/A%20corporate%20sign%20for%20Baidu%20by%20Tada%20Images%20via%20Shutterstock.jpg)

AI chipmakers are suddenly inseparable in investors’ minds. Companies that control the chips powering large language models can capture outsized growth, and sometimes that promise is best realized by spinning a unit out so the market can value it on its own. Big-cap tech spinoffs have a history of unlocking shareholder value, but they also carry execution and regulatory risk.

That’s precisely what’s on the table at Baidu (BIDU). The company has confirmed it is assessing a spinoff and potential listing of its AI chip division, Kunlunxin, which was recently valued at roughly $3 billion after a new funding round. Early reports suggest the unit could file for a Hong Kong IPO as soon as Q1 2026. With Baidu shares already climbing on the news, investors are asking a key question: Should you buy, sell, or hold BIDU stock now? Let's find out.

About BIDU Stock

Headquartered in Beijing, Baidu is China’s leading internet search and AI company. Baidu has evolved far beyond its roots as a search engine giant and now operates as a diversified technology company specializing in artificial intelligence and internet services. Its growth strategy is increasingly centered on high-demand sectors such as cloud computing, autonomous driving, AI model development, and its rapidly expanding mobile ecosystem, all of which position the company to capitalize on some of the fastest-growing trends in today’s digital economy.

Valued at $45 billion by market cap, BIDU is among the top gainers in its sector for 2025. BIDU shares have soared roughly 48% year-to-date (YTD), outpacing the broader market. The surge reflects renewed investor optimism around Baidu’s AI strategy, like cloud services, ERNIE chatbot expansion, autonomous vehicles, and recent news of a possible chip-unit IPO. For example, Jefferies notes strong AI momentum and cloud growth as key drivers.

On the valuation end, BIDU looks like a mixed bag. Its EV/EBIT is 145x, significantly higher than the sector median of 16x, indicating a costly stock. However, its price/book ratio of 1x is considerably lower than the sector's 1.76x, suggesting a more attractive valuation in this aspect.

Baidu Top Q3 Earnings Estimate

Baidu reported its latest earnings in mid-November. The company posted revenue of about $4.38 billion, down a little more than 7% from last year but slightly above analyst expectations. Most of the weakness came from advertising, with online marketing revenue falling to about $2.15 billion, reflecting a soft ad market.

AI was the standout. Non-advertising revenue, which includes AI cloud and other services, rose to about $1.31 billion, up 21% from last year. AI Cloud revenue alone reached about $880 million, while iQIYI, Baidu’s streaming segment, generated about $960 million, down 8%.

On the bottom line, Baidu reported a net loss of around $1.6 billion due to write-downs and investment charges. On a non-GAAP basis, the company earned roughly $545 million, with adjusted EPS of $1.23, down 34% year-over-year (YoY).

Despite the loss, Baidu’s financial position stayed strong. The company ended the quarter with about $41.6 billion in cash and investments. Operating cash flow was around $176 million, while free cash flow was negative at roughly $302 million because of higher spending on capex and R&D.

Baidu did not issue formal guidance. Management reiterated its focus on AI, while analysts project about $18.2 billion in revenue for 2025 and EPS of around $6.09.

CEO Robin Li said AI is creating “transformative value” across the business and highlighted the progress of Apollo Go robotaxis as they approach a broader adoption “tipping point.”

Recent Developments and News

Earlier this week, Baidu said it is considering a spinoff and separate Hong Kong IPO of its Kunlunxin AI chip unit. The unit was valued at RMB13 billion ($1.84B) in 2021, and recent funding suggests it is valued at RMB21 billion ($3B) today. If completed, the IPO could unlock significant value, but Baidu cautions that any spinoff is not guaranteed and needs approvals. The news of the potential IPO has been viewed positively by investors, as it leverages China’s push for homegrown semiconductors and could streamline Baidu’s structure.

On the other hand, Baidu continues to push ERNIE chatbots and cloud AI. It open-sourced its ERNIE model in mid-2025 to drive adoption and unveiled ERNIE 5.0 at its Nov 2025 conference. However, usage remains relatively low: Reuters reports ERNIE’s monthly active users were 0.8 million in September, far below competitors like ByteDance (150 million) and DeepSeek (73 million). The slow adoption and earlier-than-expected open-sourcing suggest a mixed reception of Baidu’s AI products.

Moreover, Baidu is also focusing on cost-cutting measures. Following two quarters of revenue decline, Baidu announced layoffs beginning in Q4 2025. Reports indicate cuts across many divisions, up to 40% in some teams, though AI and cloud units are largely spared. The job cuts reflect management’s effort to improve efficiency amid sluggish ad revenues.

Analysts Ratings and Price Targets

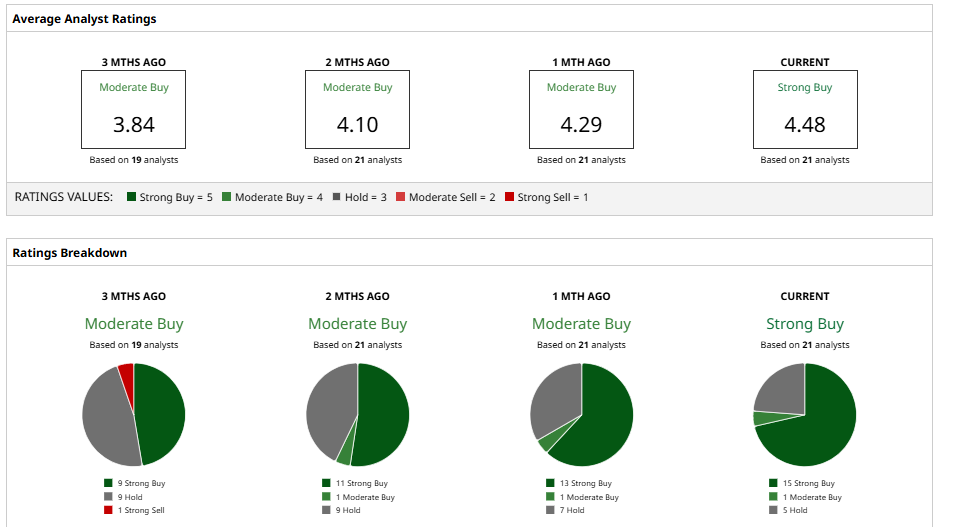

Wall Street sentiment on Baidu is mostly positive. The average 12-month price target is about $153, which implies roughly 23% upside from current levels. Among 21 analysts tracked by Barchart, the consensus is “Strong Buy.”

Separately, Goldman Sachs maintains a “Buy” with a $155 target, and Jefferies raised its target to $157 (also “Buy”), citing strong AI cloud trends. Benchmark recently upgraded Baidu to “Buy” with a $158 target, using a sum-of-parts valuation that highlights AI momentum.

By contrast, Morgan Stanley is more cautious. Analyst Gary Yu kept an “Equal-Weight” rating and lowered his target to $130, noting that recovery in Baidu’s core advertising “will take time” even as AI monetization is nascent.

Notably, J.P. Morgan turned bullish on Nov. 24, upgrading BIDU stock to “Overweight” and setting a $188 target on Baidu’s long-term AI potential.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)