/Meta%20Platforms%20by%20Primakov%20via%20Shutterstock.jpg)

Meta Platforms (META) has underperformed the broader market this year, a rare sight for a “Magnificent 7” stock. It was only a matter of time before Cathie Wood added the much-hyped “undervalued” tech stock to her portfolio. During the last week, she added 33,837 Meta shares worth over $21 million. Wood believes the company’s short-term issues present a great risk-reward opportunity, considering its long-term artificial intelligence (AI) aspirations and investments.

Meta was one of the first major companies to see a measurable return on its AI investments through improved advertising performance. However, continued investments have brought back bad memories of the past, with some comparing ongoing capital expenditures to the company’s previous failed investments, like the metaverse.

Things took a turn for the worse when Meta reported a $16 billion tax bill in its latest earnings report. The failure to convert a strong top line into equally high net income resulted in selling pressure, creating an opportunity that Cathie Wood just cashed in on.

About META Stock

META is a global tech company best known for its social media apps — Facebook, WhatsApp, and Instagram. It generates the bulk of its revenue from advertising services, which are among the best in the world, due to the large number of people who use the apps globally.

The company’s 5.45% stock returns over the past year have underperformed the S&P 500 Index’s ($SPX) 12.88% performance. Meta stock holds the fifth-largest weighting in the index.

The dip in stock price has brought the stock to a reasonable valuation, though it is by no means cheap. Its forward price-to-earnings (P/E) ratio of 27.82x is still 22% above its five-year average of 22.81x. It is worth noting, though, that of all the Mag 7 stocks, this is still a relatively low forward P/E. The forward price-to-sales (P/S) is trading on a similar premium to its historic average, but it is still the second-lowest among its Mag 7 peers.

Cathie Wood’s bull thesis is apparent when one looks at next year’s earnings growth. Excluding Nvidia (NVDA), META’s 20.3% earnings growth is well-above the rest. The gross margins of 82% even top Nvidia’s much-talked-about gross margin of 70%. Investors would be better off using the current headwinds as an opportunity, as the company is clearly strong enough to outperform peers over the next year.

Meta Posts Earnings Beat

Meta reported its earnings on Oct. 29 and beat both earnings per share (EPS) and revenue estimates. EPS came in at $7.25 versus the estimated $6.69, and revenue of $51.24 billion comfortably beat the expected $49.41 billion. Q4 revenue is expected to be $57.5 billion at the midpoint.

While the company’s growth continues to be positive, investors weren’t impressed. One major reason was the company’s continued AI investments, which could now result in capital expenditures of at least $70 billion, up from the prior lower end of $66 billion. This has been a talking point among investors for some time now, but Cathie Wood does not see this as a concern. Neither does CEO Mark Zuckerberg, who said the ability to invest larger amounts is a positive and likely to result in higher profits down the road.

In September, the company also released its Meta Ray-Ban Display Glasses. These are priced at $799 and sold out. Q4 will be the first full quarter with these glasses on the market, and Zuckerberg seemed confident in their sales.

What Are Analysts Saying About META Stock?

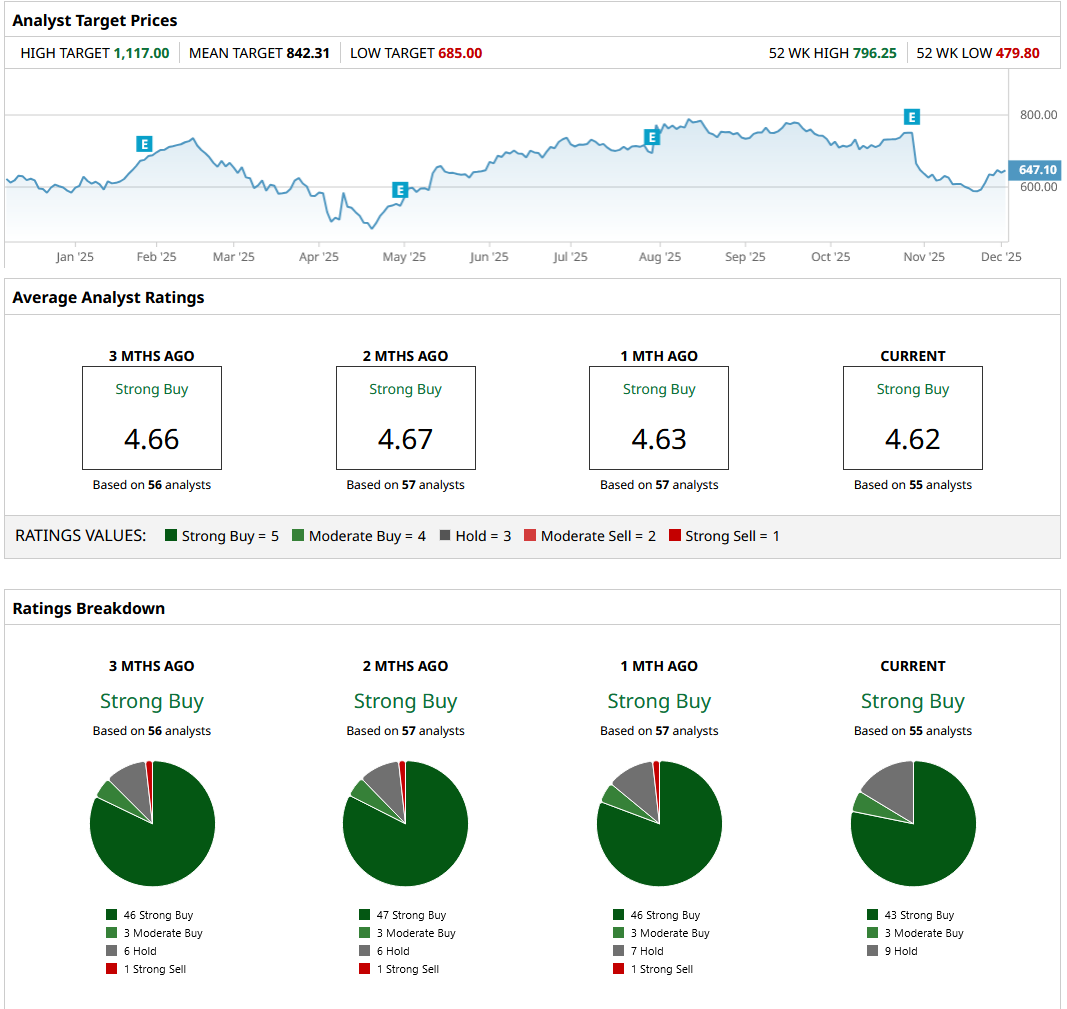

Meta Platforms is covered by 55 analysts on Wall Street, with 43 of them rating it a “Strong Buy.” This Wednesday, RBC Capital reiterated its “Buy” rating with a price target of $810, suggesting upside of 26.5%. The mean price target across all analysts of $842.31 suggests upside of 32%, while the highest price target of $1,117 is 75% above the current share price.

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock.jpg)

/Salesforce%20Inc%20logo%20on%20building-by%20Sundry%20Photography%20via%20Shutterstock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)