Cypherpunk Technologies (CYPH) shares soared as they debuted on the Nasdaq following the firm’s transition from a biotech company under Leap Therapeutics into a digital asset treasury company.

The company has already raised millions to start putting into Zcash (ZECUSD), representing a calculated bet on privacy-focused cryptocurrencies as digital surveillance concerns intensify globally

At the time of writing, CYPH stock (formerly LPTX) is trading at well over 4x its price earlier this week.

Why CYPH Shares Aren’t Worth Chasing

Despite the initial excitement, investors are recommended caution in playing Cypherpunk stock on the Zcash rebranding.

Why? Mostly because the timing of this launch coincides with deteriorating cryptocurrency market conditions that present substantial headwinds.

Bitcoin (BTCUSD) decently crashed below the psychologically critical $100,000 level as institutional inflows weaken and the Federal Reserve’s rate cut expectations diminished in the aftermath of the government shutdown.

With over $1 billion in leveraged positions liquidated and market sentiment indicators reaching extreme fear levels of 15, the Zcash strategy may not prove as rewarding for CYPH as executives hope, at least in the near-term.

ZCash Headwinds Could Hurt CYPH Stock in 2026

Caution is warranted on buying CYPH shares following the aforementioned strategic pivot since ZCash itself faces significant technical challenges as well despite institutional interest in privacy.

Zcash is currently down some 30% from its recent peak near $750.

Moreover, privacy coins face more intense scrutiny from regulators concerned about compliance with anti-money laundering requirements.

This could in turn limit mainstream institutional adoption, creating another major hurdle for the firm’s recently launched Zcash treasury strategy to prove successful for the crypto penny stock.

What’s the Consensus Rating on Cypherpunk Technologies?

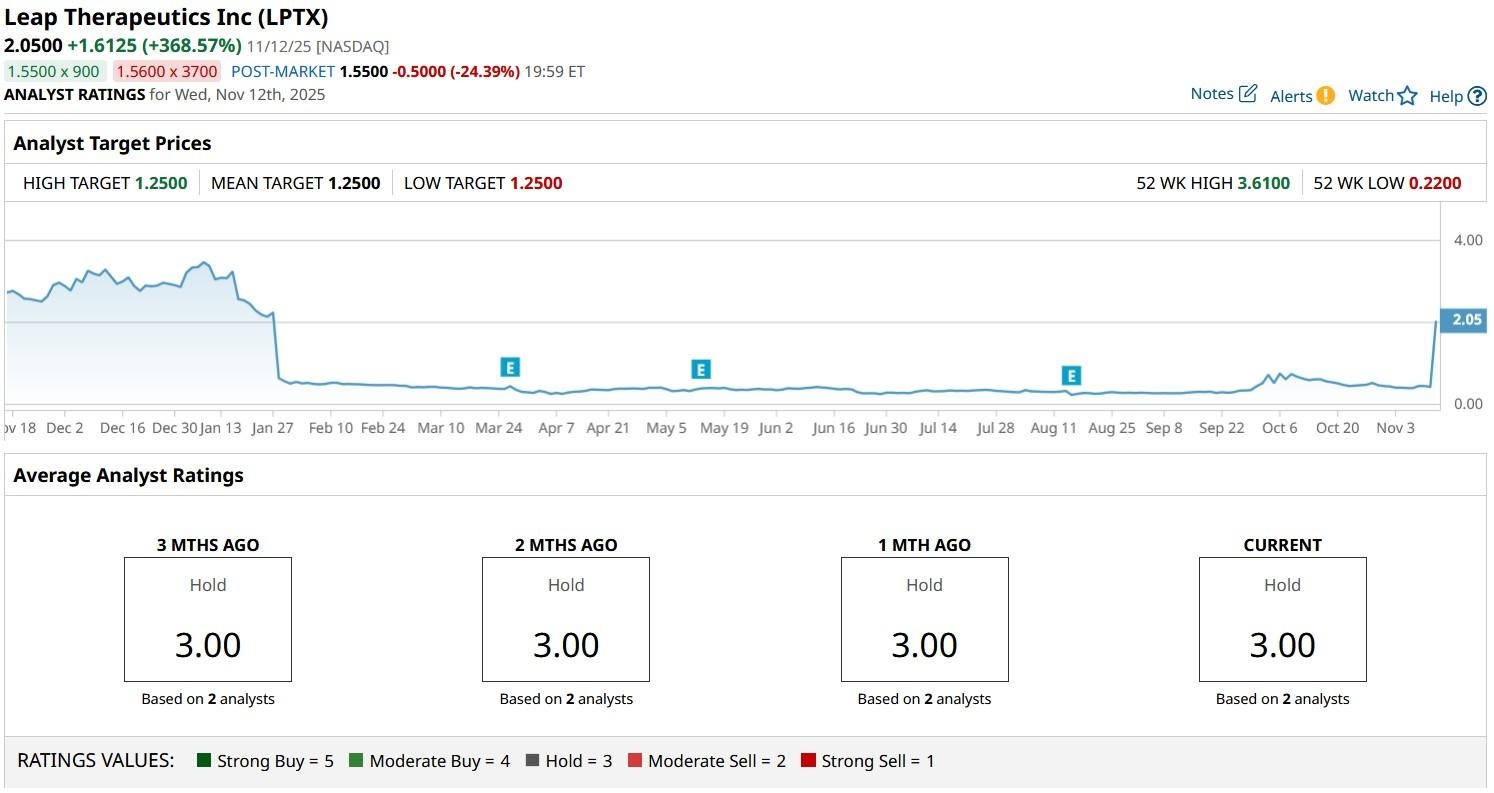

Wall Street analysts also believe the post-transformation rally in CYPH stock is overdone.

According to Barchart, the consensus rating on Cypherpunk shares currently sits at “Hold” only with the mean target of $1.25 indicating potential downside of some 30% from here.

/Cisco%20Systems%2C%20Inc_%20HQ-by%20Sundry%20Photography%20via%20iStock.jpg)