The semiconductor sector is one that has clearly benefited investors who have been consistent and patient in their approach. By investing in companies who focused on putting forward the most powerful chips which can handle ever-heavier workloads over time, the value accretion tied to such development (mainly coming from large technology companies seeking this additional compute) has made plenty of semiconductor-focused investors very wealthy in recent years.

The thing is, while most of the discussion on Wall Street and Main Street continues to surround certain high-profile chip stocks such as Nvidia (NVDA) and Advanced Micro Devices (AMD), it's also true that surging semiconductor billings in October have led to other unique and interesting opportunities in other areas of the market analysts from the Semiconductor Industry Association have pointed out.

Let's dive into one key player in the dynamic random access memory (or DRAM) market, and why Micron Technology (MU) is one specific opportunity these analysts point out as a buying opportunity right now.

Why Analysts Are Growing Bullish on Micron

Micron's status as a leading provider of DRAM to hyperscalers, cloud computing giants, and other technology superstars has led to surging interest around the need for greater memory and storage for companies looking to keep the billions of new photos and videos posted constantly, on top of all the AI-driven hosting demands too, of course.

With microprocessor billings reaching nearly $6 billion in October (a growth rate of around 16% on a year-over-year (YoY) basis), it's clear that spending is far from slowing in this often overlooked area of the semiconductor market. And while various other areas of the microprocessor market saw some weakness this past quarter, surging memory sales have led some analysts to point to companies like Micron as key winners in the long-term race for market share in this lucrative sector.

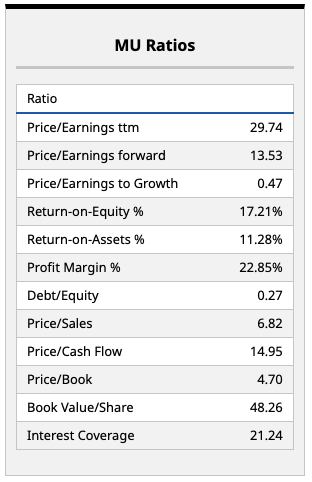

Looking at Micron's fundamentals above, I'd argue this company's valuation multiples suggest most investors view the company more as a mature player in the tech sector overall. Indeed, finding a tech company that's still growing at a decent clip, trading at just 13.5-times forward earnings isn't easy in this environment. And with a profit margin of nearly 23% and impressive ROE and ROA metrics, there's a lot to like about how this stock is positioned right now.

There's a reason why many of my peers here at Barchart tend to think Micron's impressive year-to-date (YTD) rally this year may not be over. I think the increasingly widespread view that Micron and other memory players could be the more profitable and stable way to play consistent growth in the microprocessor market is one worth hanging onto.

What's funny is I haven't looked at Micron in a little while, and the company's fundamentals did surprise me at first glance. These numbers were perhaps most surprising, given the performance of MU stock over the course of the past year, and the fact that this company still appears to be valued as a bargain despite its surge this year.

What Does Wall Street Think?

Following publications from industry groups, think tanks, and others who have a vested interest in one particular narrative can be helpful to a certain degree. But the inherent bias investors can rest assured is there may leave some investors looking for more certainty in what they're looking at.

On that topic, I tend to focus more of my time on what analysts on Wall Street think about a given company. That's because the individuals following specific companies over many years, using complex models to attempt to place a net present value on a company's future cash flows, may mean more for investors today than a broader piece covering overall growth in a given sector or other structural trends that could lead to a “rising tide lifting all boats.”

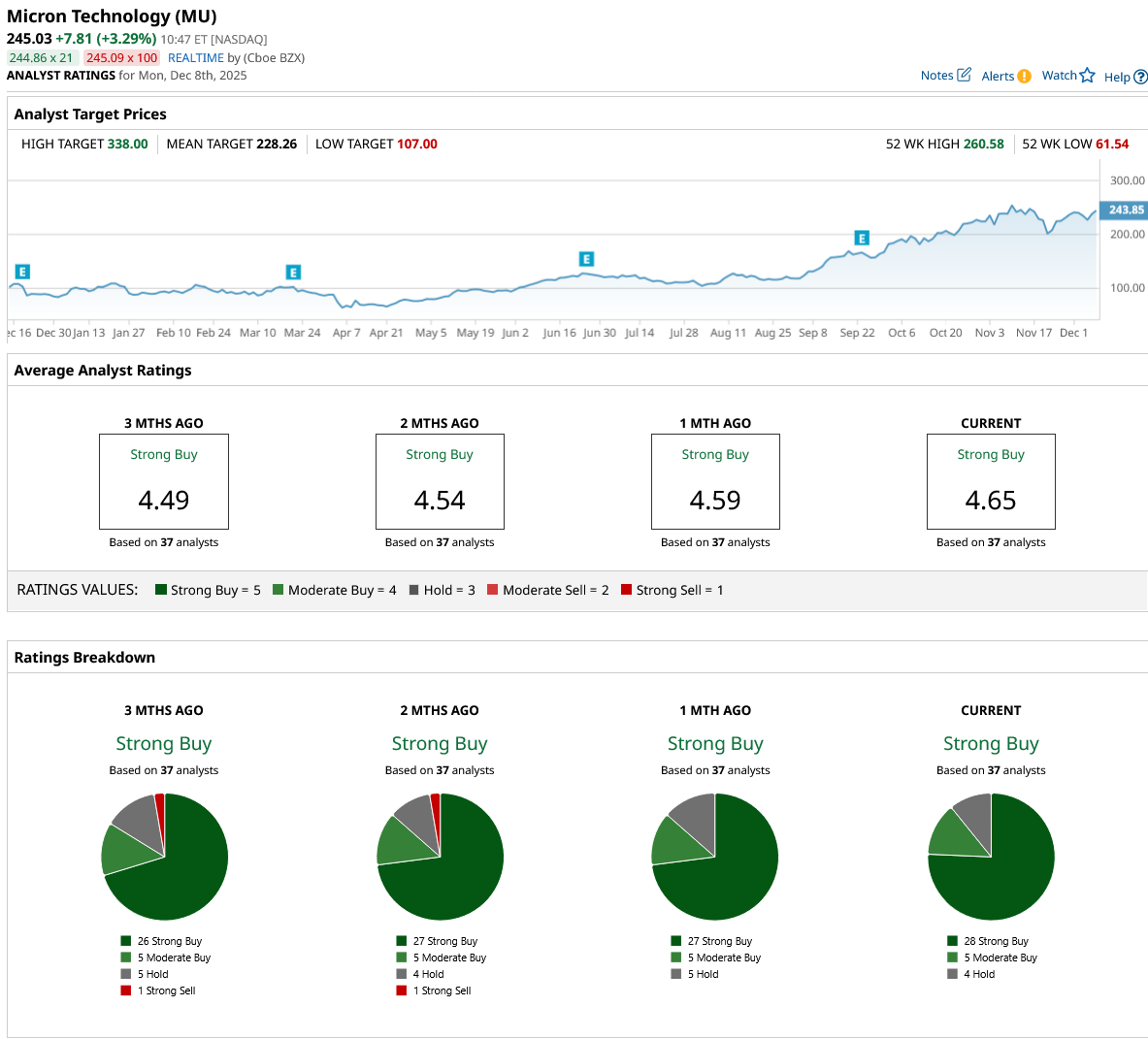

In that regard, I think it's useful to look at the consensus Wall Street estimate for MU stock, which currently sits right around where this stock is trading today. Personally, I think that's a simple reality that there's a lag between when an analyst takes a snapshot of a given company and assigns a price target. In this case, I'd think that most of the 37 analysts that cover Micron have likely not updated their analysis in a few months.

Most of Micron's recent move has come over the course of the past two quarters, driven by solid earnings over both periods. I think Micron's ability to continue to produce blowout earnings could drive even more upside in this stock, considering its current valuation multiple suggests Micron is one of the cheapest names in its sector.

Those thinking long-term have plenty of reasons to jump on this bandwagon, in my view. Personally, Micron is a top growth stock on my watch list now, and I'll certainly be highlighting this company moving forward.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)