/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)

Microsoft (MSFT) stock is inching up on Thursday morning after the tech giant denied recent reports that it has lowered sales quotas for its artificial intelligence (AI) offerings.

The Information had claimed earlier this week that MSFT’s customers were showing resistance to its new AI software products, but the company dismissed them as unfounded rumors on Dec 4.

At the time of writing, Microsoft shares are down over 10% versus their year-to-date high in late October.

D.A. Davidson Says Buy Microsoft Stock Heading into 2026

Microsoft’s update made D.A. Davidson analysts reiterate their “Buy” rating on the Nasdaq-listed firm.

The investment firm sees MSFT stock hitting $650 next year (35% upside from current levels) as it continues to offer the “best AI exposure” heading into 2026.

According to its research note, the recent OpenAI concerns are overblown and the ChatGPT company’s infrastructure and cloud expenditures will continue to flow heavily through Azure.

On Thursday, D.A. Davidson also told clients that Microsoft remains a core long-term holding, irrespective of whether AI is a bubble or not.

MSFT Remains a Relatively Cheaper AI Stock

D.A. Davidson analysts remain bullish on Microsoft shares as the Redmond-headquartered firm is strongly positioned to remain “the fastest growing hyperscaler” in 2026.

MSFT has free access to OpenAI’s latest models for seven years. Meanwhile, it has already started diversifying its artificial intelligence bets, including a sizable investment in Anthropic.

This will help the giant remain an AI winner for the long term, the investment firm concluded.

What’s also worth mentioning is that Microsoft is currently going for about 30x forward earnings, which makes it significantly cheaper to own than other top AI stocks like Nvidia (NVDA) at over 41.

How Wall Street Recommends Playing Microsoft

Investors could also take heart in the fact that D.A. Davidson is not the only Wall Street firm that’s recommending sticking with MSFT shares heading into 2026.

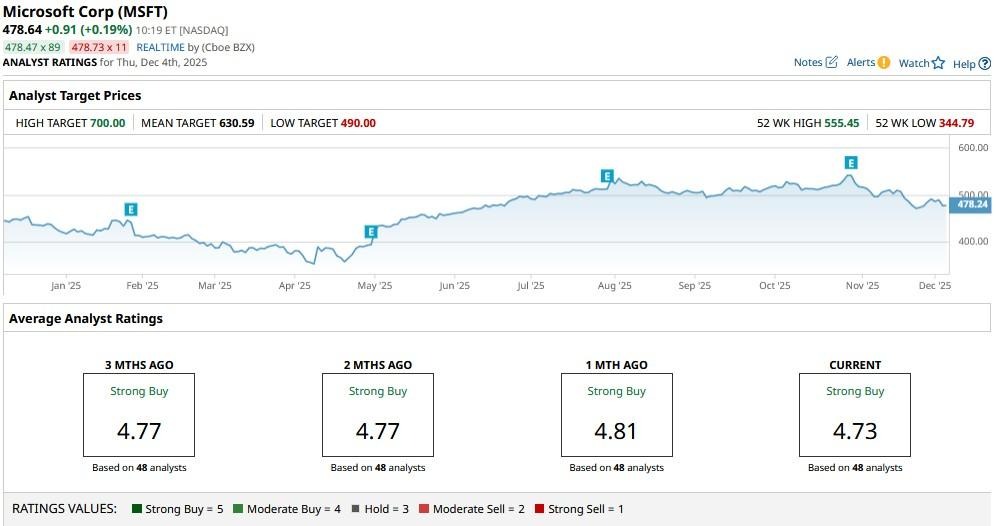

According to Barchart, the consensus rating on Microsoft also currently sits at “Strong Buy” with the price targets going as high as $700 indicating Microsoft stock is not out of juice just yet.

/McDonald's%20Corp%20arches%20by-%20TonyBaggett%20via%20iStock.jpg)