Howdy market watchers!

It’s the most wonderful time of the year! Hope everyone had a great Thanksgiving and managed to reach common ground on all the political opinions with your closest family members.

There continues to be plenty to discuss even among the conservatives as the headlines keep flowing and the divisions deepen. Suffice it to say, if you were unsure of your stance on an issue, I’ll bet your position is now formed and your resolve hardening by the hour. The divisiveness of all the battles being forged regardless of how worthy they are, could begin to impact the effectiveness of this Administration on the most important of them.

So far, the markets have managed to grind higher through the uncertainty with a pre- and post-Thanksgiving rally adding pep to the step of the bulls. From grains to cattle to equities, energy and metals, there was plenty of green across the screen in Black Friday’s shortened trading session not to mention on Wednesday.

The month of November is closing on a high note after several markets were in correction territory just days and weeks prior. With more signs pointing to a Fed interest rate cut at the next FOMC meeting that will conclude on December 10th, the US dollar index has finally softened its stride after trading above 100.00 in early November for the first time since August 1st. This has supported the grain and metals markets, in particular.

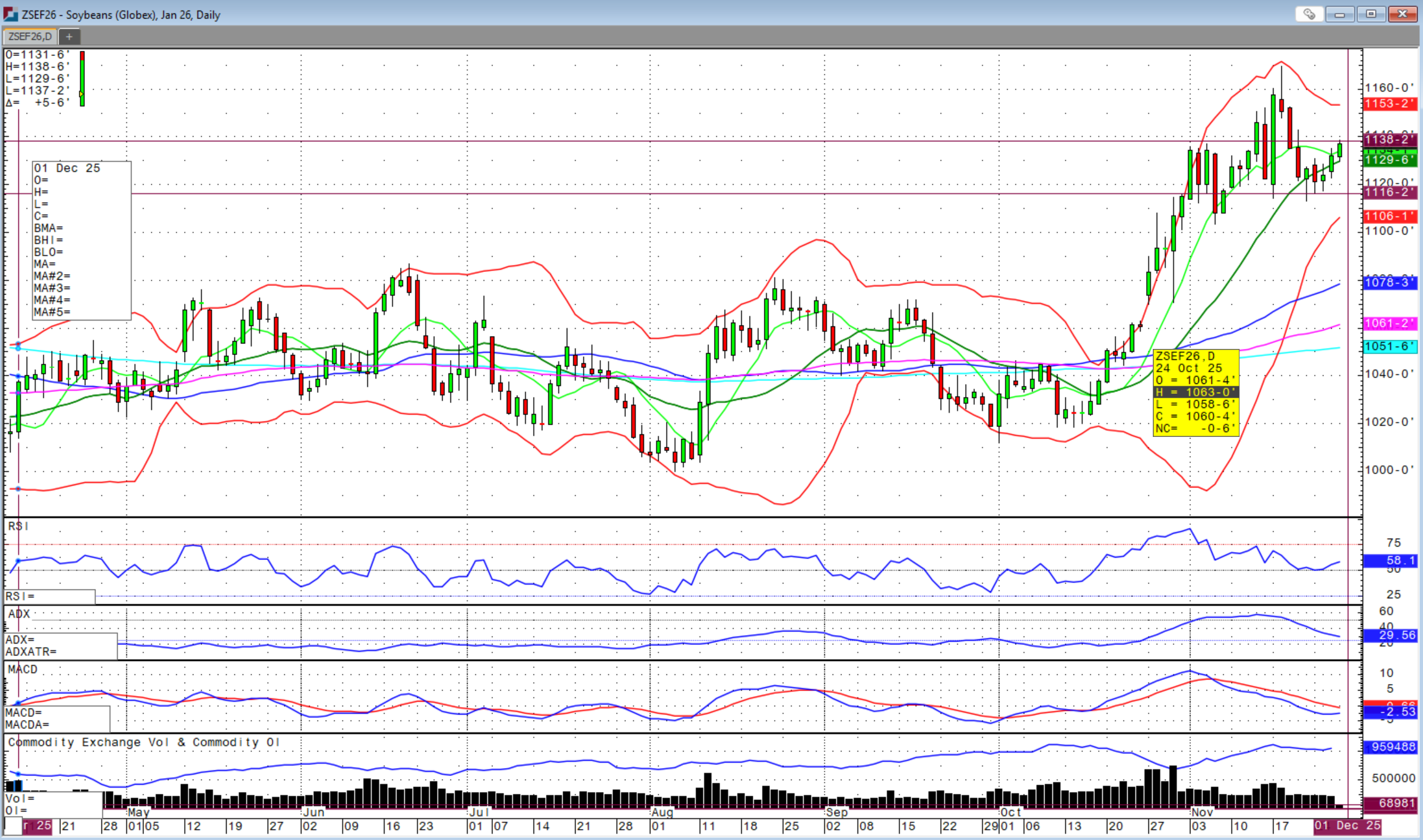

China has continued to buy US soybeans though in smaller than expected quantities. However, continued buying and the looming commitment of 12 million metric tons by January has kept the bulls in favor. Friday’s higher high and close above Wednesday’s high is encouraging for further follow-through, but it is all dependent on China, which warrants caution. News that China has rejected Brazil soybean cargos due to sanitary issues should also be supportive, but we will see how this develops. It is likely a non-tariff barrier that will justify US soybean purchases by Chinese importers.

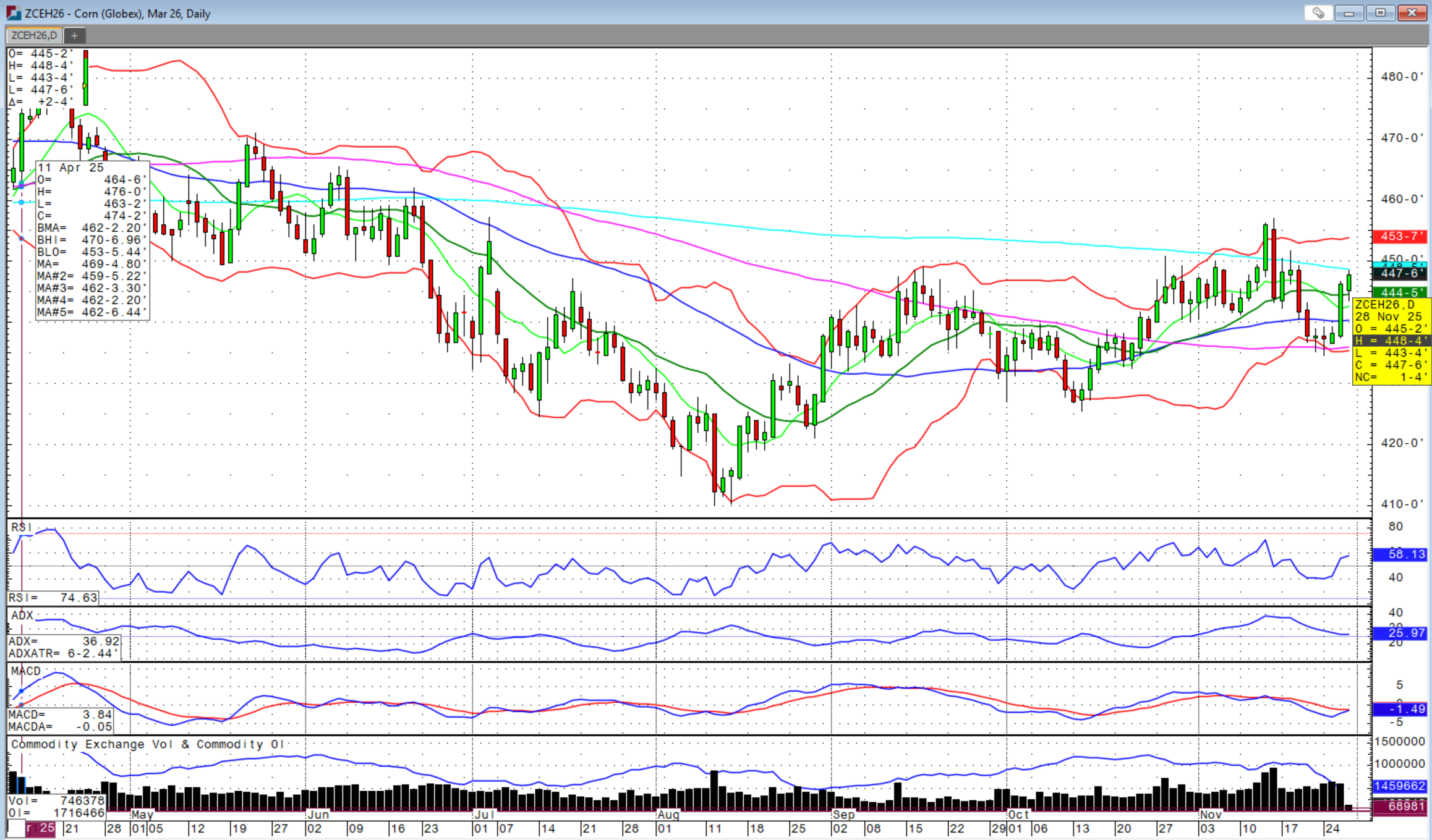

Corn futures also had an encouraging close to the week with March futures reaching the 200-day moving average and closing near that high. For both corn and soybean futures, we are forming the right shoulder of a head-and-shoulders pattern. Technically, this is a decisive area. March corn futures will need to trade and close above $4.50 and January futures above the $11.45 area for more upside. If either contract fails at these levels, we will likely be heading lower.

The wheat market struggled to hold gains with headlines of increasing crop sizes in Argentina and Russia. With the US and Europe struggling to negotiate a compromise between Russia and the Ukraine, further tensions could bring some risk premium back to the wheat markets. Having said that, the wheat market hasn’t cared much about this conflict since 12 months after it started. At the time, that was a huge surprise to myself and many traders, but frankly, it just doesn’t seem to matter much for the wheat complex. If there is agreement, it will likely lean bearish. If the conflict continues to escalate, it could be slightly bullish, but not enough to unilaterally drive the wheat market higher, in my opinion.

Moisture is coming to the US southern plains that will improve wheat conditions that are behind last year, but in line with the 10-year average, despite cold temperatures. The snow forecast for Kansas and fringes of the neighboring states will provide some protection from these colder temperatures. Watch how this December contract closes out and then we will see if improved exports can improve the wheat demand picture. Further weakness in the US dollar should help hold things together if that materializes.

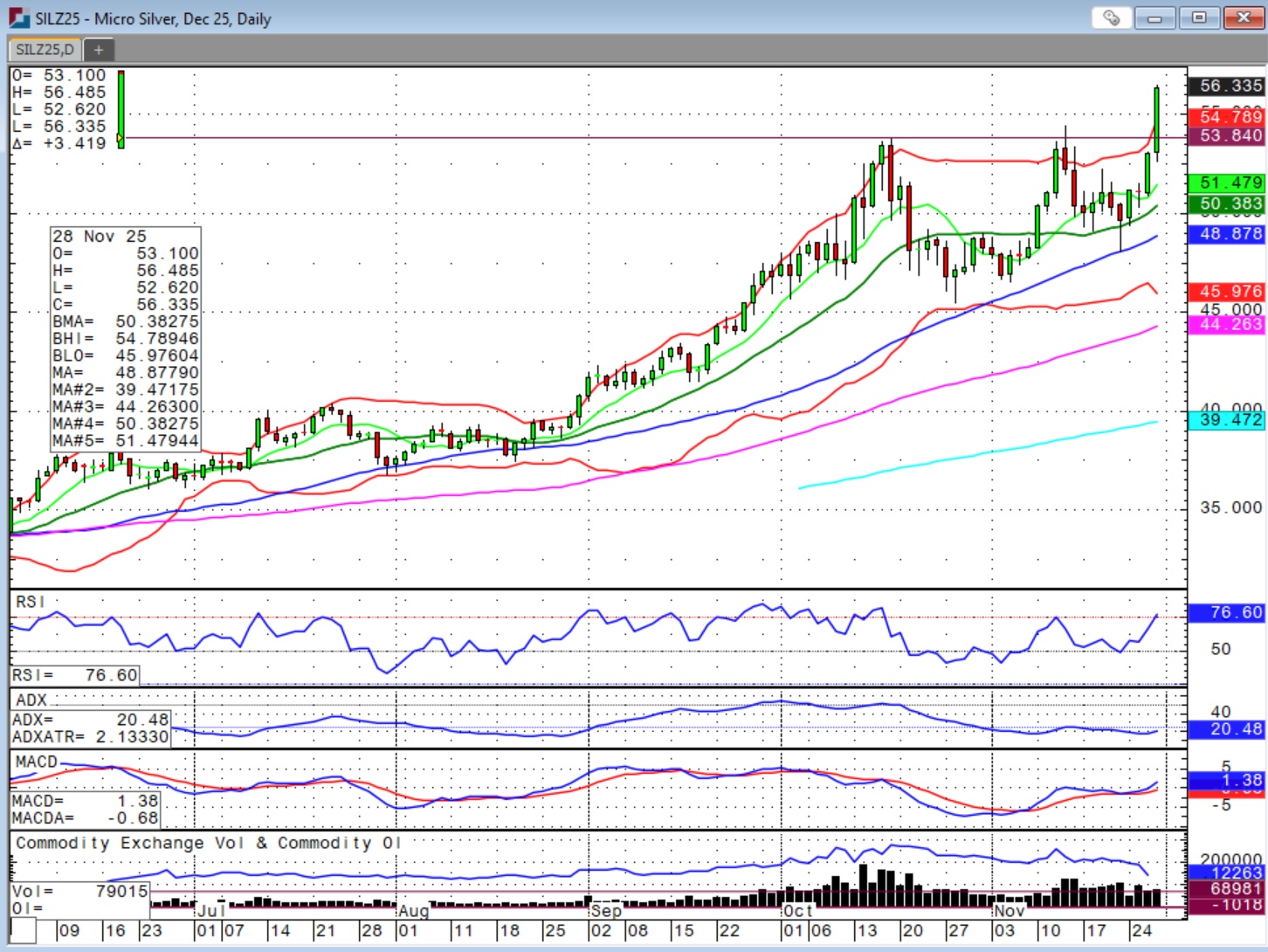

Quickly on metals, high ho silver away! Yes, I trade silver if you’re interested as we made new highs above $56 per troy ounce on Friday. Gold also traded higher, but not back to its recent highs, yet. Is the rally in metals a sign of nervousness ahead for the broader market? It seems so with stock performance and investment outside the AI boom being meager at best.

The CBOE Volatility Index (VIX) is low and could be a buy with stock market volatility expected between now and the end of the year. The Fed rate cut has helped the equity complex rebound from the recent correction, but fiscal policy uncertainty and the next government funding in January could bring back herd mentality with some profit taking. Buffet, who has officially stepped aside as the CEO of Berkshire Hathaway, has moved a lot to the sidelines, but who knows. Thus far, every dip has been a buying opportunity. Remember, there is no way to time the market, but just food for thought to expect more volatility as we approach yearend of just after. The VIX is a good way to remain positioned, but be able to trade volatility.

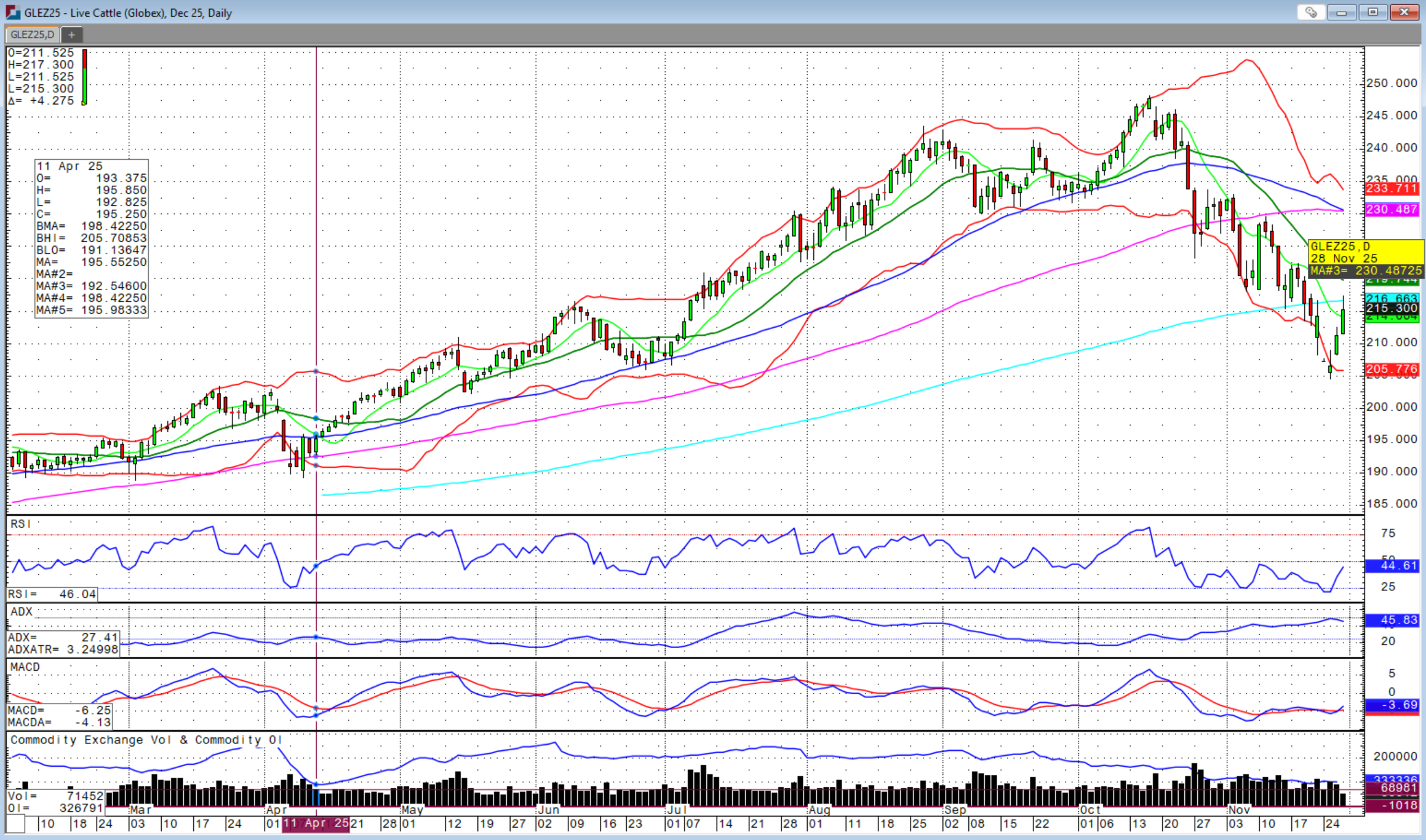

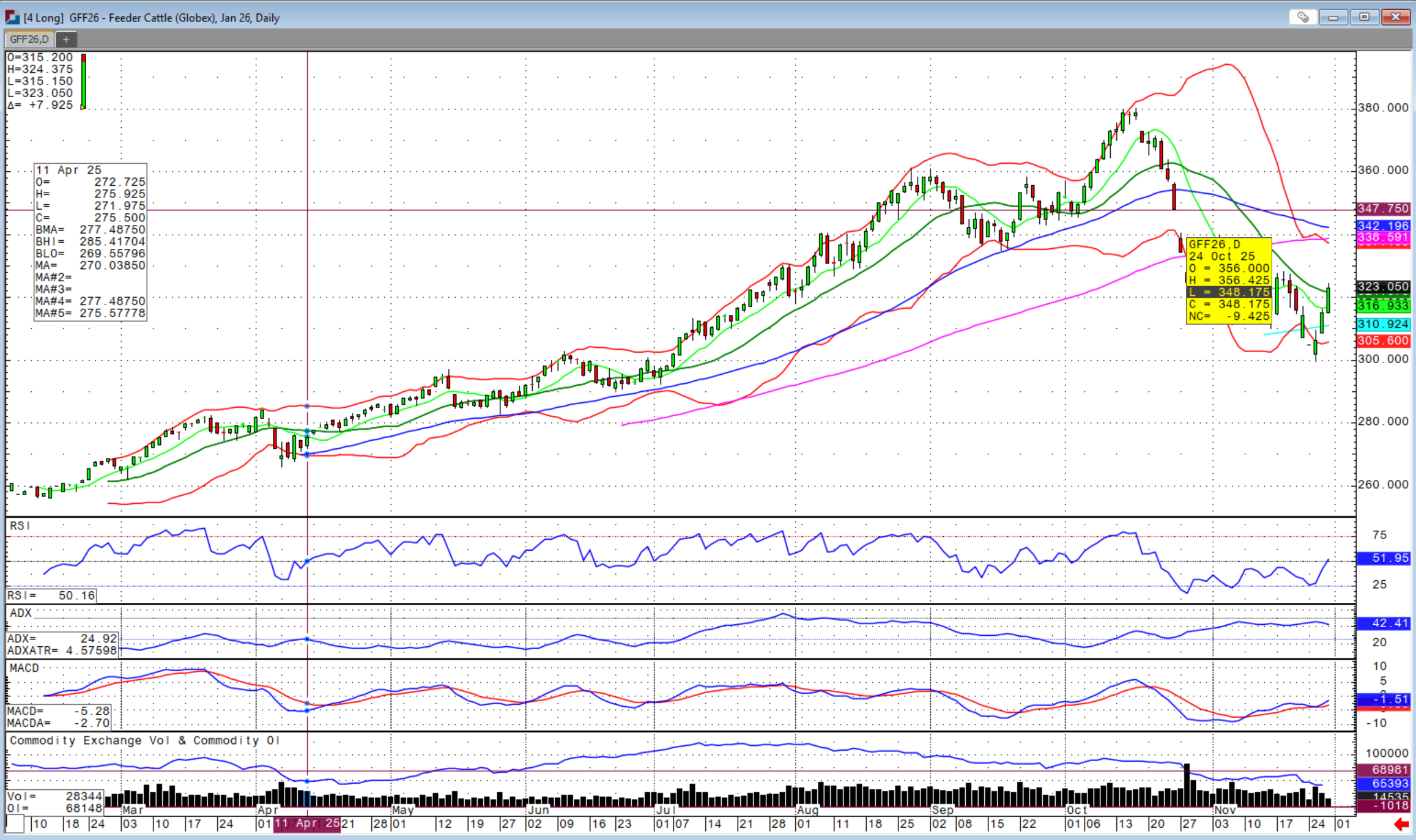

Possibly the best news I have to share is that the market sentiment in the cattle complex has certainly shifted back to the bull camp! Some are calling the recent low and rebound a spike recovery signifying the bulls are back in charge. With fed cattle cash trade reaching $220 in Texas and Kansas, $5.00 per cwt higher than last week, the fundamentals are coming back in focus as the driver of futures. December Live cattle futures are trading around $215-216.00, under cash prices.

If we can see continued firmness in fed cattle cash and feeder cattle sales next week, I think we could see a solid recovery across the cattle complex. Winter storms across the Midwest are also adding risk premium to contracts as this slows down gains and overall movement. This market has weathered so much bearishness in recent weeks with the final news to be the reopening of the US-Mexican border. However, this may already be priced in and I think the market is already rationalizing that it will be a steady go and still, just a drop in the bucket of what the US market slaughters, especially with consumer demand intact. Now, that doesn’t mean it will be straight up, but I could also see this border reopening and then reclosing once the first official screwworm case is detected in the US cattle herd.

With all the headwinds that this Administration is leaning into, being the one in charge if and when screwworm reemerges in the US market since it was eradicated in the 1960s is not one you want to claim. We will see how this plays out, but I think January feeders have a chance to get back to the $340-345.00 level. We could see more slaughter plant closures to come, but this is just a sign of how few cattle are available in the market. Future closures should be less impactful as this first Tyson closure and shift reduction at another plant with markets limit down on Monday after the prior Friday announcement. However, be cautious and reward rallies as the cattle complex will also be sensitive to any major correction or volatility in the stock market should that come to fruition.

Sidwell Strategies is the one-stop shop to protect cattle with futures, puts, LRP or a combination of all, which is probably the best strategy overall. If you’re ready to trade commodity markets, give me a call at (580) 232-2272 or stop by my office to get your account set up and discuss risk management and marketing solutions to pursue your objectives. Self-trading accounts are also available. It is never too late to start and there is no operation too small to get a risk management and marketing plan in place.

Wishing everyone a successful trading week! Let us know if you'd like to join our daily market price and commentary text messages to stay informed!

Brady Sidwell is a Series 3 Licensed Commodity Futures Broker and Principal of Sidwell Strategies. He can be reached at (580) 232-2272 or at brady@sidwellstrategies.com. Futures and Options trading involves the risk of loss and may not be suitable for all investors. Review full disclaimer at https://www.sidwellstrategies.com/fccp-disclaimer-21951.

/AI%20(artificial%20intelligence)/AI%20microchip%20by%20DesignKingBD360%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

/Dominos%20Pizza%20Inc%20storefront%20by-KathyDewar%20via%20iStock.jpg)