/Westinghouse%20Air%20Brake%20Technologies%20Corp%20logo%20and%20phone-by%20IgorGolovniov%20via%20Shutterstock.jpg)

With a market cap of $33.8 billion, Westinghouse Air Brake Technologies Corporation (WAB) is a leading global provider of technology, equipment, and services for the freight rail and passenger transit industries. Headquartered in Pittsburgh, Pennsylvania, the company produces locomotives, braking systems, digital and automation solutions, and a wide range of components that improve rail efficiency, safety, and sustainability.

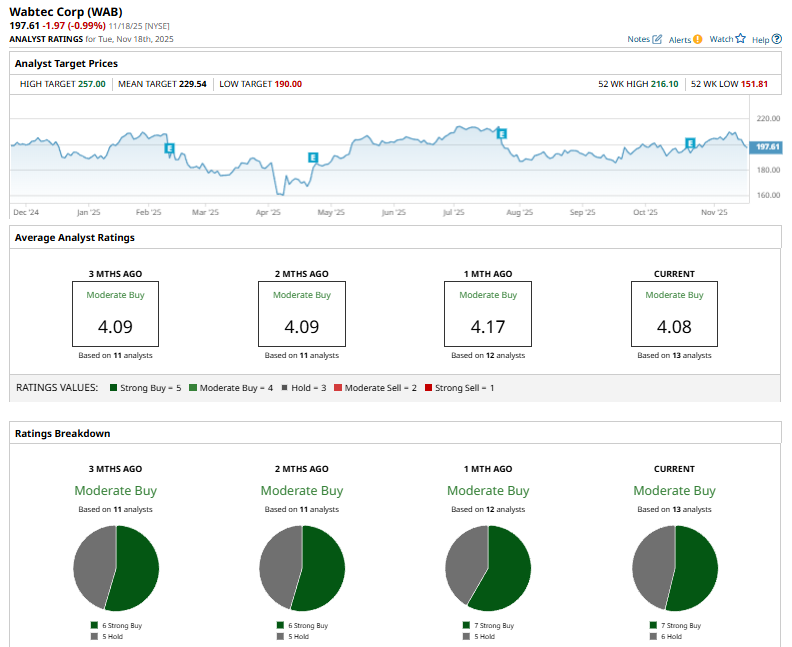

WAB’s stock prices have grown 1.1% over the past 52 weeks, lagging the S&P 500 Index’s ($SPX) 12.3% gains over the past year. In 2025, WAB has surged 4.2%, trailing the $SPX’s 12.5% rise.

Narrowing the focus, WAB has outperformed the iShares Environmental Infrastructure and Industrials ETF’s (EFRA) marginal decline over the past 52 weeks and 3.7% dip on a YTD basis.

On Oct. 22, 2025, Wabtec reported its third-quarter results, with revenue rising 8.4% to $2.89 billion and adjusted EPS increasing 16% to $2.32. The company’s multi-year backlog also grew to $25.6 billion, though operating cash flow slipped to $367 million compared to last year. Despite the solid beat and raised full-year EPS outlook, the stock still fell about 2.3% as investors reacted to ongoing macro pressures and working-capital headwinds.

For the current fiscal year, ending in December, analysts expect WAB to report an impressive 18.3% year-over-year increase in adjusted EPS to $8.94. The company has a mixed earnings surprise history. It has surpassed the Street’s bottom-line estimates in three of the past four quarters, while missing on one occasion.

WAB has a consensus “Moderate Buy” rating overall. Of the 13 analysts covering the stock, opinions include seven “Strong Buys” and six “Holds.”

This configuration is bullish than two months ago when it had six “Strong Buy” suggestions.

On Oct. 7, Citi restated its “Buy” stance on Westinghouse Air Brake Technologies, backing it with a $225 price target.

WAB’s mean price target of $229.54 indicates a modest premium of 16.2% from the current market prices. Moreover, the Street-high target of $257 suggests a notable 30.1% upside potential.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Apple%20logo%20on%20store%20front%20by%20frantic00%20via%20iStock.jpg)