The Bull Strangle Newsletter, released weekly, shares a trading strategy that has achieved a documented 76% trade win rate and outperformed the S&P 500 by 240% since inception. The strategy combines buying stock and simultaneously selling out-of-the-money covered calls and cash-secured puts to generate option premiums and manage risk.

Margin Calculations Are Complex — and Differ Across Brokers

Margin calculations are often presented as precise, formula-driven values, but they are highly complex and vary from one broker to another. Each firm applies its own combination of Regulation T rules, portfolio-margin modeling, and volatility adjustments.

Even identical positions can produce different margin requirements depending on the brokerage. These variations can make it difficult — and largely unnecessary — to replicate exact figures in a spreadsheet or calculator. The truth is that margin calculations only matter if a trader plans to borrow against existing holdings or trade on leverage.

Margin Only Matters When Borrowing Is Involved

If a trader uses margin borrowing, the account’s margin equity and loan balance determine how much can be borrowed, how much interest is owed, and how close the account is to a margin call.

However, the Bull Strangle Strategy is deliberately structured to avoid these issues. It is a cash-secured approach that emphasizes measured position sizing, steady option income, and capital preservation — not borrowing to increase exposure.

The Bull Strangle Framework Keeps 25% Excess Cash

A defining feature of the Bull Strangle method is maintaining roughly 25% of total capital as unused cash. This excess-cash cushion ensures that:

- Positions are always fully funded.

- Short-term drawdowns, assignments, or new trades never require borrowing.

- The account always remains highly liquid.

Because of this built-in liquidity, margin borrowing is never required, and the complexities of broker-specific margin math becomes irrelevant.

“Cash Available Without Margin Impact” — The Practical Measure

Instead of focusing on abstract margin formulas, Bull Strangle traders monitor one simple, reliable figure found in every brokerage account “Cash Available Without Margin Impact”.

This number represents how much cash can be deployed for new trades without increasing margin exposure or triggering a loan. It provides a clear, real-time view of capital that is free to use.

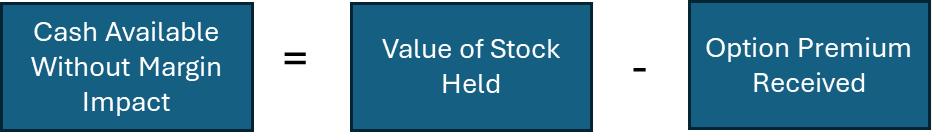

For Bull Strangle positions, the relationship can be expressed simply:

Example

- 100 shares @ $100 = $10,000 value

- Total option premium received = $500

- Cash Available Without Margin Impact = $9,500

In this example, $9,500 of actual cash supports the trade — no borrowing, no leverage, and full clarity about capital in use.

Note: The Bull Strangle Newsletter calculates all returns based on “Cash Available Without Margin Impact.” This method reflects true cash usage and provides a consistent measure of performance across all positions.

How Capital Frees Up Week by Week

As options decay during the four-week expiration cycle, the option premium liability steadily disappears, and Cash Available Without Margin Impact rises. The example below assumes the stock remains stable near $100 while both options lose time value.

Capital gradually releases back into account each week, allowing new Monday trades to be opened as the prior Friday expirations close.

Why This Approach Simplifies Capital Management

By focusing on Cash Available Without Margin Impact, traders gain:

- A simple and consistent view of liquidity, regardless of broker.

- A clear measure of how much capital is deployed versus free.

- A disciplined framework that avoids the risks of margin borrowing.

This method aligns perfectly with the Bull Strangle philosophy — stay fully funded, collect option income, and maintain flexibility week after week.

In Summary

Margin math may be complicated, but it’s irrelevant when trades are fully cash-secured. The Bull Strangle strategy eliminates margin risk by keeping 25 % of capital uncommitted and managing exposure through the simple, transparent lens of Cash Available Without Margin Impact.

This single number tells the complete story: how much is invested, how much is free, and how capital quietly refreshes every week as options expire and new opportunities arise.

More Information

For a short video explaining the Bull Strangle strategy.

To subscribe to the Bull Strangle Newsletter

Contact

Darren Carlat

Managing Director

DualEdgeResearch@gmail.com

(214) 636-3133

Disclaimer

This information is for informational purposes only and should not be considered as investment advice. Past performance is not indicative of future results, and all investments carry inherent risk. Consult with a financial advisor before making any investment decisions.

/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/McDonald's%20Corp%20arches%20by-%20TonyBaggett%20via%20iStock.jpg)