/AI%20(artificial%20intelligence)/AI%20engineer%20working%20on%20laptop%20by%20ART%20STOCK%20CREATIVE%20via%20Shutterstock.jpg)

Artificial intelligence (AI) is creating trillion-dollar opportunities, but not all AI stocks are built the same. In the race for long-term dominance, two names are consistently standing out. While Nvidia (NVDA) remains the undisputed powerhouse behind today’s AI infrastructure, Palantir (PLTR) is the emerging software force driving real-world AI adoption. Both are growing at extraordinary rates, both sit at the heart of massive technological transformations, and both claim moats that competitors struggle to match. The question now is, when looking a decade ahead, which could be the better long-term AI buy?

The Case for Nvidia

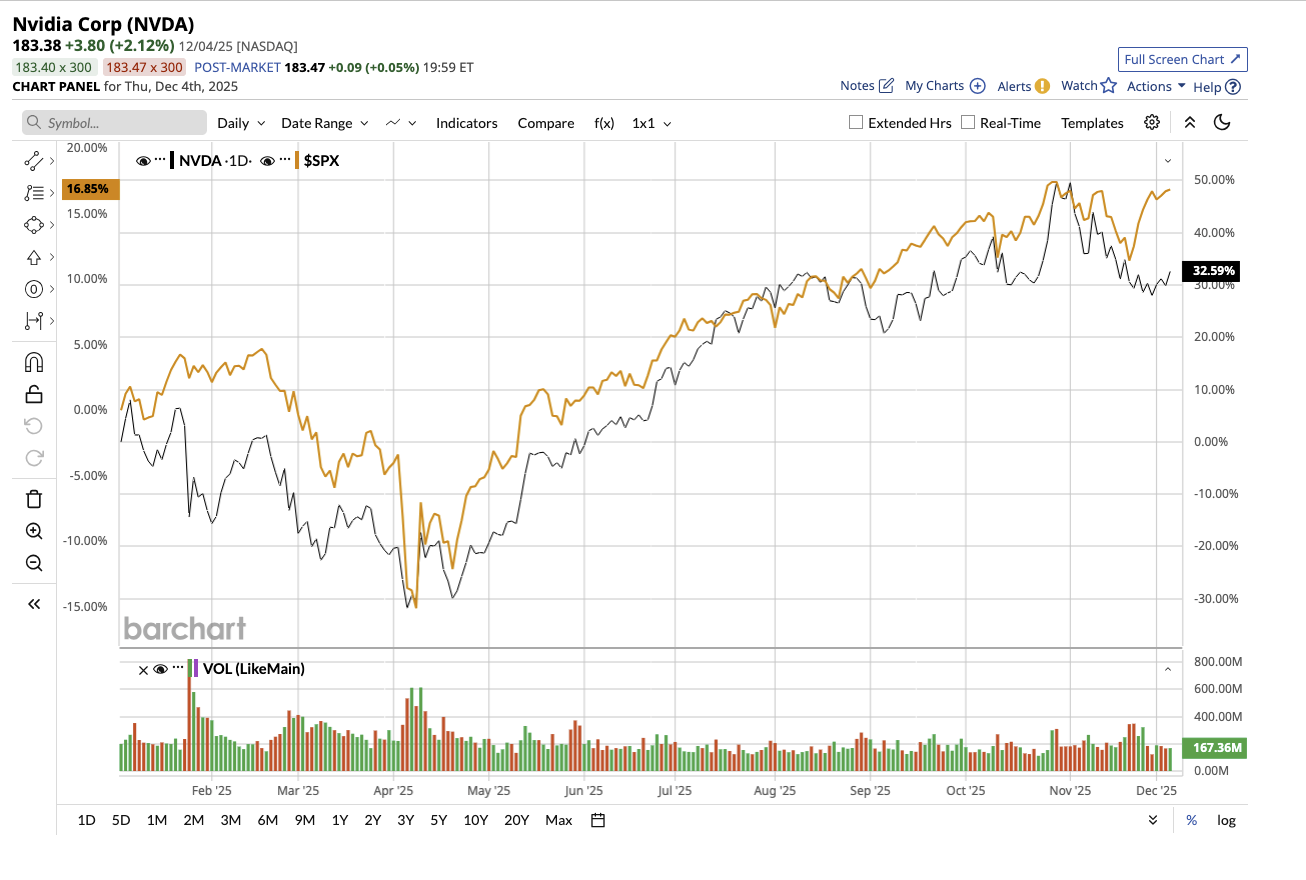

Valued at $4.4 trillion, Nvidia designs and builds the powerful chips, hardware systems, and software that run modern AI. Nvidia continues to deliver staggering results each quarter, cementing its position as the undisputed leader in AI infrastructure. NVDA stock has returned over 21,695% over the last decade and is up 32% year-to-date (YTD).

In its most recent third quarter of fiscal 2026, Nvidia reported $57 billion in revenue, up 62% year-over-year (YoY), with a record $10 billion sequential jump. Earnings surged 67%, and gross margins climbed to an exceptional 73.6%, indicating overwhelming demand and pricing power. Its Data Center segment, the engine of modern AI, generated $51 billion, up 66%. Cloud providers remained sold out of Nvidia hardware, and even older-generation GPUs like Hopper and Ampere remained fully utilized. Blackwell's GB300 currently accounts for two-thirds of its revenue, and networking is rapidly expanding thanks to NVLink and Spectrum-X.

Perhaps most importantly, Nvidia shows no signs of slowing. Its next platform, Vera Rubin, launches in 2026 with seven new chips that will again push performance to new heights. Nvidia also unveiled major AI factory initiatives involving five million GPUs, showcasing its long-term dominance in global AI infrastructure.

Financially, Nvidia is strong with $60.6 billion in cash and $22 billion in free cash flow at the end of the quarter. It also has a low debt-to-equity ratio of 0.06. NVDA stock still trades at 24.6x forward fiscal 2027 earnings, below its historical average. Analysts expect 56% earnings growth in fiscal 2026 and 59% growth in fiscal 2027, indicating that Nvidia is a powerhouse with a multi-year runway powered by accelerated computing, generative AI, and agentic AI.

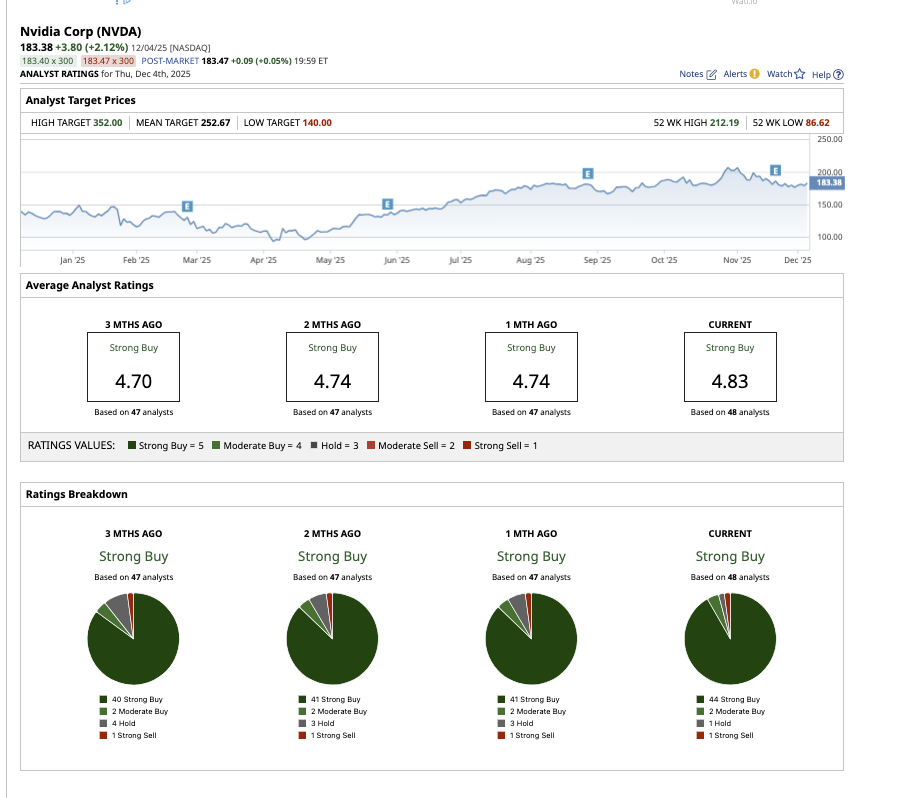

What Does Wall Street Say About NVDA Stock?

Wall Street sees a potential upside of 38% from current levels based on its average target price of $252.67. Plus, the high price estimate of $352 implies an upside potential of 92% over the next 12 months. Overall, NVDA stock remains a “Strong Buy.” Out of the 48 analysts covering the stock, 44 have a “Strong Buy” recommendation, two rate it a “Moderate Buy,” one rates it a “Hold,” and one says it is a “Strong Sell.”

The Case for Palantir Technologies

While Nvidia drives the hardware side of AI, Palantir is becoming the software intelligence layer that sits on top of it. Valued at $407.4 billion, Palantir builds deeply integrated platforms, Foundry, Gotham, and AIP, that governments and enterprises use to transform data into real-time decision-making. Palantir went public in 2020 and has not been on the market as long as Nvidia. However, the stock has returned over 554.1% during the last five years. Also, PLTR has outpaced Nvidia this year, growing 136.6% YTD.

In the most recent third quarter, Palantir reported 63% revenue growth to $1.18 billion, with its government segment continuing to anchor the business. U.S. government revenue rose 52%, fueled by defense and intelligence programs and new AI contracts. International government revenue climbed 66%, driven strongly by its expanding work with the UK. Palantir's contract momentum hit record levels, with $2.8 billion in total contract value, up 151% YoY, including 204 deals worth more than $1 million. An astounding 134% net dollar retention rate shows that once consumers use Palantir's services, they significantly boost their usage.

Analysts have remained skeptical of Palantir’s dependence on government contracts, but the company has successfully mitigated the risk. Its U.S. commercial division is now its fastest-growing segment, surging 121% YoY, as enterprises accelerate AI adoption through AIP. Despite still being in the growth stage, what’s impressive is that Palantir is scaling profitably with a net income of $476 million, or 40% of revenue, with an adjusted earnings per share of $0.21 in the quarter. Adjusted gross margin stood at 84%. The company also generated $2 billion in trailing 12-month free cash flow. CEO Alex Karp credits these results to two decades of deep technological investment and not just hype.

With analysts forecasting 76% earnings growth in 2025 and 36.7% growth in 2026, Palantir’s long-term trajectory remains steep, though its 179x forward P/E signals that investors are already pricing in much of its future potential.

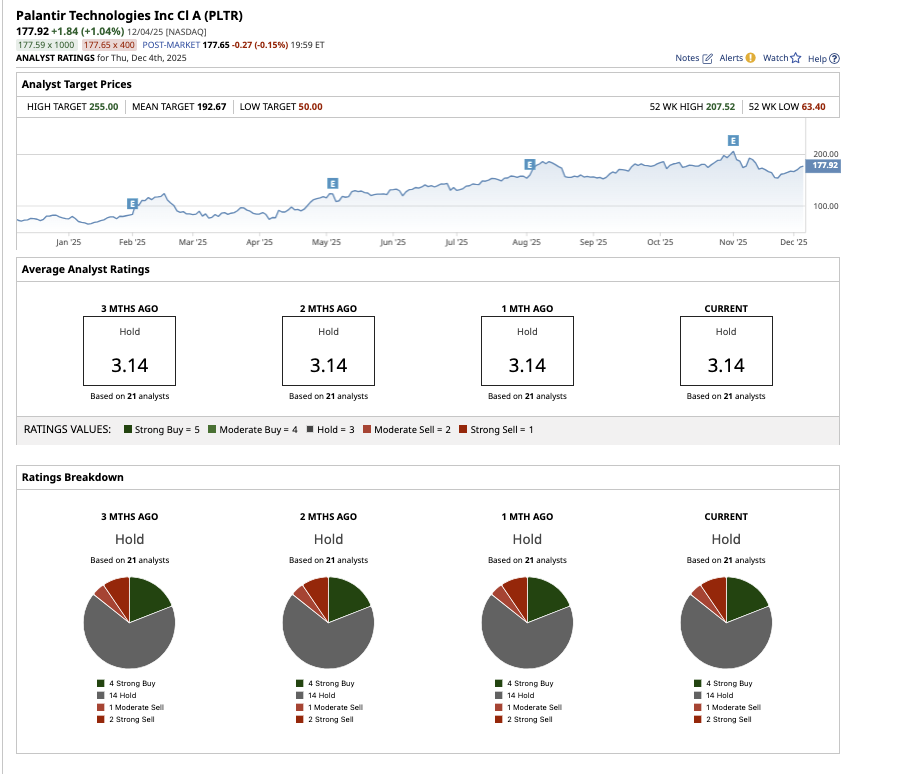

What Does Wall Street Say About PLTR Stock?

While Wall Street remains strongly bullish about NVDA, analysts remain skeptical about PLTR stock and rate it an overall “Hold.” Out of the 21 analysts covering the stock, four have a “Strong Buy” recommendation, 14 rate it a “Hold,” one says it is a “Moderate Sell,” and two say it is a “Strong Sell.”

Nonetheless, analysts see potential upside of 38% from current levels based on PLTR’s average target price of $192.67. Plus, the high price estimate of $255 implies an upside potential of 92% over the next 12 months.

Which Is the Better Long-Term AI Buy?

Both companies are extraordinary in their own way, and each deserves a spot in a diversified portfolio. Nvidia is the ideal option for investors looking to gain exposure to the rapid development of AI computation as well as the hardware backbone that supports every model, data center, and AI breakthrough. Its current valuation still looks reasonable relative to its growth trajectory and competitive moat.

Meanwhile, Palantir is the best pick for those who believe that the future of AI is not merely computing but also the application of intelligence to real-world decisions. Its premium valuation reflects expectations that it will become the defining AI software provider over the next decade. However, risk-averse investors might want to wait for a better entry point.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)