Direct indexing is no longer a strategy reserved for ultra-rich investors. Retail investors can access it now. While it is a relatively newer term for retail investors and might feel like another finance buzzword, it is a powerful tool that can actually lower an investor’s tax bill and allows them to customize their portfolios that align with their personal values.

What is Direct Indexing?

Direct indexing refers to the investment strategy where an investor owns the individual stocks that make up an index, like the S&P 500, instead of owning a single fund or ETF that tracks that particular index. While on the surface, this might sound simple, the implications of this strategy are compelling. The investor holds the underlying securities and can customize their holdings by excluding or including certain sectors in their portfolio. Additionally, they can perform tax maneuvers on single positions. All of this wouldn’t be possible inside a pooled fund.

Why Do Investors Use Direct Indexing?

Personalization and Values Alignment

More investors are seeking to align their portfolios with their personal and social beliefs. Direct indexing makes that possible. The investors can exclude specific industries that they do not support, such as tobacco or weapons, and overweight sectors that they have a strong confidence in, such as renewable energy or AI. This way, they can create a portfolio that reflects their personal values without sacrificing diversification. This degree of customization wouldn’t be possible with off-the-shelf index funds.

Minute Control over the Portfolio

Investors gain the ability to micro-manage their portfolios with direct indexing, where they can adjust exposure, avoid overlap with other holdings, and also gift individual securities. Thanks to technological advancements and fractional shares, this institutional level of control is now available to everyday investors by means of direct indexing.

Tax Loss Harvesting at the Stock Level

Tax-loss harvesting is one of the most powerful advantages of direct indexing. When an individual stock in an investor’s portfolio drops in value, they can sell that position to realize a tax loss, offsetting the gains elsewhere in the portfolio, thereby improving the after-tax returns significantly. Unlike mutual funds or ETFs, where everything is pooled together, direct indexing allows for individual stock-level tax management.

Who should consider Direct Investing?

Direct Indexing is especially beneficial for high-income investors with taxable accounts seeking tax minimization. It is an ideal choice for investors who are focused on ethical or ESG investing and want to personalize their holdings accordingly. Direct indexing is also preferred by advisors and wealth managers who want to offer more and better customization options.

Traditionally, direct indexing was only available to high-net-worth individuals due to high minimums, which often were $250,000 or more, but new fintech platforms have broken down this barrier. Some platforms now allow direct indexing at as little as $1000-$5000 with annual fees ranging from 0.20% to 0.40%, depending on services and automation level.

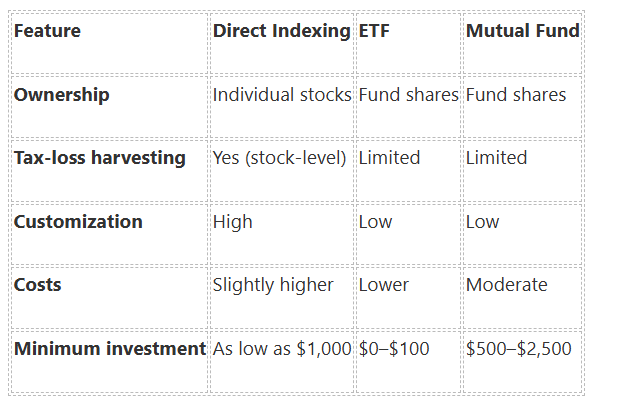

Direct Indexing vs. ETFs and Mutual Funds

Best Platforms offering Direct Indexing in 2025

Public.com

Minimum investment requirement is around $1,000. Public.com stands out because it has made direct indexing accessible to everyday investors by removing high account minimums and offering intuitive portfolio customization tools. Investors have the choice to select from prebuilt indices such as the S&P 500 or the Nasdaq 100, and they can customize it accordingly and apply tax-loss harvesting automation. Public.com offers a low-cost, user-friendly gateway to direct indexing, a strategy once exclusive to the ultra-rich.

Fidelity Investments

The minimum investment requirement stands at $5000. Fidelity’s direct indexing platform integrates seamlessly with its broader ecosystem, which provides robust tax optimization and allows advisors to implement ESG or personal preferences easily. It is ideal for investors already managing taxable accounts in the Fidelity ecosystem who want deeper control and advanced reporting.

Charles Schwab Personalized Indexing

The minimum investment requirement is typically around $100,000, which is on the higher end, but Charles Schwab’s service focuses mainly on high-net-worth investors and advisors. While its minimums are higher, its sophisticated tax optimization makes it appealing to serious investors.

Wealthfront

With a minimum investment of $100,000, Wealthfront is one of the great platforms for direct indexing. Its automated tax-loss harvesting and daily rebalancing make it one of the best robo-advisors for tax efficiency.

How to choose the right direct indexing platform?

The checklist below would come as a rescue while comparing platforms for direct indexing:

- Tax optimization frequency: How frequently are the losses harvested – daily, weekly, or monthly? It is an essential point of consideration.

- Customization options: Investors seeking to align their portfolios with personal and ethical preferences should select a platform offering a high level of customization options.

- Fee transparency: Investors should always choose a platform that offers transparent, all-in pricing without additional advisory or platform fees or hidden charges.

- Reporting and support: Ensuring robust tax documentation and support for taxable accounts is essential.

- Minimum investment: Investors who want to start small would prefer fintech platforms such as Public.com, whereas large account balance holders would opt for platforms like Charles Schwab, which can offer them trusted services and professional assistance required by the high-net-worth clients.

Steps to get started with Direct Indexing

- Assessing the portfolio: It is important to decide how much of the taxable assets the investor wishes to dedicate to direct indexing.

- Comparing platforms: Fees, tools, customization options, and minimum investment requirements should be considered before choosing the platform.

- Setting up the customization preferences: The investor should choose which stocks or sectors to include or exclude.

- Monitoring and rebalancing: Automation helps, but periodic review ensures alignment with goals.

Direct indexing is transforming how people invest. What was once reserved for institutions and the wealthy is now accessible to nearly anyone, thanks to fintech innovation. Platforms like Public.com, Fidelity, and Schwab have made it easier to build personalized, tax-efficient portfolios that align with your financial goals and values. If somebody is looking to reduce taxes, gain control over their holdings, or make their portfolio more personal, direct indexing could be one of the smartest investment strategies of 2025.