12/9/25

.

.

.

.

If you don't like the customer service or lack of personal attention you are receiving from your broker, you have options, and you don't have to stay there. Account transfers are easy and so is opening a new account. Sign Up Now

.

.

If you would like to receive more information on the commodity markets, please use this link to join my email list Sign Up Now

.

.

IT WAS GREAT TO MEET ALL OF YOU IN AMARILLO AND IT WOULD BE A PRIVILEGE TO WORK WITH YOU.

.

.

The Livestock Markets were mixed today, and all closed near unchanged on the day. February'26 Live Cattle were 207 ½ cents lower today and settled at 226.95. Today's high was 228.60 and that is the new 1-month high as well. Today's low was 225.65 and the 1-month low is 204.32 ½. Since 11/7 February'26 Live Cattle are 7.20 higher or more than 3%. The January'26 Feeders bounced well off the lows today and almost settled unchanged for the day. The January'26 Feeder Cattle were 15 cents lower today and settled at 335.50. Today's high was 338.67 ½ and the 1-month high is 340.07 ½. Today's low was 332.75 and the 1-month low is 299.52 ½. Since 11/7 January'26 Feeder Cattle are 15.92 ½ higher or almost 5%. The Hogs settled more than a dollar off the lows today. February'26 Lean Hogs were 52 ½ cents lower today and settled 81.87 ½. Today's high was 82.52 ½ and the 1-month high is 83.60. Today's low was 80.65 and the 1-month low is 77.12 ½. Since 11/7 February'26 Lean Hogs are 2.52 ½ higher or more than 3%. The February'26 Fats set a new 1-month high today, just 63 ½ below the 50-day moving average at 229.23 ½. The 100-day moving average sits just 2.30 above the 50-day at 231.53 ½. I do not believe this rally is over yet and feel it can kick into high gear between now and the end of January. We should have more market information at the end of January'26, and then everything can be reassessed, but I am looking for a continued rally. I feel the Feeders have the most to gain, and if they can climb 5-dollars higher from here, and I feel they can, then it will be off to the races again. The 50-day moving average in the January'26 Feeders is 339.88 ½, the 100-Day moving average is 340.02 ½, and the 1-month high is 340.07 ½. So, if the January'26 Feeders can settle 5-dollars higher from today's settlement price, it would be above all of those levels, and I feel we could see it by the end of the week. Whenever they decide to open the Border to Cattle from Mexico, I feel any big move lower has already taken place, as the Funds have already liquidated their long position, and open interest is low. If the Cattle Markets break on that news, then I see it as a buying opportunity. The February'26 Hogs settled lower today, but 1.22 ½ off the low. I feel the Hogs finally have a chance to trade higher from here, and I bought a couple for a Customer today. I would like to work with you and earn your trust and your business. I have many ways to play the Cattle Markets moving forward. Give me a call if you have any questions.

.

.

NOW IS THE TIME TO OPEN AN ACCOUNT BEFORE ANOTHER MONTH PASSES BY - (ONLY 3 WEEKS LEFT THIS YEAR) If you hit the link and provide your information, you will have a wealth of Market information at your fingertips. Sign Up Now

.

.

The need for a successful business to have a trading account is immeasurable. Look at the market movement in all markets over the last three months. Opening an account sometime in the future will not help you if you need access now. To be successful, and able to manage risk, you need to be proactive now and secure your access to markets in real time. You can be both Prepared and Patient at the same time. ***WATCH FOR TRADE DEAL NEWS***

.

.

Through Walsh Trading I have built the best 5-man team in the business. Give me a call and let me show you how the Pure Hedge Division can help your bottom line.

.

.

The Grain Markets were mixed, with the Corn gaining on the day. January’26 Soybeans closed a few cents off the lows today and did not look very good. January'26 Soybeans were 6 ½ cents lower today and settled at 1087 ¼. Today's high was 1094 ¾ and the 1-month and contract high are 1169 ½. Today's low was 1084 ½ and that is the new 1-month low as well. Since 11/7 January'26 Soybeans are 29 ¾ cents lower or more than 2 ½%. March'26 Corn was the only one to stay in the green today. March'26 Corn was 4 ¼ cents higher today and settled at 448. Today's high was 449 and the 1-month high is 457. Today's low was 443 ½ and the 1-month low is 434 ½. Since 11/7 March'26 Corn is 6 cents higher or more than 1 %. The Wheat settled near the middle of today's trading range and closed fractionally lower. March'26 Wheat was ¼ of a cent lower today and settled at 534 ½. Today's high was 537 ¾ and the 1-month high is 563 ¼. Today's low was 531 ¼ and the 1-month low is 529 ¾. Since 11/7 March'26 Wheat is 7 ¾ cents lower or more than 1%. The Soybeans have continued to trade lower, and I feel it is not over yet. Last week I recommended buying the 1080 Puts, and that has worked out well so far. China is still playing games and is well short of any commitment they will not honor anyway. With flash sales of just a few hundred thousand tones, 3-weeks left in the year, and today's announcement of 12 billion to help the Farmers, I can see that continuing to pressure the market lower. Last week I wrote, “I feel any Bean purchases from China are already priced into the market, and over the next three years, their Soybean purchase agreements (25MT) is below the standard amount they would buy anyway, and they are not look looking to do the US any favors either. I recommend Hedging as far out as possible now, and with an expected check from the government, you can lock in a high sale price. I would also recommend hedging using an OTC Structured Product and maximize your sale price. I can explain how that works if you are interested.” Brazil has planted a monster Soybean crop as well. There is still time to catch a break in the Soybeans, but the sooner the better, as the Option Premium could shoot much higher. Last week I continued to buy Puts in the Beans and also bought the March'26 and July'26 Soybean 1050/1000 Put Spreads, just in case. The Corn looked good today, but it could be difficult to have a big rally with the Beans looking this weak. The WASDE Report did not look very good for the Wheat, but it did not want to break, I guess, and the Wheat can trade anywhere at any time. I am still Bullish the Soybean Oil and that could help stabilize the Soybeans, but that does not mean the beans can't shoot lower and then climb back. I feel the Soybean Oil will continue higher from here and pick up the pace in 2026, as biofuel percentages are set to increase in multiple countries next year, and I feel we can see a substantial move higher in the first 3-month and 6-month time frames next year. I continue the buy the Soybean Oil Futures Spreads, and Call Spreads, and sell Put Spreads in several different contract months. Give me a call if you would like to know more about any of these markets. I will have a few new recommendations tomorrow, send me an email if you are interested. Have a great night.

.

.

REASONS WHY I AM STILL BULLISH SOYBEAN OIL.

.

.

Here is why I like the Soybean Oil. The Palm Oil supply is getting tight, and export controls seem very possibly next year. The Indonesian Government must be worried about their supply, as they seized land in Palm Oil producing regions and placed them under State Owned Control. At the same time, the production and export supplies of Sunflower Oil are expected to decline, as the price continues to climb and make cheaper Soybean Oil more attractive. Sunflower Oil supplies are already tight, as production estimates have decreased throughout Europe, Russia, and Ukraine, which will limit the amount of Sunflower seed crushing, again making the cheaper Soybean Oil more attractive. Biofuel percentages are set to increase in Brazil, Indonesia, and Malaysia, and I would not be surprised if the Biofuel blend rates were raised domestically as well. Argentia has already sold most of their Soybeans to China, so their crushing will be limited as well. It all points to what could be a very dramatic price increase in the Soybean Oil Market. I have continued to buy Soybean Oil Future Spreads and Options Spreads, with a new target level of 64.00-66.00. The market breaking the last two days was an unexpected opportunity, I took advantage of it, and will continue to do so, with Spreads in the Futures and Options. I have 3-month, 6–month, and 12-month strategies completed, and ready to go. Give me a call if you would like to know more.

.

.

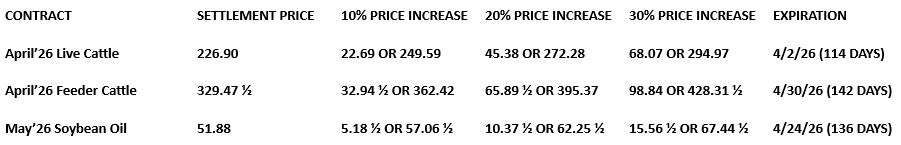

10% 20% 30% VALUES AND WHERE THE FUTURES PRICES WOULD BE IN THE FATS FEEDERS AND SOYBEAN OIL

.

.

.

.

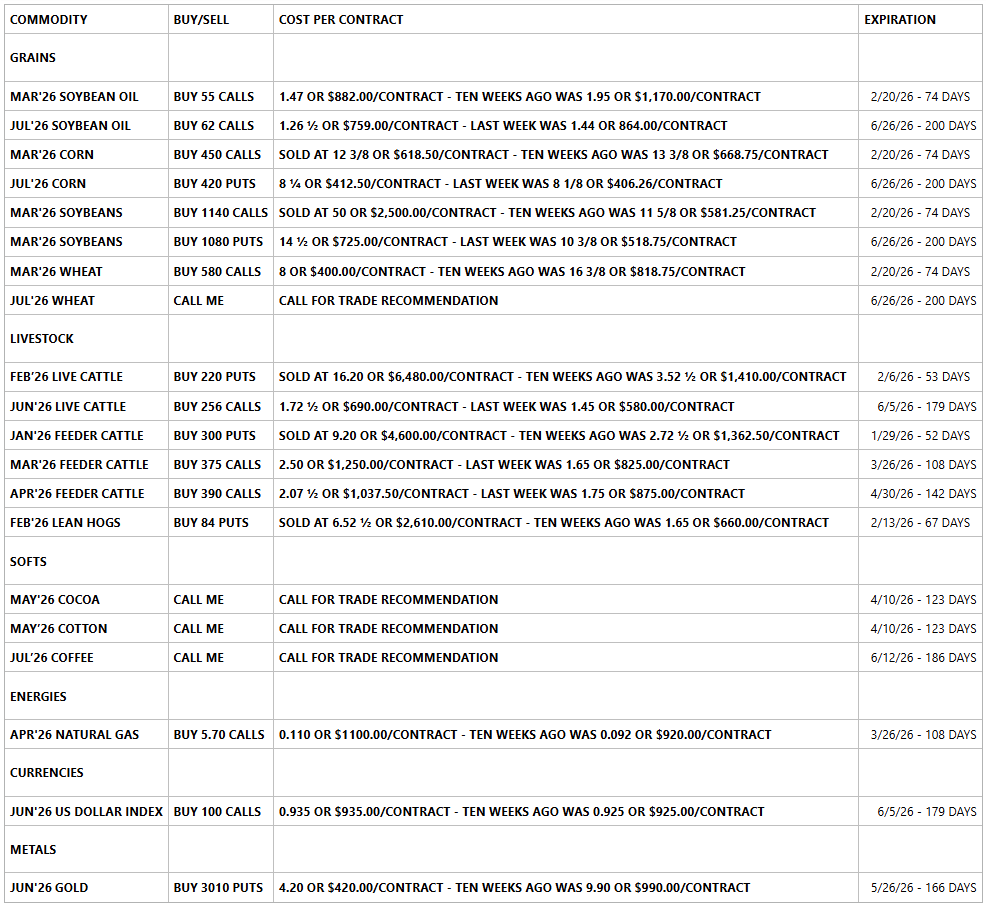

THIS WEEKS WALSH GAMMA TRADER FROM YESTERDAY 12/8/25 BELOW.

.

.

.

.

The need for a successful business to have a trading account is immeasurable. Look at the market movement in all markets over the last three months. Opening an account sometime in the future will not help you if you need access now. To be successful, and able to manage risk, you need to be proactive now and secure your access to markets in real time. You can be both Prepared and Patient at the same time. WATCH FOR TRADE DEAL NEWS

.

.

If you don't like the customer service or personal attention you are receiving from your broker, you have options, and you don't have to stay there. I can have your new account open in 1-2 days. Call me anytime 312-957-8079 BALLEN@WALSHTRADING.COM Sign Up Now

.

.

.

.

USE THE QR CODE BELOW TO SIGNUP FOR TRADE ALERTS

.

.

If you would like to open an account, please call or send me an email BALLEN@WALSHTRADING.COM

.

.

.

.

If you would like to receive more information on the commodity markets, please use the link to join my email list Sign Up Now

.

.

Thank you to all of my Canadian Customers. If you live in Alberta or Ontario, you are able to open an account in the USA. Hopefully we can work with the Province of Saskatchewan, and all Canadian Provinces soon. Your ability to open an account in the US is blocked by your Provincial Governments, not by the United States.

.

.

Thank you to all of my old and new Customers. I appreciate your business. To those of you that are close to opening an account, please call me if you have any questions, and I look forward to working with you soon. To anyone thinking about opening a Hedge or Trading account, give me a call and we can talk about it.

.

.

Most Recent Walsh Gamma Trader Link - Walsh Gamma Trader

.

.

GOD BLESS AMERICA

.

.

.

.

.

.

.

.

Give me a call if you have any questions.

.

.

Bill Allen

Vice President

Pure Hedge Division

Direct: 312-957-8079

WALSH TRADING INC.

311 South Wacker Drive

Suite 540 Chicago, Illinois 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Space%20Technology%20by%20Rini_%20com%20via%20Shutterstock.jpg)

/Apple%20Inc%20logo%20on%20Apple%20store-by%20PhillDanze%20via%20iStock.jpg)