Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Commentary

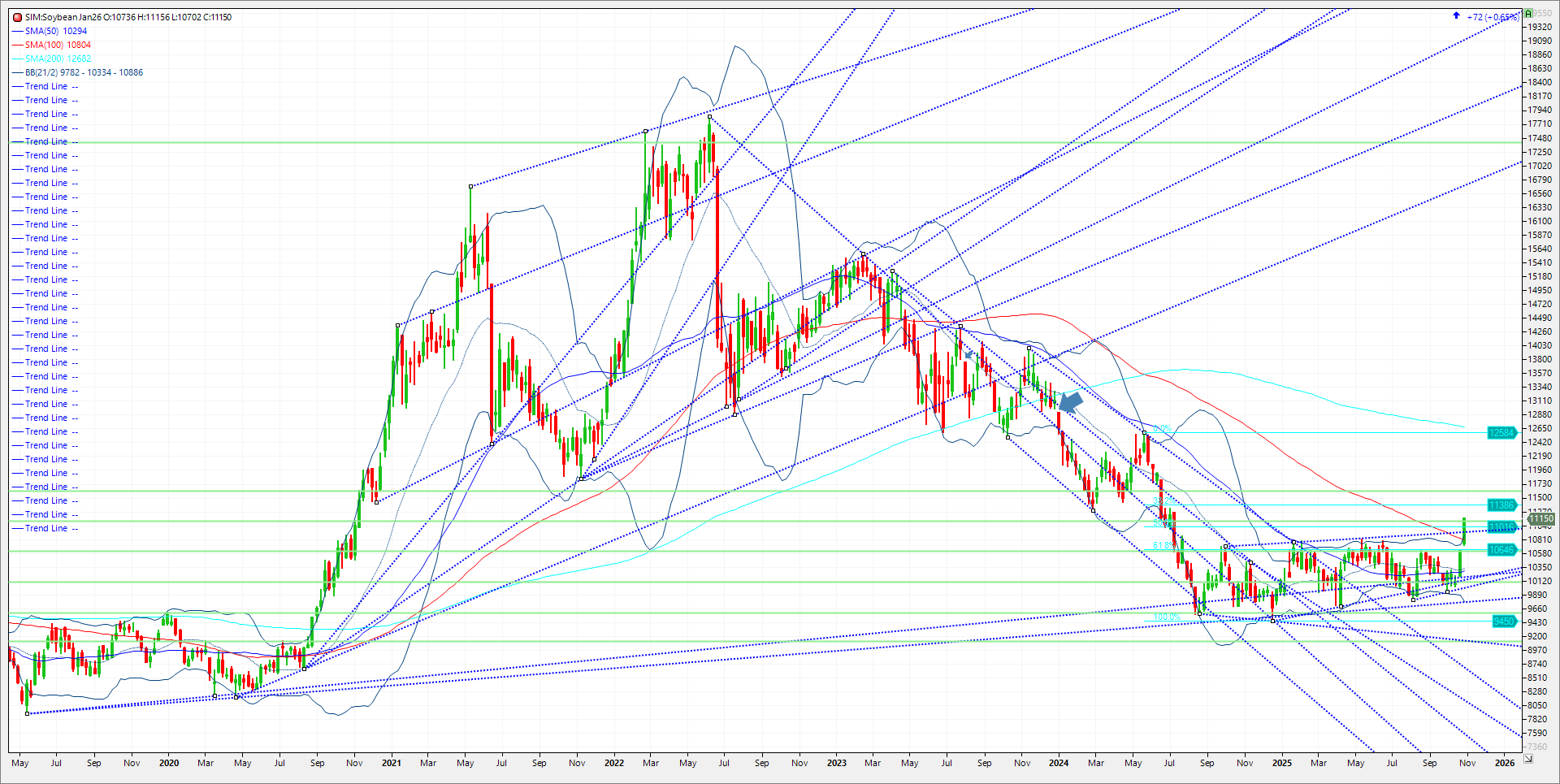

This week’s trade commenced with a gap higher after weekend talks between the U.S. and China were viewed in an increasingly positive light in my opinion. Meal futures rallied higher and ultimately pushed to a seven-and-a-half-month high, which helped drive soybeans to levels not seen in more than a year. While both are hovering in technically overbought territory, confirmed purchases from China could be creating a breakout on the charts. (See below) President Trump returned from South Korea with a handful of trade agreements with the most notable one being with China, while the details continue to be worked out ahead of an anticipated signing of the China agreement hopefully within the next week. This means that President Trump’s threatened 100% additional tariffs do not go into effect on 11/1/25 as scheduled, and port fees by both China and the United States should soon be suspended. It was confirmed then that China bought at least seven U.S. soybean cargoes this week. The cargoes are for shipment later this year and in early 2026. The total volume is about 420,000 tons. The sales for future shipment in my view have limited a correction thus far as traders grasp the potential supply and demand landscape. As harvest winds down in the U.S., producers in South America advance planting efforts. Early indications may point to another bumper crop in Brazil as planted acres are to rise year on year yet again, but we are way too early to offer any predictions as weather will determine output. How to play this bean market in my view moving forward. I see two scenarios playing out where both levels may be seen this year. One is last week's gap at 1070 and this week’s. The upside target is 1162. That level represents 15% higher on year while 12.11 represents 20% higher on year. My contention is that we say one of these levels sooner than later. I don’t see the chart developing a right shoulder and trading sideways in my opinion. I see this market either breaking 50 cents or rallying towards 12.00 Conservative trade idea below.

Trade Ideas

Futures-N/A

Options-Buy the Dec soybean 1070 put and at the same time buy the Dec soybean 1150 call. This option strategy is a strangle. Pay 7 cents or $350 for the strangle plus commissions and fees.

Risk/Reward

Futures-N/A

Options-Risk on a GTC stop loss at 5 cents or $250 plus trade costs and fees. Work to exit strangle at 25 cents on a good to cancel order for a gain of 18 cents per strangle less trade costs and fees.

If you would like to receive more information on the commodity markets, please use the link to join our email list Sign Up Now

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

311 S Wacker Drive Suite 540

Chicago, Il 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

/Oracle%20Corp_%20logo%20on%20phone%20and%20stock%20data-by%20Rokas%20Tenys%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)