/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

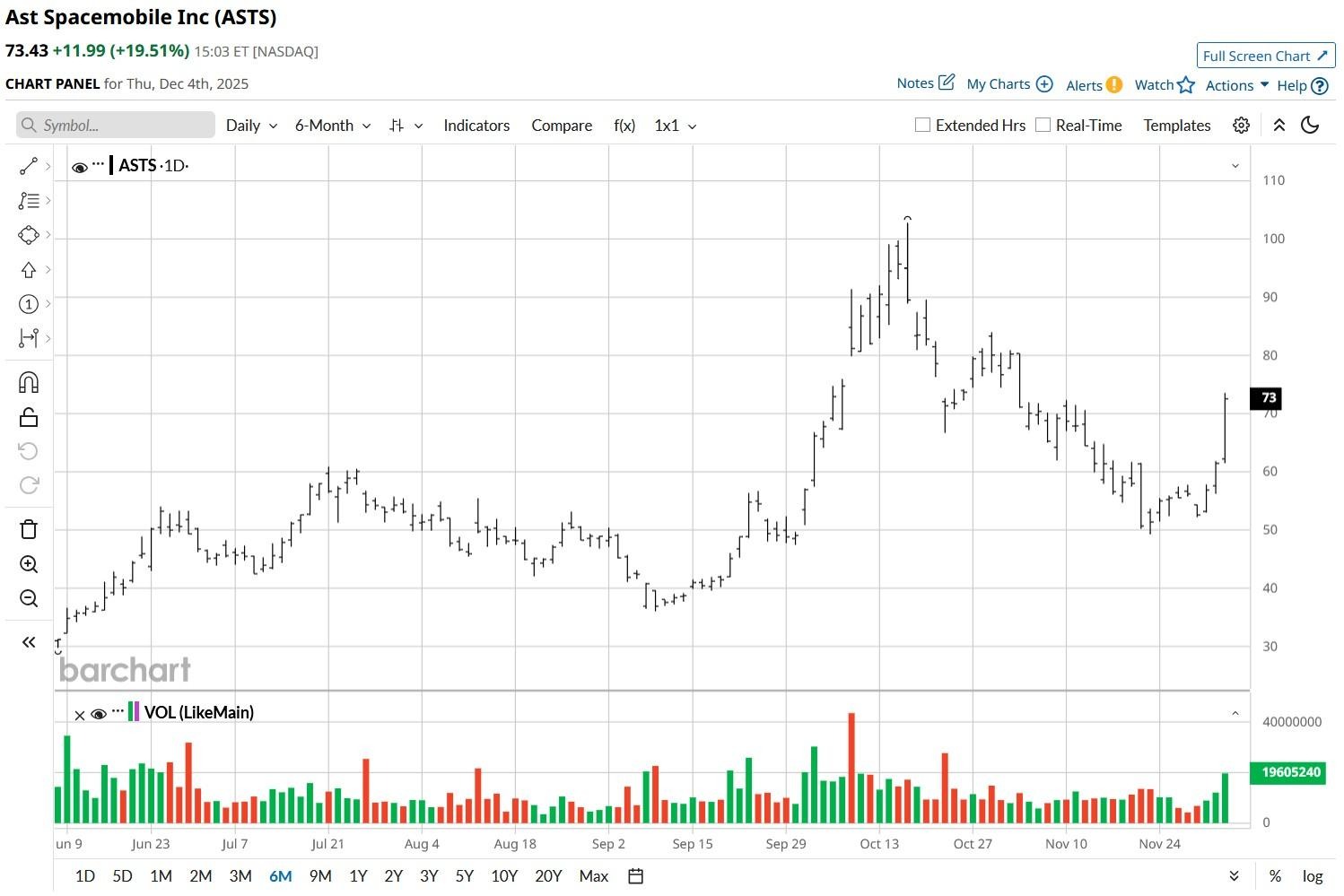

AST SpaceMobile (ASTS) stock is up nearly 20% today amid renewed excitement around the upcoming launch of its next-generation satellite, BlueBird 6.

Investors seem convinced that the Dec. 15 event will expand ASTS’ direct-to-smartphone satellite coverage, a milestone that could meaningfully advance its commercial rollout.

Following today’s rally, AST SpaceMobile stock is up more than 300% versus its year-to-date low.

What the BlueBird 6 Launch Means for ASTS Stock

The upcoming launch of BlueBird 6 is more than just a technical milestone, it’s a credibility test for the Midland-headquartered AST SpaceMobile.

Successful deployment will validate the firm’s ability to scale its satellite constellation, paving the way for commercial service agreements with carriers like AT&T (T) and Vodafone (VOD).

ASTS shares are pushing aggressively to the upside in the build-up to the Dec. 15 event as proof of reliable coverage could accelerate the company’s revenue growth.

Moreover, a smooth launch could mitigate execution risks as well, potentially drawing institutional interest that drives its share price higher in 2026.

Is It Worth Buying AST SpaceMobile Shares Today?

AST SpaceMobile shares sure aren’t cheap given the company is yet to turn a profit and its price-sales (P/S) multiple currently sits at north of 4,500x.

However, it’s targeting a massive untapped market, connecting billions of smartphones directly to satellites without specialized hardware, which, nonetheless, makes it attractive to own heading into 2026.

Plus, the Nasdaq-listed firm has already secured partnerships with global telecom giants, meaning it has a ready distribution channel. A $1.15 billion convertible notes offering bolstered its balance sheet in November as well.

Even from a technical perspective, the stock is trading decisively above its major moving averages (50-day, 100-day, 200-day) – indicating the broader uptrend remains intact – with the 100-day RSI at 55 confirming the momentum is not near exhaustion yet.

What’s the Consensus Rating on AST SpaceMobile?

Wall Street analysts are focused on AST SpaceMobile’s moat more than its stretched valuation for 2026 as well.

The consensus rating on ASTS shares remains at “Moderate Buy” with price targets going as high as $95 indicating potential upside of another 25% from current levels.

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock.jpg)

/Salesforce%20Inc%20logo%20on%20building-by%20Sundry%20Photography%20via%20Shutterstock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)