Nuvve (NVVE) shares more than tripled on Thursday after the San Diego-headquartered energy-technology company announced a groundbreaking battery storage aggregation agreement in Japan.

This deal marks the first of its kind for existing stationary storage batteries in the country, involving a substantial high-voltage storage installation in Tainai City

The installation will have an impressive output capacity of 1,999 kW and storage capacity of 8,170 MWh. Despite today’s massive surge, NVVE stock is down over 90% versus its year-to-date high.

Significance of Japan Deal for Nuvve Stock

For Nuvve stock, the strategic significance of this battery storage agreement extends well beyond immediate revenue generation.

It demonstrate NVVE’s ability to expand its vehicle-to-grid (V2G) tech expertise into the broader stationary storage market.

According to the company’s chief executive Gregory Poilasne, this deal marks the first step in showcasing new possibilities for utilizing storage resources in Japan.

Over time, this distributed operation model will be extended to various regions, he confirmed.

In short, the agreement positions Nuvve as the aggregator for market operations, participating in supply-demand adjustment and wholesale electricity markets while contributing to regional power stabilization.

NVVE Shares Remain a Super High-Risk Investment

While promising, the Japan deal doesn’t warrant investing in NVVE shares, at least not at current levels.

Why? Because the price action is hard to justify given the Nasdaq-listed firm is deeply unprofitable and has rather limited visibility into future revenues.

More importantly, despite its meteoric rally on Thursday, Nuvve remains a penny stock, which makes it particularly vulnerable to speculative trading behavior that often punishes latecomers.

Plus, since the company’s stock price still sits well below $1, there’s a real risk of delisting heading into 2026 as well. NVVE continues to trade handily below its 200-day MA, indicating the broader downtrend is intact.

Wall Street Does Not Currently Cover NVVE Stock

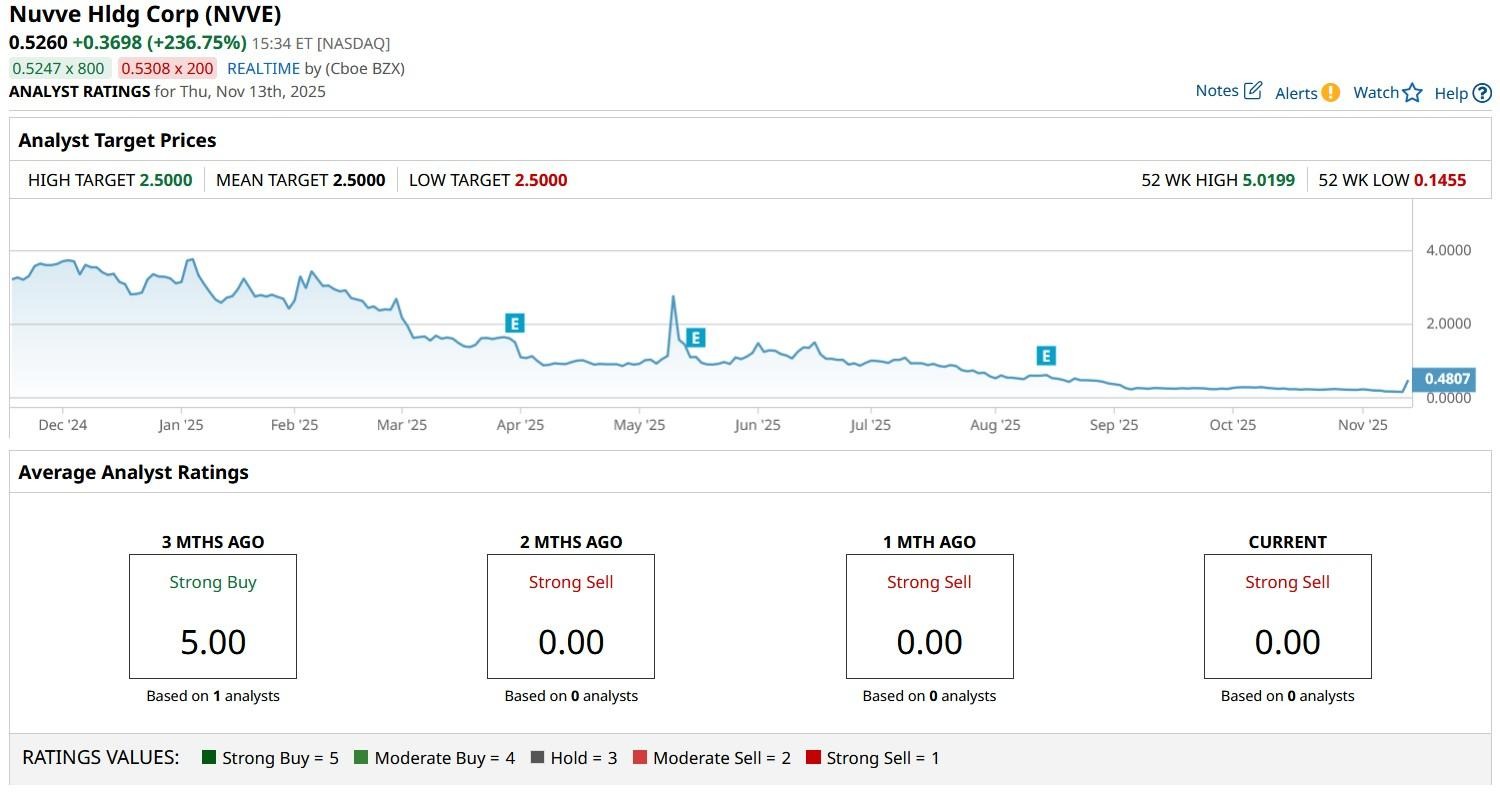

What’s also worth mentioning is that Nuvve stock doesn’t currently receive coverage from Wall Street analysts.

That’s a huge red flag for seasoned investors since it signals limited institutional interest, reduced visibility, and fewer professional insights to guide investment decisions or risk assessment.

/AI%20(artificial%20intelligence)/Businessman%20touching%20the%20brain%20working%20of%20Artificial%20Intelligence%20(AI)%20Automation%20by%20Suttiphong%20Chandaeng%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Netflix%20open%20on%20tablet%20by%20rswebsols%20via%20Pixabay.jpg)