/AI%20(artificial%20intelligence)/Close-%20up%20of%20computer%20chip%20with%20AI%20sign%20by%20YAKOBCHUK%20V%20via%20Shutterstock.jpg)

Advanced Micro Devices (AMD) has quickly emerged as one of the most appealing names in the artificial intelligence (AI) hardware space. With increasing demand for AI accelerators, significant momentum in data center chips, and a product roadmap that continually pushes performance boundaries, AMD is establishing itself as a credible contender to industry titans.

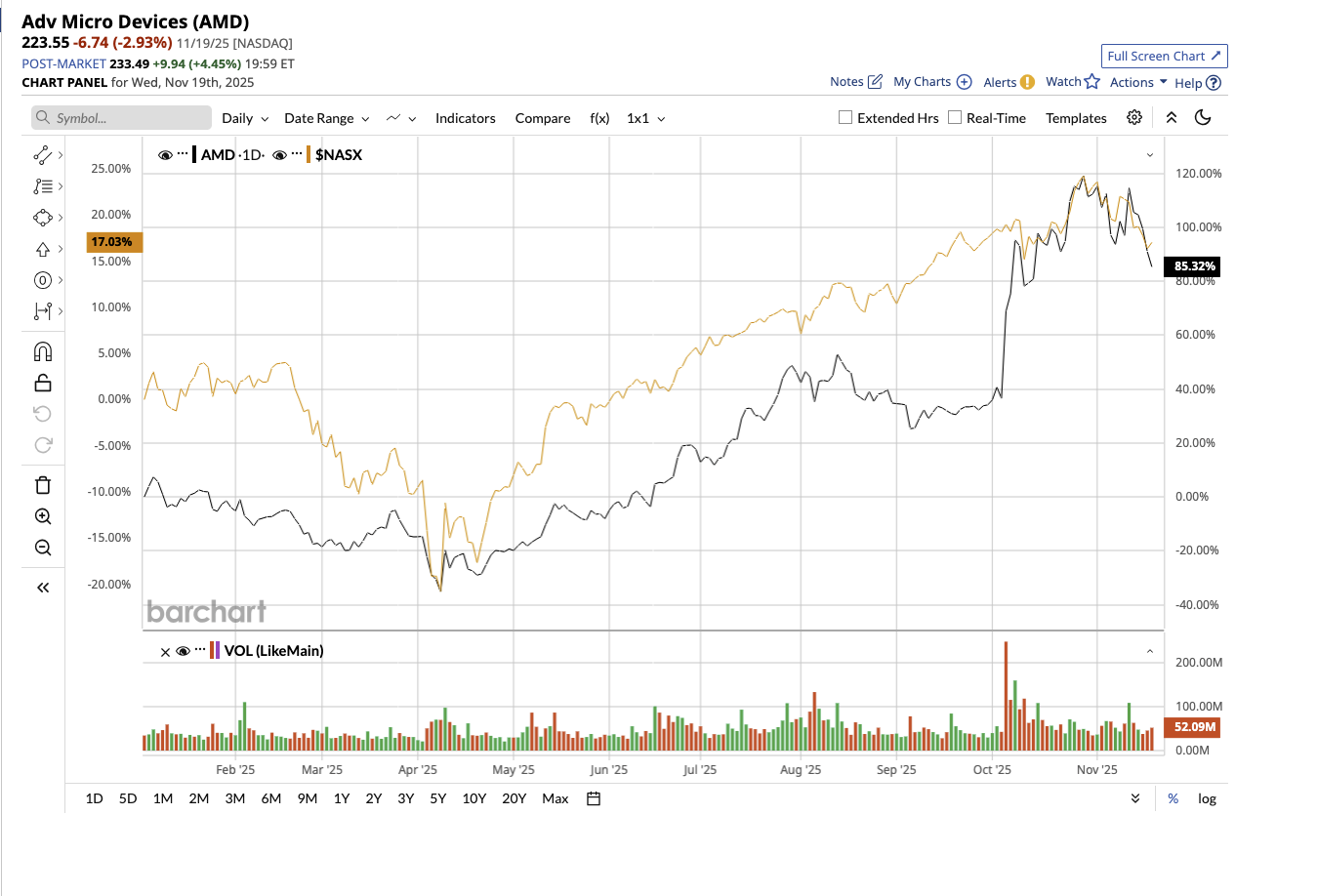

AMD stock has surged 77% so far this year, considerably outpacing the broader market. Is another major breakout on the horizon? Let’s find out.

Valued at $363.9 billion, AMD designs, builds, and sells the processors and graphics chips that run modern computing and AI. In the third quarter, revenue surged 36% year over year to $9.2 billion, supported by booming demand across data center AI, servers, and PCs and record sales of EPYC, Ryzen, and Instinct processors. Adjusted earnings per share rose 30% to $1.20, also up 150% sequentially, while gross margin stood at 54%.

AMD’s data center segment saw a revenue increase of 22% year over year to $4.3 billion. The Instinct MI350 series ramped fast, and server CPU revenue reached an all-time high. Fifth-generation EPYC processors quickly gained popularity, accounting for over half of all EPYC sales. AMD's AI business for data centers is entering a new era of rapid expansion. Oracle was the first to publicly offer MI355x instances, while partners like IBM, Cohere, Character AI, and Luma AI started using MI300X at scale.

AMD is already prepping for the next leap with its 2nm Venice processors, which will be available in 2026. Management indicated that early testing displayed strong performance, resulting in exceptional client interest. This quarter, AMD secured one of its largest-ever customer wins, signing a multi-year agreement with OpenAI to install 6 gigawatts of Instinct GPUs, including MI450 accelerators, beginning in 2026. This merger might generate more than $100 billion in revenue over the next few years. Oracle will also act as MI450's principal launch partner, with tens of thousands of deployments planned for 2026 and 2027.

The client and gaming segment generated a record $4 billion, up 73% year on year. Client revenue alone increased by 46% to $2.8 billion, led by record Ryzen processor sales and a more diverse mix. Gaming revenue increased 181% to $1.3 billion, reflecting increased console demand and strong Radeon GPU performance. However, embedded segment sales declined 8% year-over-year but increased 4% sequentially as some end markets recovered.

A Company Entering Its Strongest Growth Era

AMD generated $1.5 billion in free cash flow. The company repurchased $89 million in stock during the quarter, totaling $1.3 billion year-to-date, with $1.4 billion remaining under its current authorization. On the balance sheet, AMD had $7.2 billion in cash and $3.2 billion in total debt.

For 2026, the company is prioritizing growth in both revenue and gross margin dollars while continuing to steer margins higher over time. Management noted that targeted investments in AI silicon, software, and platforms are preparing the company for long-term revenue and earnings growth. With Instinct GPUs' fast scaling, EPYC CPUs gaining market dominance, and next-generation platforms like MI400, Helios, and Venice in the works, AMD is expected to generate tens of billions of dollars in annual AI revenue by 2027.

This quarter marks the beginning of AMD’s next major growth phase. Analysts expect the company’s earnings to increase by 19.8% in 2025, followed by another 62.2% in 2026. Currently, it is valued at 35 times forward 2026 earnings, compared to its historical average of 114x, making it a reasonable AI-led semiconductor stock to buy now.

Is AMD Stock a Buy, Hold, or Sell Now?

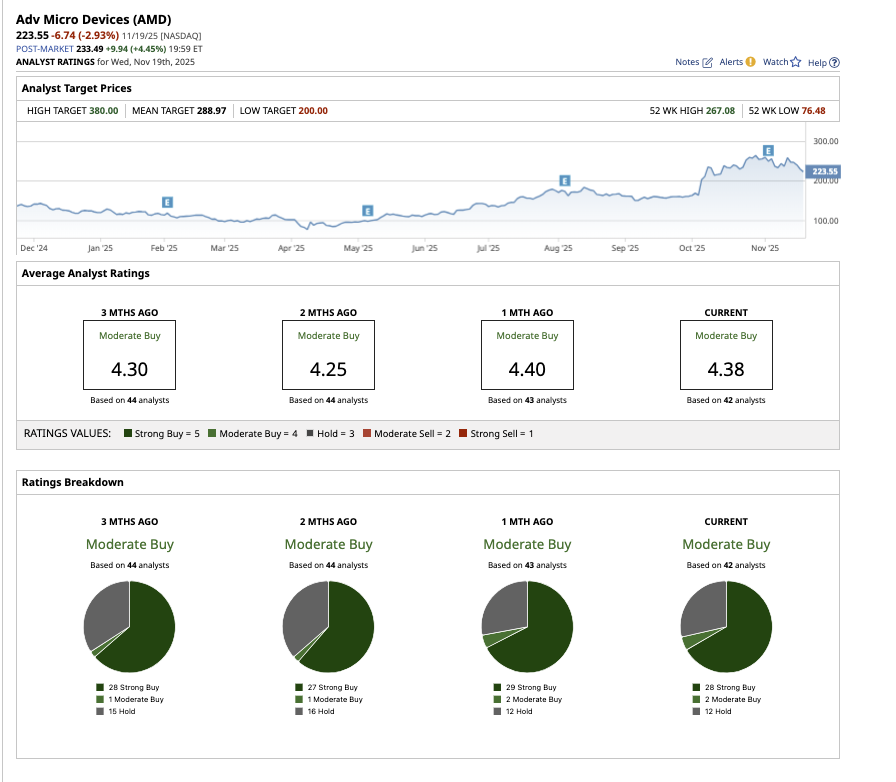

Overall, Wall Street rates AMD stock as a “Moderate Buy.” Of the 42 analysts that cover AMD, 28 rate it a “Strong Buy,” while two recommend a “Moderate Buy,” and 12 recommend a “Hold.” Based on its average price target of $288.97, analysts see potential upside of about 38% over the next 12 months. Furthermore, its high target sits at $380, indicating a potential price increase of 33% from current levels.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Microsoft%20France%20headquarters%20by%20JeanLuclchard%20via%20Shutterstock.jpg)

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/International%20Business%20Machines%20Corp_%20logo%20on%20storage%20rack-by%20Nick%20N%20A%20via%20Shutterstock.jpg)