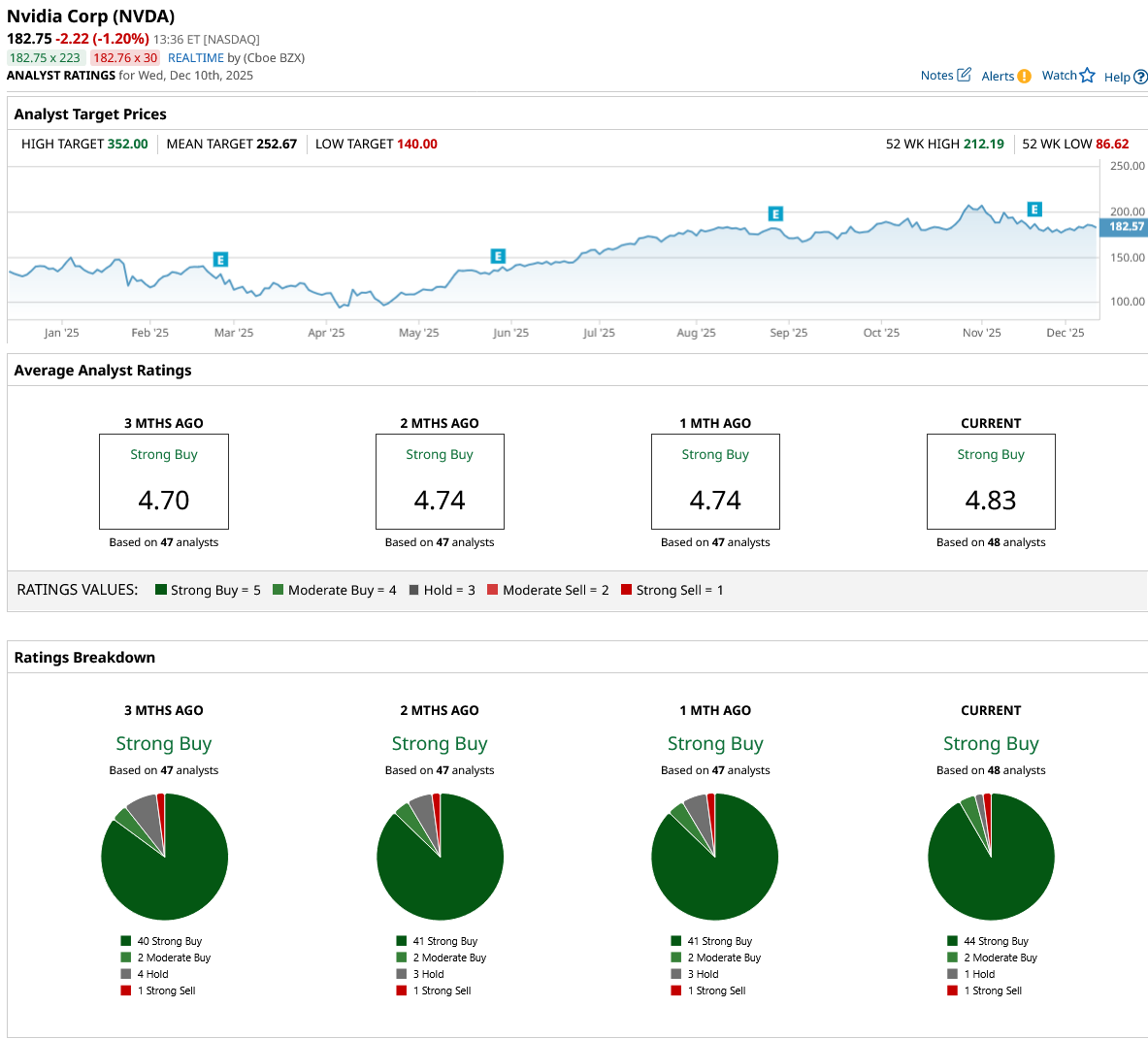

Out of the 48 analysts covering NVDA stock, 44 recommend “Strong Buy,” two recommend “Moderate Buy,” one recommends “Hold,” and one recommends “Strong Sell.” The average Nvidia stock price target is $252.67, above the current price of $183.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Pfizer%20Inc_%20logo%20sign-by%20JHVEPhoto%20via%20iStock.jpg)

/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)