With a market cap of $27.5 billion, Extra Space Storage Inc. (EXR) is a self-administered and self-managed REIT and a member of the S&P 500. As of September 30, 2025, it owned and/or operated 4,238 self-storage stores across 43 states and Washington, D.C., totaling approximately 2.9 million units and 326.9 million square feet of rentable space.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Extra Space Storage fits this criterion perfectly. Operating under the Extra Space brand, the company is the largest self-storage operator in the United States, offering secure and conveniently located storage solutions for individuals and businesses.

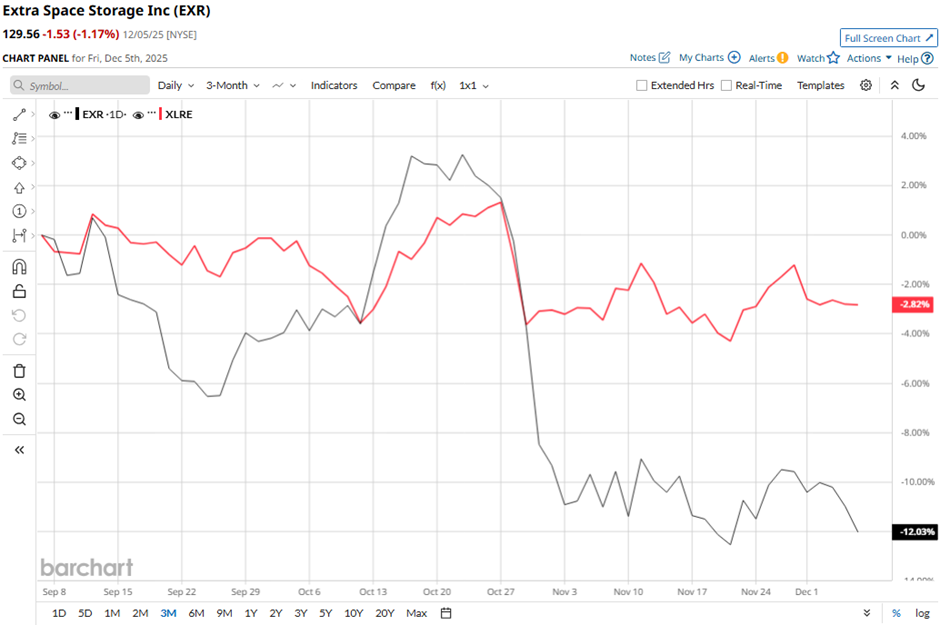

Shares of the Salt Lake City, Utah-based company have declined 21.7% from its 52-week high of $165.54. Over the past three months, its shares have decreased over 12%, underperforming the Real Estate Select Sector SPDR Fund’s (XLRE) 2.8% drop during the same period.

Longer term, EXR stock is down 13.4% on a YTD basis, lagging behind XLRE's marginal gain. Moreover, shares of the self-storage facility REIT have dipped 20.8% over the past 52 weeks, compared to XLRE's 6.5% decline over the same time frame.

The stock has been in a bearish trend, consistently trading below its 200-day moving average since last year.

Despite reporting better-than-expected Q3 2025 core FFO of $2.08 on Oct. 29, shares of EXR fell 4.9% the next day because the company missed revenue expectations, generating $858.5 million in the quarter. Investors were also weighed down by the 14.3% year-over-year drop in net income to $0.78 per diluted share, driven by a substantial $105.1 million loss tied to assets held for sale and sold.

In comparison, rival Lineage, Inc. (LINE) has performed weaker than EXR stock. LINE stock has dipped 39.7% YTD and 43.8% over the past 52 weeks.

Despite the stock’s weak performance, analysts remain moderately optimistic about its prospects. EXR stock has a consensus rating of “Moderate Buy” from 22 analysts in coverage, and the mean price target of $153.79 is a premium of 18.7% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20SoFi%20logo%20on%20an%20office%20building%20by%20Tada%20Images%20via%20Shutterstock.jpg)

/Stickers%20with%20AMD%20Radeon%20and%20Nvidia%20GeForce%20RTX%20graphics%20on%20new%20laptop%20computer%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20phone%20and%20site-by%20Majahid%20Mottakin%20via%20Shutterstock.jpg)