/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)

Palantir (PLTR) shares are inching further down in morning trading on Wednesday, Nov. 5 as valuation concerns continue to weigh on sentiment despite a blockbuster third-quarter release.

Trading at a forward price-earnings (P/E) multiple of nearly 465x, PLTR is currently one of the most expensive software names in the benchmark S&P 500 Index ($SPX).

Despite the post-earnings dip, Palantir stock remains up roughly 145% versus the start of this year.

Where Options Data Suggests Palantir Stock Is Headed

Options traders seem to be pricing in potential for a continued decline in PLTR stock over the next four weeks, given the put-to-call ratio on contracts expiring Dec. 5 currently sits at 1.32.

In fact, longer-dated options expiring mid-January also have the lower bound pegged at nearly $155, according to Barchart, suggesting Palantir shares could lose another 16% through the end of 2025.

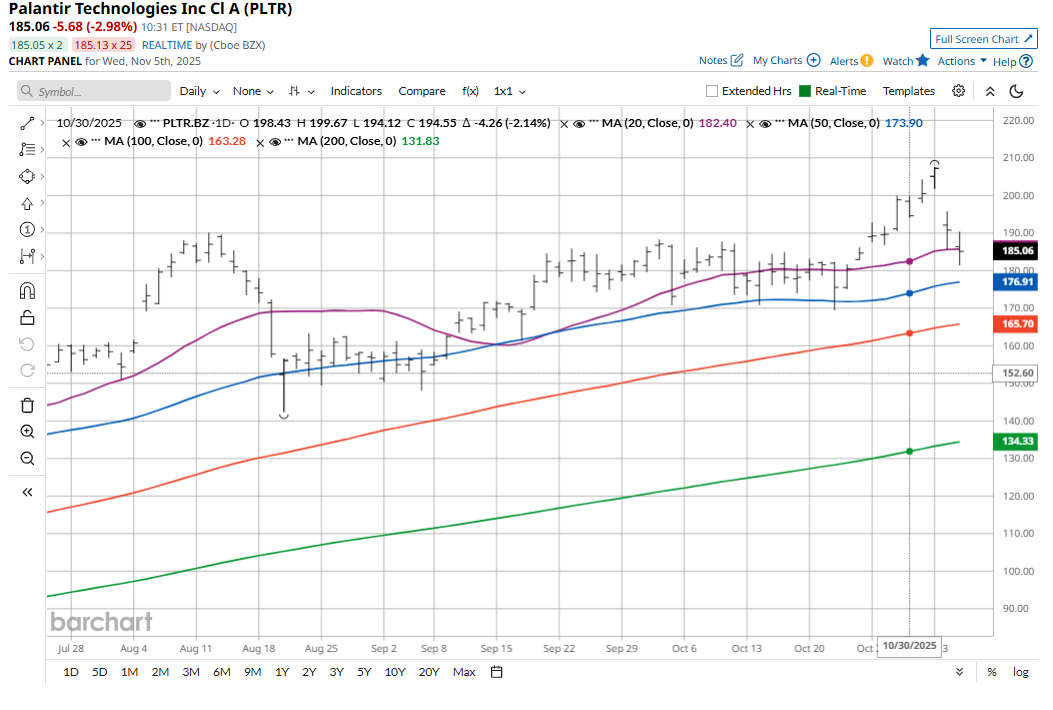

At writing, the Nasdaq-listed firm is testing a support coinciding with its 20-day MA at $185.69 level. A sustained break below this price could further accelerate bearish momentum in the near-term.

Palantir remains a risky investment heading into 2026 also because insiders have sold it aggressively over the past 12 months, indicating a lack of confidence in the company’s long-term prospects.

Don’t Count on a Swift Recovery in PLTR Shares

Gabriela Borges, a senior Goldman Sachs analyst, also recommends caution in buying PLTR stock on the post-earnings dip.

In a research note, Borges agreed that Palantir is among “a handful of software names that are clearly benefiting from artificial intelligence deployments today.”

However, much of that upside and years of flawless of execution is already priced into the AI stock at current levels, she added, maintaining her “neutral” stance on the Denver-headquartered firm.

Borges raised her price objective on Palantir stock to $188, but that still doesn’t indicate any meaningful upside from here.

Wall Street Recommends Caution on Palantir Technologies

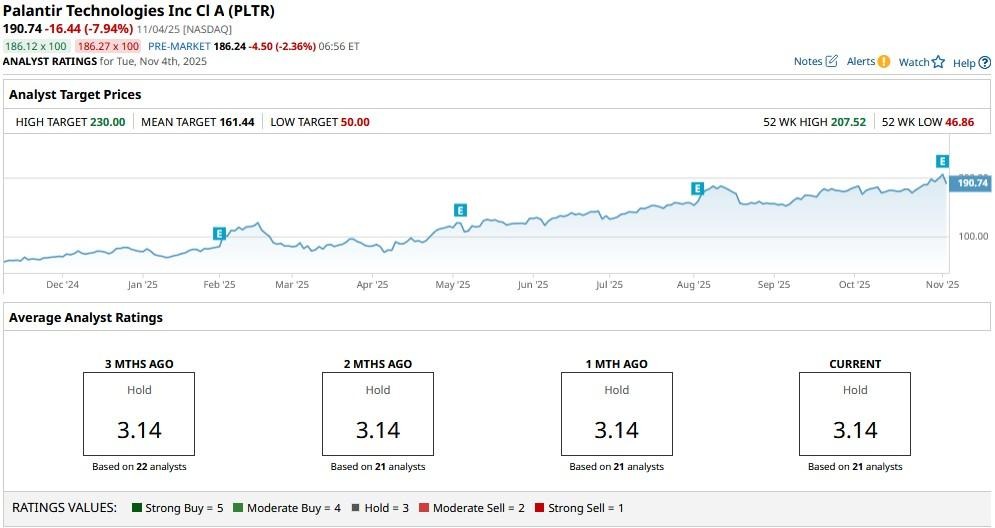

Other Wall Street firms agree with Goldman Sachs’ cautious view on Palantir stock as well.

According to Barchart, the consensus rating on PLTR shares currently sits at “Hold” only with the mean target of about $161 indicating potential downside of another 13% from here.

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/Apple%20products%20arranged%20on%20desk%20by%20tashka2000%20via%20iStock.jpg)