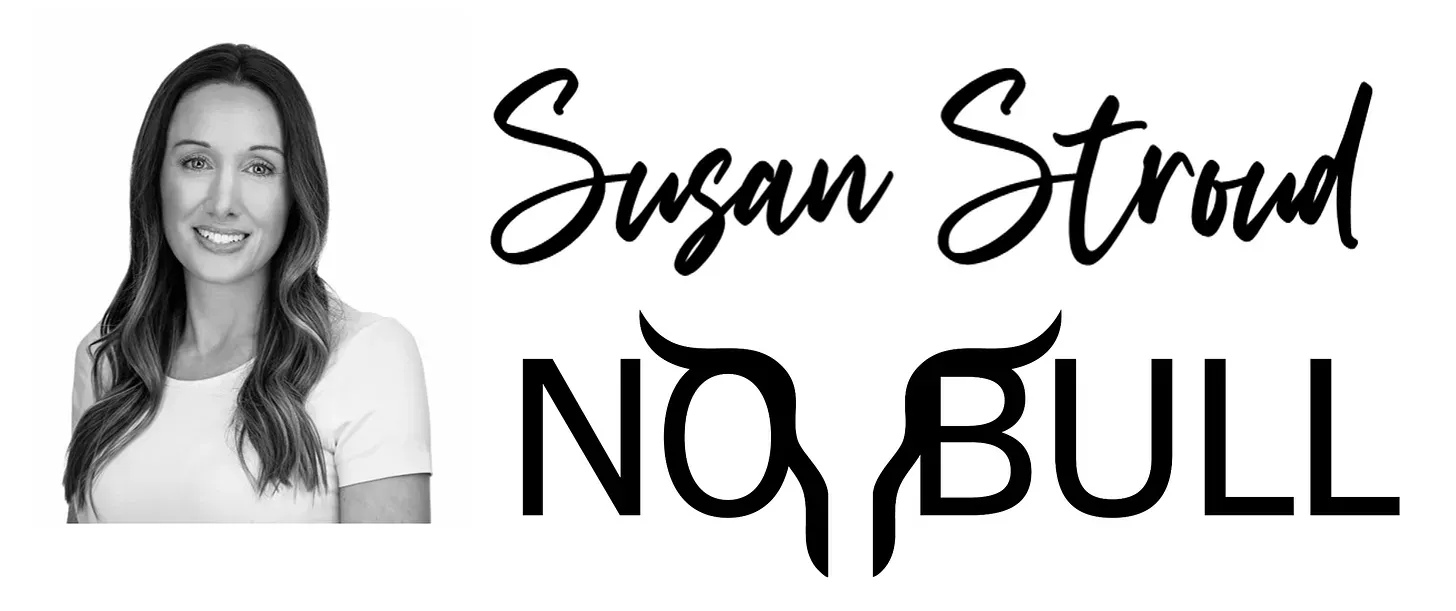

5 | How low can you go?

For the fourth year in a row, the Mississippi River at St. Louis sits near all-time lows as we head into critical winter months—when a record corn export program and an influx of inbound bean trains from the north and west in addition to a steady stream of meal trains will be fighting for dock space to load reduced-draft barges bound for the U.S. Gulf.

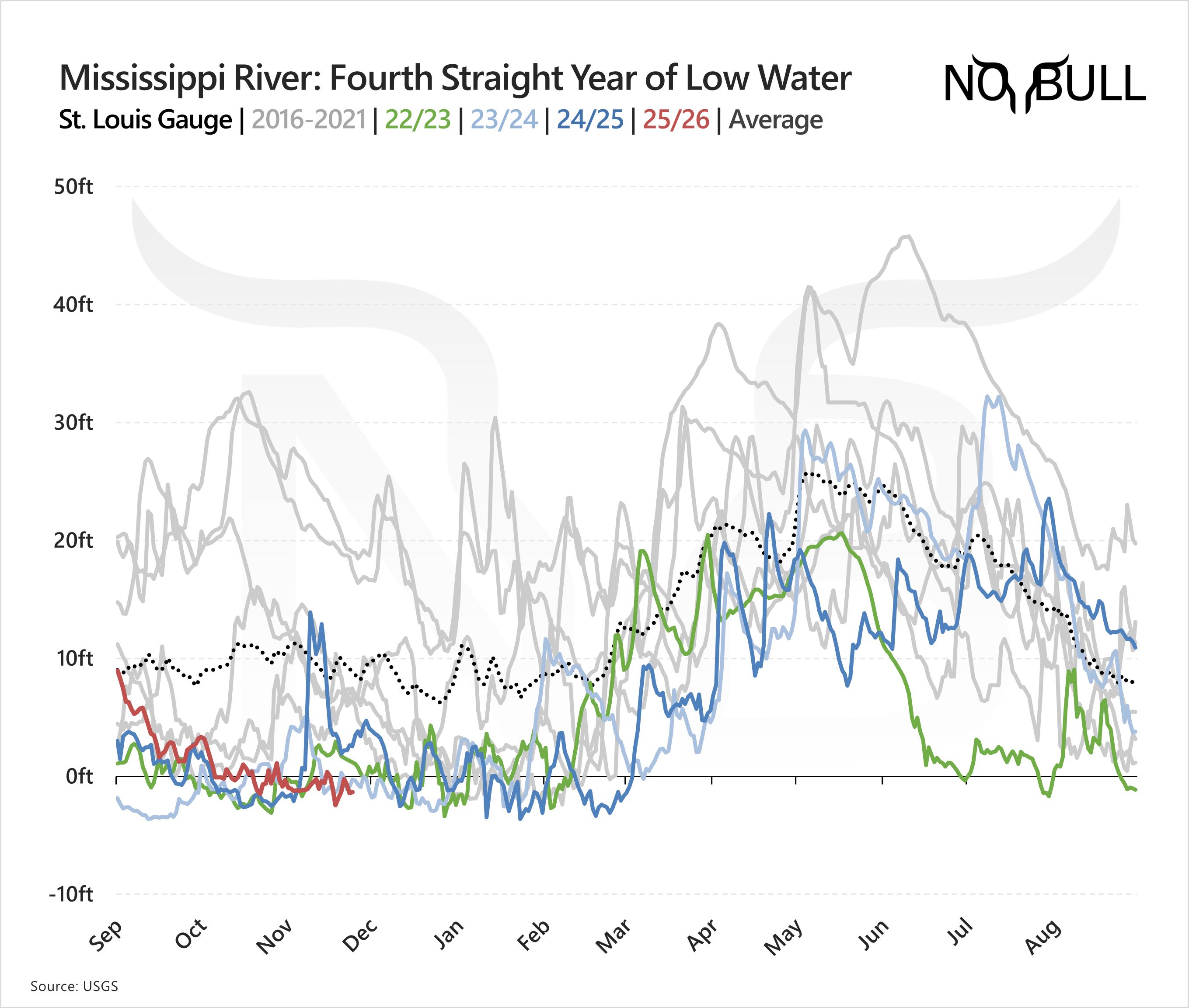

4 | Rhetoric Rallies

After spending the first ten months of the year locked in a narrow $10.00–$10.50 range, soybeans have rallied markedly since mid-October, driven by thawing U.S.–China relations, a subsequent “deal,” and renewed Chinese purchasing.

What’s especially notable is how each leg higher has been tied to Truth Social posts, meetings, and rhetoric coming out of Washington.

Trump’s statements have repeatedly helped turn the market whenever futures slipped below $10, and recent gains have unfolded alongside a steady stream of comments promoting China’s supposed purchase commitments—commitments that Beijing has still not publicly confirmed.

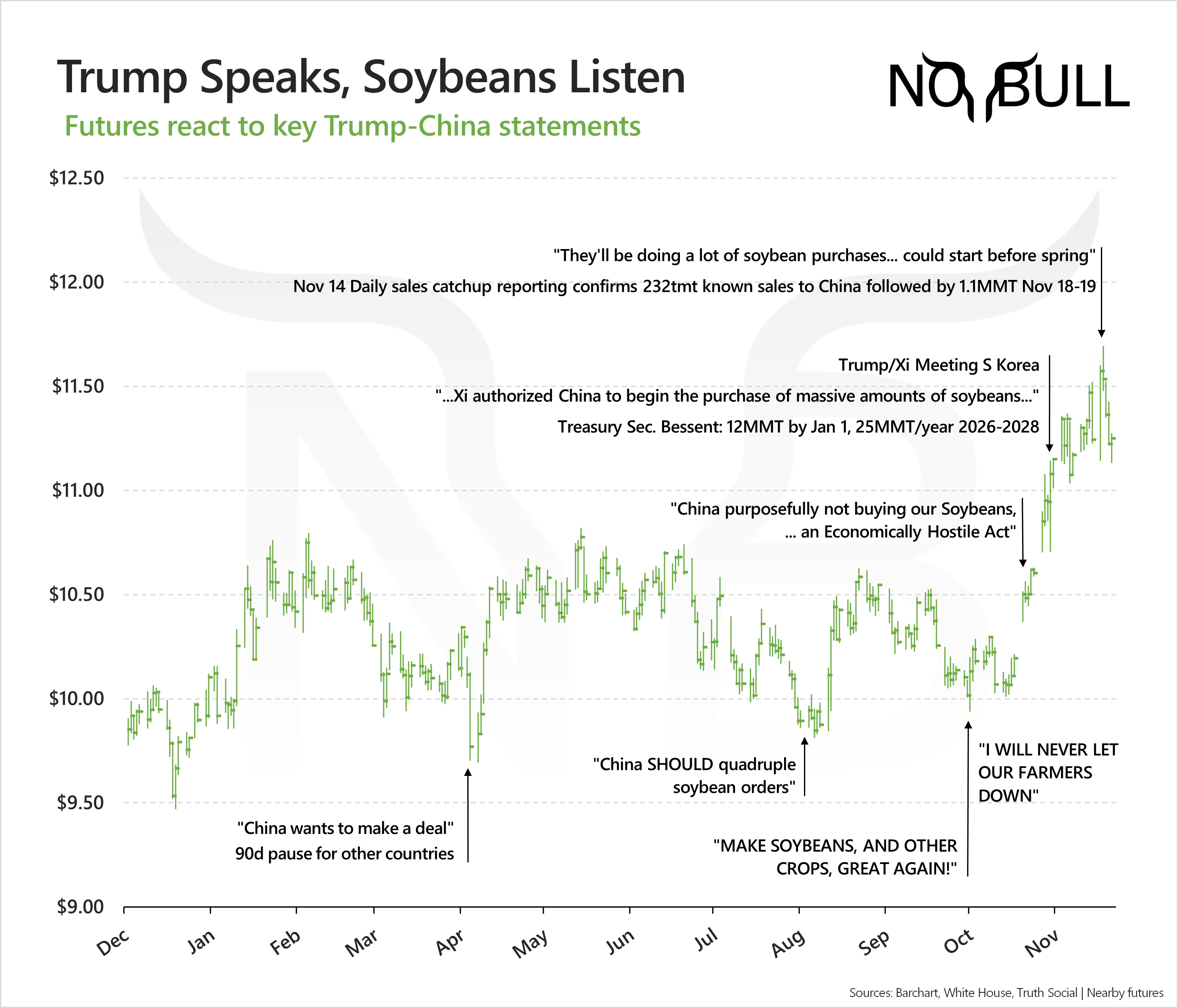

3 | From fireworks to faceplant

Soybeans logged their most volatile week since the week of the August WASDE in the week ending November 21 - a near-60c roller coaster range that started with fireworks before ending with a face plant as the reality of China’s slow return to the US market set in.

The week started with a bang on Monday as China returned to the U.S. market in size: futures logged their largest one-day move in ten months as Chinese buyers scooped up a dozen boats of U.S. beans.

USDA confirmed 792 TMT (29 mbu) Tuesday morning, followed by another 330 TMT (12 mbu) later that session, pushing January futures to their highest level since June before momentum evaporated into a late-day reversal.

By Thursday, an additional 462 TMT (17 mbu) brought total estimated Chinese commitments to 2.5 MMT (90 mbu) — still only 20% of the touted 12 MMT “agreement,” leaving nearly 9.5 MMT to go with less than six weeks left in the year.

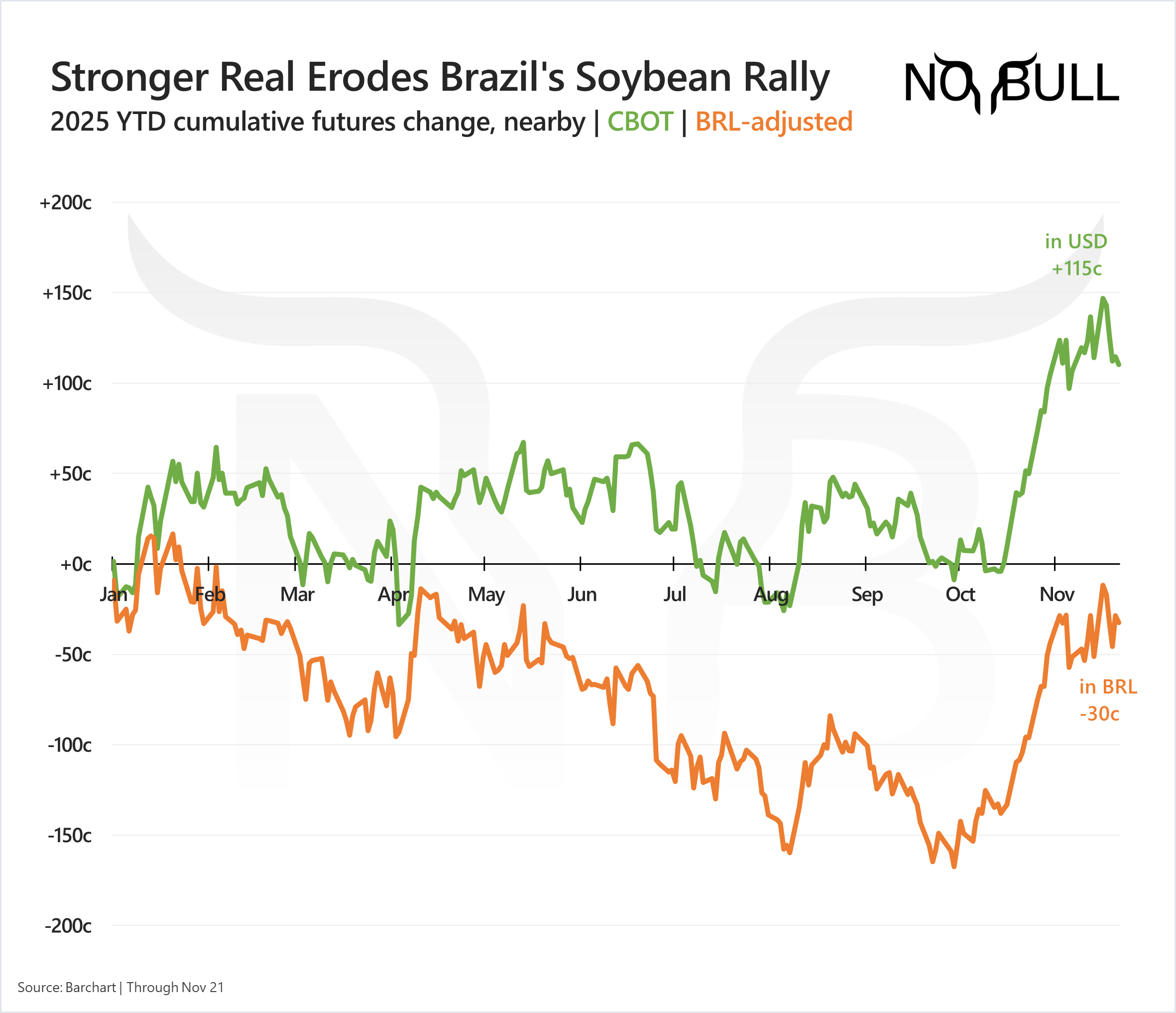

2 | Same futures, two REALities

While U.S. farmers are cheering a stronger market (FINALLY), Brazilian farmers are wondering where the rally went.

The Brazilian real’s appreciation against the U.S. dollar has fully erased the CBOT gains, leaving soybeans in BRL-equivalent futures actually 30 cents lower year-to-date.

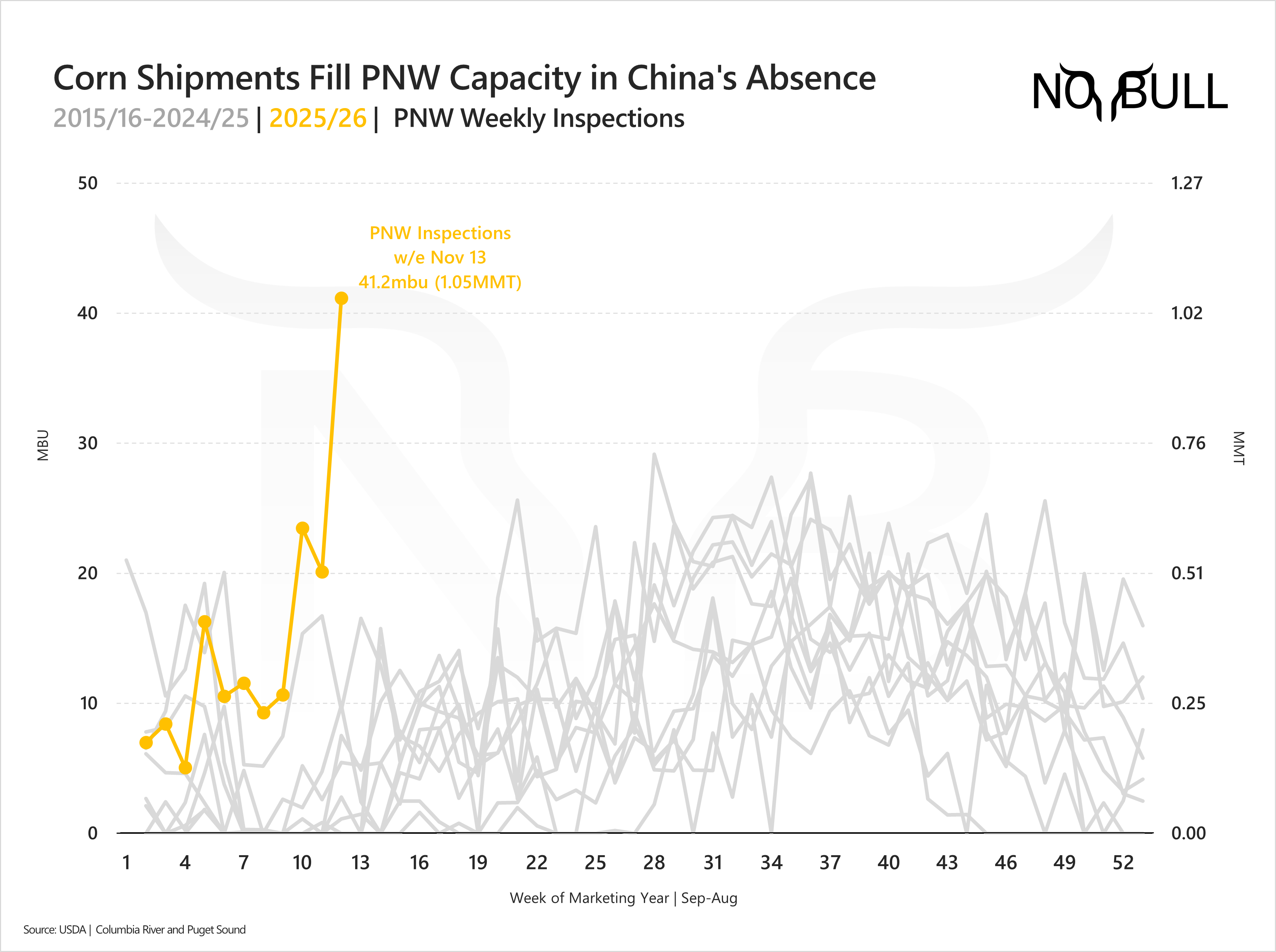

1 | One large outlier

U.S. corn remains competitive into Asia, evident in another massive week of PNW inspections.

With China largely absent from the U.S. soybean market, corn has filled export capacity that would normally be dominated by early-season soybean shipments.

That begs the question: if China returns in size, can West Coast exporters accommodate both a record corn program and renewed soybean demand at the same time?

For the full version of this update or to subscribe, visit NoBullAg.Substack.com.