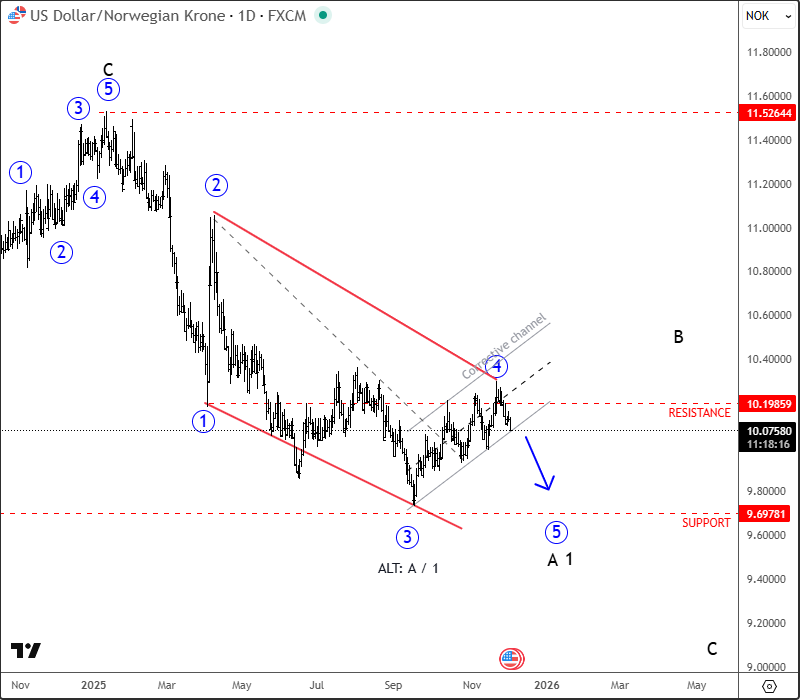

USDNOK has been making a recovery over the last few weeks, but so far the move up from the September lows is not in five waves yet. In fact, it can still be just another countertrend move before another drop, especially after the market turns down from 10.20 – 10.30 resistance. So, if price slips out of the current corrective channel, then weakness could resume into wave five, targeting the 9.69 area.

However, a push higher above the corrective channel would suggest that USDNOK has completed the diagonal pattern and that a minimum three-wave recovery is underway — possibly a black wave B/2 rally that could unfold later this year or in 2026.

www.wavetraders.com

For a detailed view and more analysis like this, you can watch below our latest recording of a live webinar streamed on December 01:

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)