Leap Therapeutics (LPTX) shares closed a remarkable 368% higher on Nov. 12 after the company announced a crypto treasury strategy focused exclusively on ZCash (ZECUSD).

According to LPTX’s press release, it secured nearly $59 million in private placement funding led by Winklevoss Capital and immediately deployed $50 million to acquire 203,775 ZEC tokens.

Leap will officially rebrand as Cypherpunk Technologies today, Nov. 13, and will begin trading under the new ticker symbol CYPH. For now, LPTX stock is going for roughly 9x its price in mid-August.

Why LPTX Stock Soared on the ZCash Announcement

The announcement effectively transforms Leap Therapeutics into a digital asset treasury company, positioned to benefit from continued momentum in ZCash that has already soared over 1,400% in 2025.

ZEC is broadly known among crypto enthusiasts as the “encrypted Bitcoin.”

The token’s price could push meaningfully higher over time as it continues to galvanize investors’ interest with its superior safety features, a scarce commodity in an increasingly digital world.

Additionally, with the ZCash treasury strategy, LPTX shares will now be able to attract previously sidelined crypto-focused investors, with the added demand expected to drive them higher in 2026.

LPTX Shares Remain Super Risky to Own

Investors must still tread with caution on Leap Therapeutics because anchoring its stock price to a volatile asset like ZCash presents substantial risks as well.

Privacy-focused cryptocurrencies face intensifying regulatory headwinds, including the European Union’s planned 2027 ban on privacy coins and anonymous crypto accounts.

Major exchanges have already begun delisting privacy assets to maintain regulatory compliance.

Arthur Hayes, the co-founder of BitMEX, recently warned for ZEC holders to withdraw from centralized exchanges. This underscores growing regulatory pressure on privacy coins that may impact distribution and liquidity.

Moreover, Leap Therapeutics is vulnerable to high volatility and pump-and-dump behavior due to its penny stock status, which makes it even more unattractive for serious investors.

What’s the Consensus Rating on Leap Therapeutics?

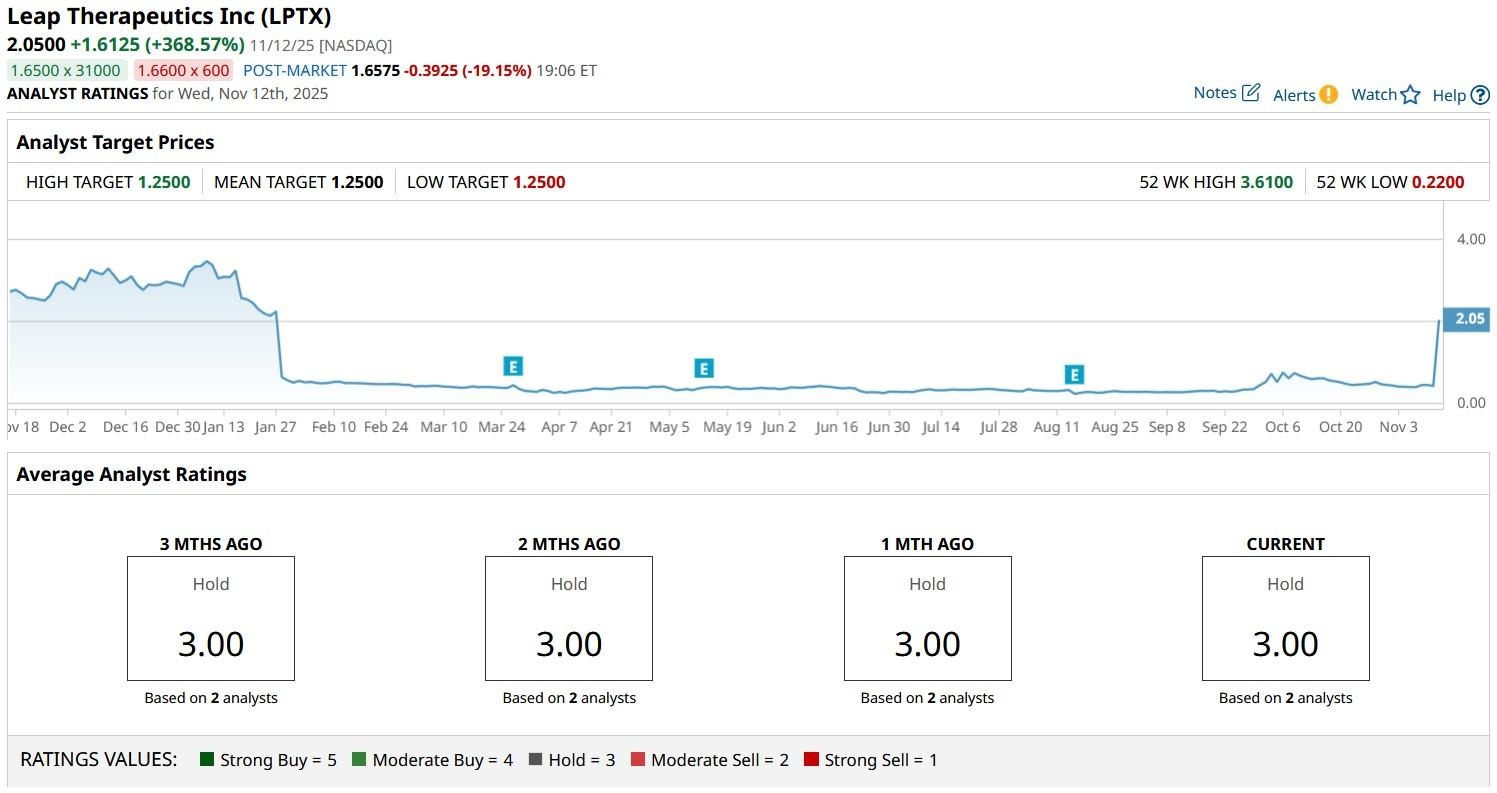

Note that Wall Street analysts also remain bearish on Leap Therapeutics stock heading into 2026.

According to Barchart, the consensus rating on LPTX shares currently sits at “Hold” only, with the mean target of about $1.25 indicating potential downside of more than 35% from here.

/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)

/AI%20(artificial%20intelligence)/Ai%20chip%20by%20Quality%20Stock%20Arts%20via%20Shutterstock.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)