The article below is taken from our US Single Stocks service (Beta launch). If you’re interested, register at https://wavetraders.com/ and get free access today

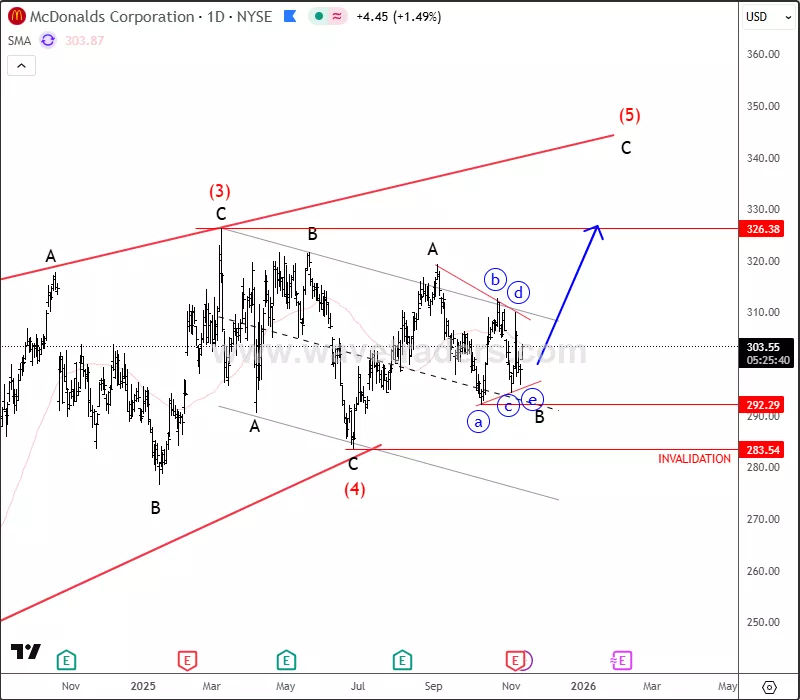

McDonald’s (MCD) remains one of the most iconic and globally recognized fast-food brands, founded in 1940 in San Bernardino, California. Renowned for its classic burgers, fries, and speedy service — with the Big Mac as its signature item — the company now operates in more than 100 countries, serving millions daily and adapting its menu to local preferences and global trends. Back on September 2, we noted that McDonald’s appeared to be trading within the final fifth wave of a larger wedge formation — a structure that still remains valid.

Currently, the stock continues to shape what looks like an ending diagonal, a pattern that often precedes a significant market reversal. The price action suggests that wave four likely completed near 283, followed by a strong rally to the upper boundary of the channel, likely wave A of a developing wave five. After a brief consolidation or triangle in wave B, another push toward new highs is possible before the pattern concludes. Once that final move plays out, however, caution is warranted, as the broader bullish cycle could be nearing completion.

Highlights:

Trend: Bullish break expected after B triangle, for ATH (wave five diagonal)

Support: 300, 292,

Resistance: 326

Note: Final leg higher before potential reversal

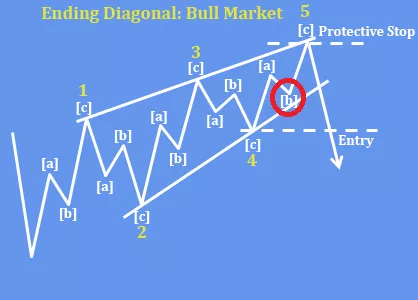

Some Educational content on Ending Diagonals:

The basic ending diagonal (wedge) pattern suggests that the final subwave (c) of wave 5 may still be missing before the completion of the top formation. This implies that the market could experience one last push higher to finalize the structure before a potential reversal occurs.

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

/AI%20(artificial%20intelligence)/AI%20microchip%20by%20DesignKingBD360%20via%20Shutterstock.jpg)