Bath & Body Works (BBWI) shares lost nearly 25% on Thursday after the home fragrance and personal care retailer reported disappointing financials for its third quarter.

Investors bailed on BBWI also because management guided for a high-single-digit decline in Q4 revenue even though the brand is widely considered a holiday season staple.

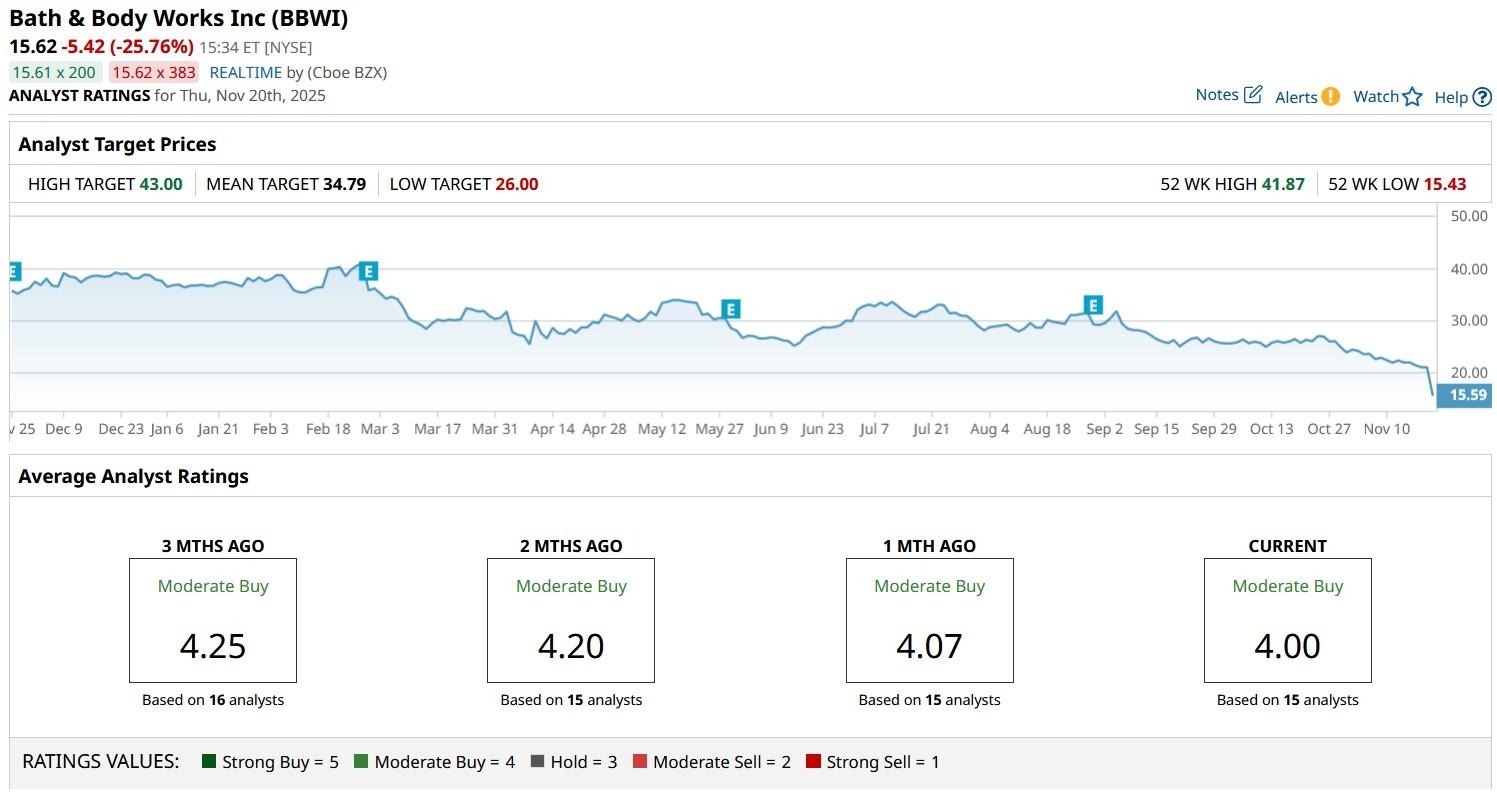

Following the post-earnings plunge, Bath & Body Works stock is down over 60% versus its year-to-date high in late February.

Is Bath & Body Works Stock Worth Buying After Q3 Earnings?

Long-term investors could consider loading up on BBWI shares at current levels as Daniel Heaf, the company’s new chief executive, is fully committed to fixing the strategic missteps of the past.

His transformation plan, dubbed the “Consumer First Formula,” aims to generate $250 million in cost savings over the next two years, and refocus the brand on its legacy categories, including body care, home fragrances, soaps, and sanitizers.

Heaf’s strategy comprises exiting non-core segments like men’s grooming and hair care, launching on Amazon marketplace to capture an estimated $70 million in gray market sales, and minimizing organization complexity as well.

Collectively, these initiatives position Bath & Body Works as a compelling turnaround play.

BBWI Shares Are Trading at an Attractive Valuation

Bath & Body Works shares may be worth owning heading into 2026 since much of the downside appears priced into them already at current levels

At the time of writing, the retail stock is going for about 6x forward earnings only – a compelling multiple for a business that continues to generate significant cash flow.

BBWI maintains relatively stable finances with expected free cash flow of some $650 million this year, with plans of $400 million in share buybacks strengthening the argument for a rebound.

Finally, the NYSE-listed firm’s 14-day relative strength index sits at less than 15 currently, which further signals the bearish momentum is now exhausting.

How Wall Street Recommends Playing Bath & Body Works

Investors could take heart in the fact that Wall Street firms continue to favor owning Bath & Body Works stock for the next 12 months.

The consensus rating on BBWI shares currently sits at “Moderate Buy” with the mean target of about $35 indicating potential upside a whopping 130% from here.

/Apple%20Inc%20logo%20on%20Apple%20store-by%20PhillDanze%20via%20iStock.jpg)

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)