I have a few charts for just you today, but right now it’s only one that really matters – the USD Index.

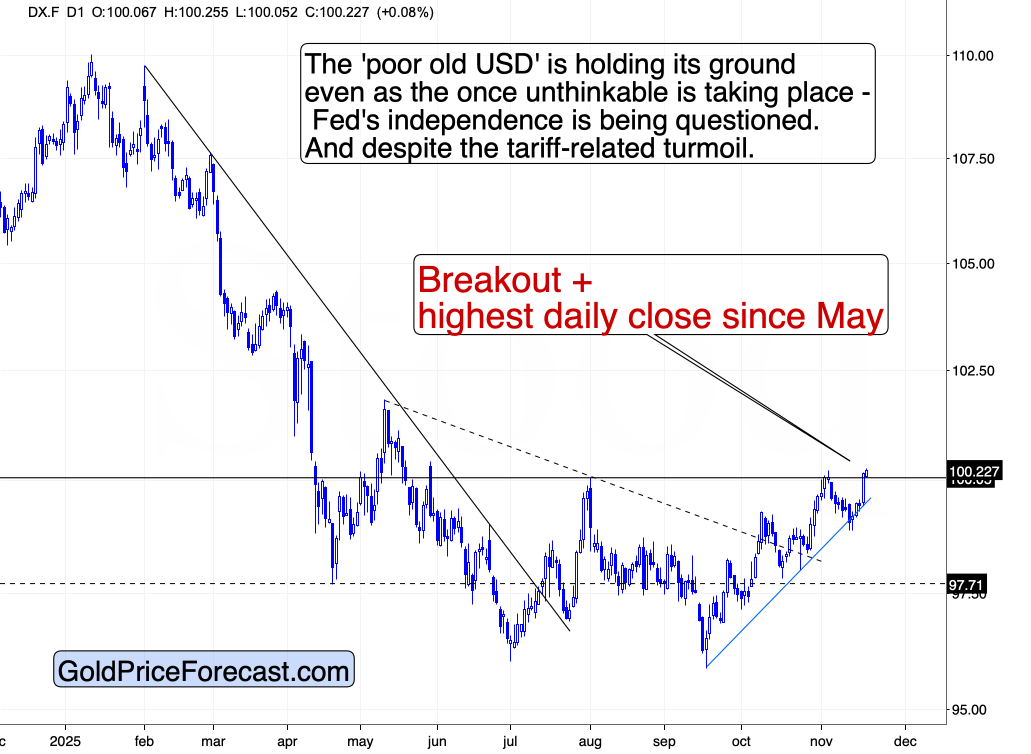

Yesterday, the USD Index futures closed above the 100 level for the first time since May, and today’s intraday price is also highest since May.

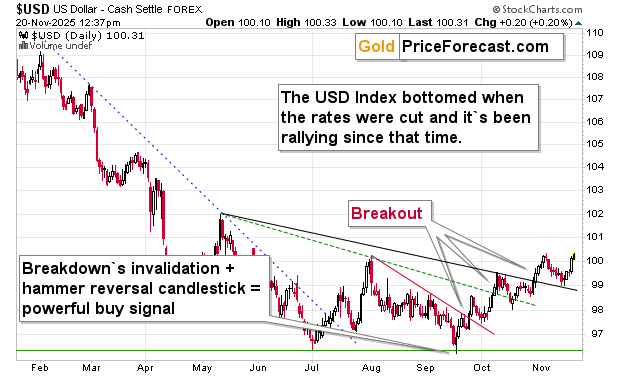

The breakout is even clearer on the cash version of the USD Index.

The price moved above 100, then moved back down a bit – held (intraday low at 100.10) – and then moved up again.

The breakout is not yet confirmed, but it’s clear that this situation is different. It’s not the emotional reactive rally that we saw in May. Nor is it a spike-shaped top that we saw in July-August.

It’s a clear move up that followed several breakouts.

And a invalidation of the breakdown to new yearly lows in mid-September.

That day – when the rates were cut for the first time – was the key one. Despite all the negativity hitting it (even the Fed’s independence was questioned), the USD rose like phoenix from the ashes.

I’ve been writing this many times, but it’s worth repeating again – the most bullish situation for any market is when everything that could have gone wrong… Already has. Or actually, it’s even better when the market declined and the sentiment worsened despite a positive change on the fundamental front (here: tariffs).

We saw all of that in case of the USD Index.

And then it recovered.

It’s been rallying ever since the mid-Sep bottom with relatively shallow corrections.

Of course, the best is yet to come.

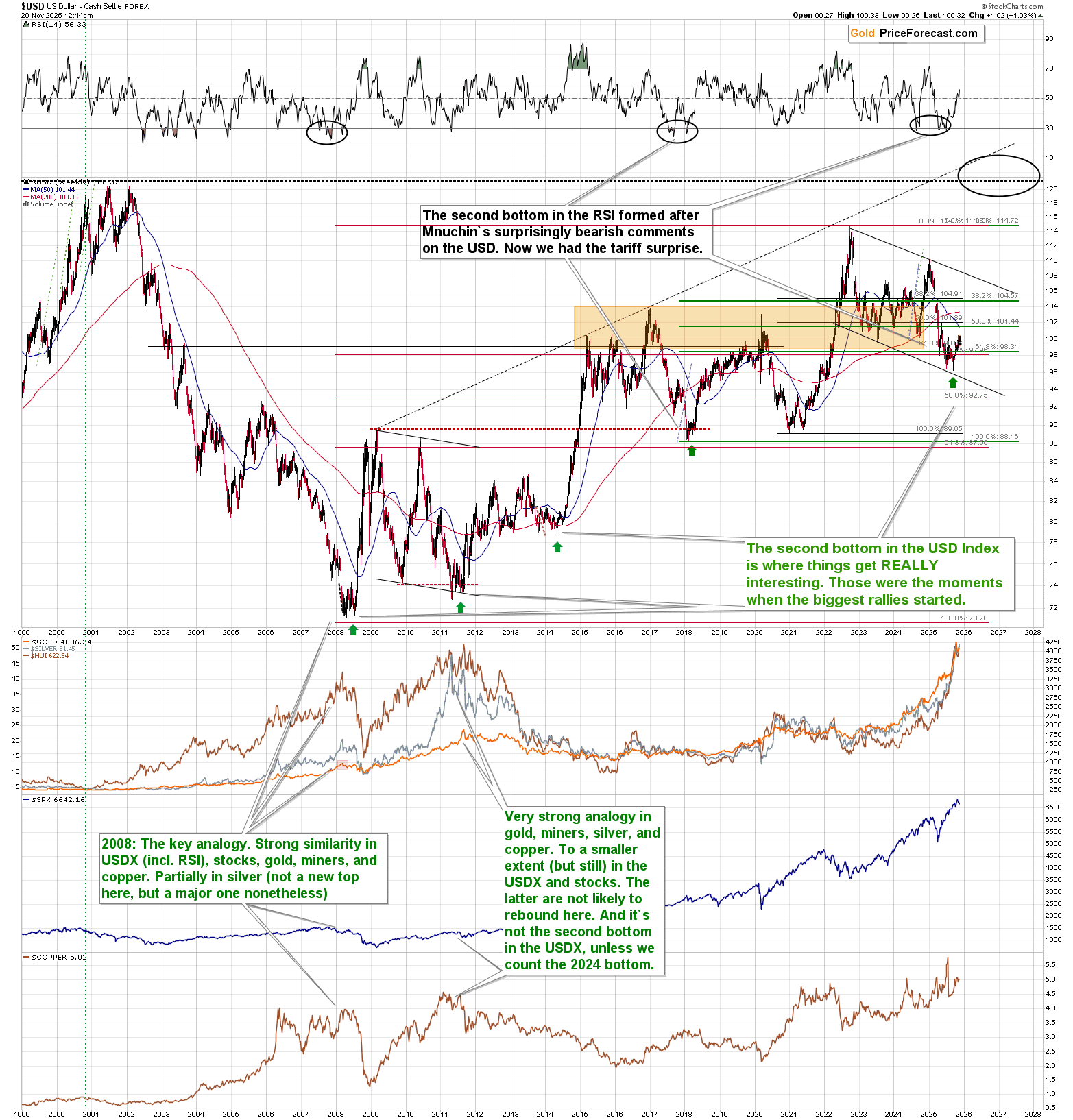

The broad double-bottom – the kind of a bottom that marked the beginning of huge rallies, including the 2008 one – was just formed. The confirmation of the breakout above 100 will make it clear that the bottoming process is complete. The following price action is likely to be huge, especially if the AI-led stock market bubble bursts.

Please note what happened in 2008 – despite great rally in mining stocks and silver at that time – both declined truly profoundly (before taking off again). The approximately 500% rally in silver that followed the 2008 bottom is particularly notable and, as you know – we’re likely to see something even better in silver in the future.

In the meantime, the USD Index is likely to soar and this just might be the case that stocks fall dramatically as well.

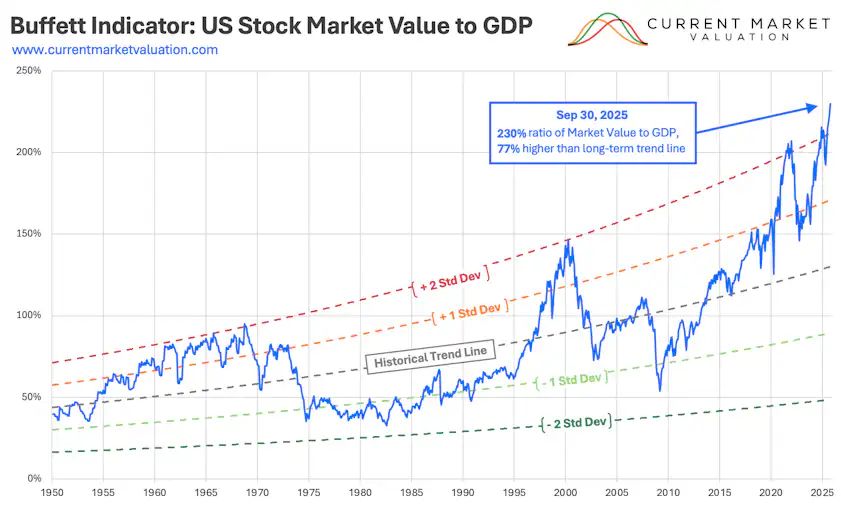

Here’s a chart that I just saw on LinkedIn.

The previous moves to the red line (2 standard deviations from the mean) have previously resulted to declines below the light-green line representing one standard deviation below the mean.

The line on the chart is not just stock market valuations – its stock market valuation divided by the GDP.

Yes, that’s how crazy the current stock market valuations are.

Is this time different?

In a way – yes, the AI tech is revolutionary.

In another way – absolutely not. Wasn’t Internet revolutionary? And yet, once the dot-com bubble burst, the stock market collapsed. The S&P 500 value was cut in half. NASDAQ gave away over 75% of its value.

As I wrote before – that’s likely the first crack in the stock-AI-crypto-correlated dam.

And it’s getting bigger each day.

Gold is still hesitating, waiting on signals – which are likely to arrive shortly.

Exactly like stated on the chart.

When the USD Index finally soars in a meaningful way, I doubt that gold (as well as the rest of the precious metals sector) and commodities like copper will be able to hold up even decently.

New Service Launch – Anna’s Trading Lab

As you may know (if you’re our Diamond Member), we’re launching a new premium newsletter on Golden Meadow® - Anna’s Trading lab.

Anna’s Trading Lab is a new newsletter covering multiple markets – gold, silver, stocks, bitcoin, and other markets where the opportunity arises. It’s provided by Anna Radomska, who has been successfully providing premium analyses on Golden Meadow® and in the preceding years on Sunshine Profits in the following products: Stock Trading Alerts, Oil Trading Alerts, Forex Trading Alerts, Oil Investment Updates, Forex Trading Alerts, and Day Trading Alerts.

You can read Anna’s welcome message, and her analyses (posted yesterday) in her space on Golden Meadow®.

Thank you for reading my today’s analysis – I appreciate that you took the time to dig deeper and that you read the entire piece. If you’d like to get more (and extra details not available to 99% investors), I invite you to stay updated with our free analyses - sign up for our free gold newsletter now.

Thank you.

Przemyslaw K. Radomski, CFA

Founder

Golden Meadow®

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)