/Factset%20Research%20Systems%20Inc_%20logo%20on%20keyboard-by%20rafapress%20via%20Shutterstock.jpg)

Norwalk, Connecticut-based FactSet Research Systems Inc. (FDS) is a financial data provider. It provides integrated financial information and analytical applications to the investment community. With a market cap of $10.9 billion, FactSet operations span the Americas, Europe, the Middle East, Africa, and the Indo-Pacific.

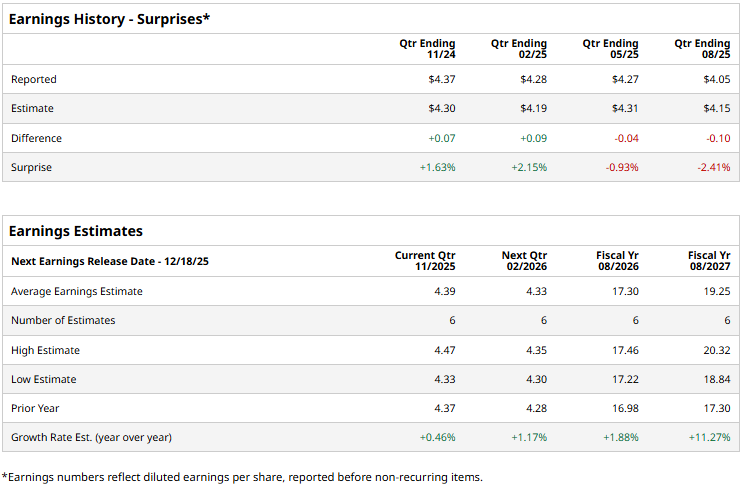

The financial data provider is expected to announce its Q1 results by mid-December. Ahead of the event, analysts expect FactSet to deliver an adjusted profit of $4.39 per share, marginally up from $4.37 per share reported in the year-ago quarter. The company has a mixed earnings surprise history. While it surpassed the Street’s bottom-line estimates twice over the past four quarters, it missed the projections on two other occasions.

For the full fiscal 2026, FDS is expected to deliver an adjusted EPS of $17.30, up 1.9% from $16.98 reported in 2025. While in fiscal 2027, its earnings are expected to surge 11.3% year-over-year to $19.25 per share.

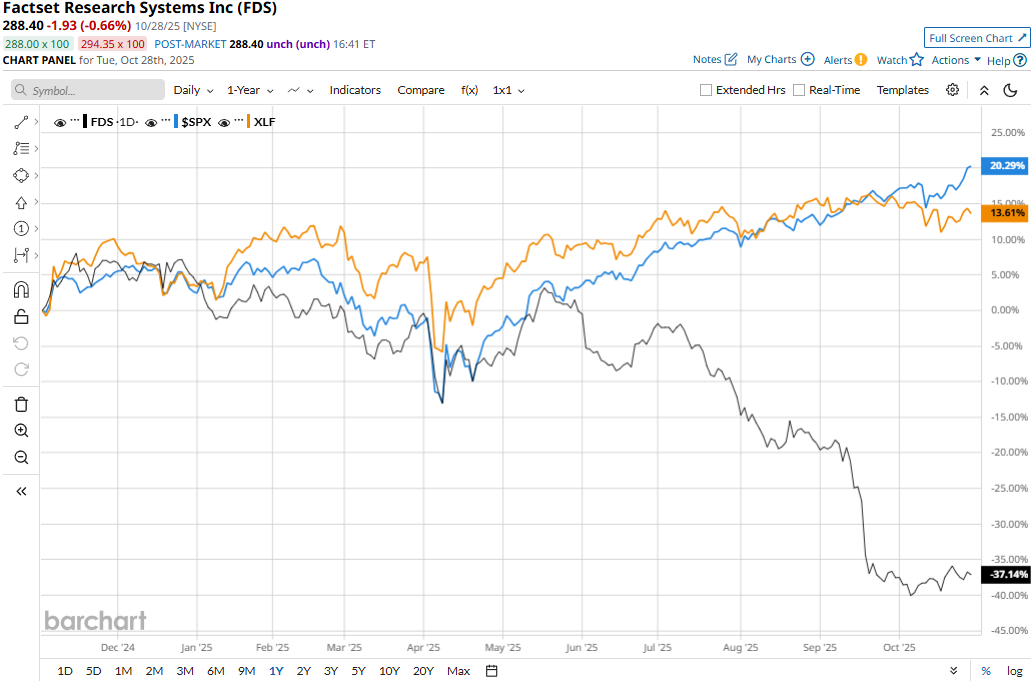

FDS stock prices have tanked 37.2% over the past 52 weeks, notably underperforming the Financial Select Sector SPDR Fund’s (XLF) 12.2% gains and the S&P 500 Index’s ($SPX) 18.3% returns during the same time frame.

FactSet Research’s stock prices plunged 10.4% in a single trading session following the release of its Q4 results on Sept. 18. At the end of August, the company’s annual subscription value (ASV) stood at $2.4 billion, up a notable 6.7% year-over-year. Meanwhile, its revenues for the quarter increased 6.2% year-over-year to $596.9 million, beating the consensus estimates by 72 bps.

However, the company’s operating margins got squeezed during the quarter, observing a 200 bps contraction year-over-year, coming in at 33.8%. While its adjusted EPS grew 8.3% year-over-year to $4.05, it fell 2.4% below the Street’s expectations. Moreover, the company’s 2026 adjusted EPS guidance of $16.90 to $17.60 fell significantly below the analyst’s projections, dampening investor confidence.

Analysts remain cautious about the stock’s prospects. FDS has a consensus “Hold” rating overall. Of the 19 analysts covering the stock, opinions include two “Strong Buys,” 10 “Holds,” and seven “Strong Sells.” Its mean price target of $335.07 suggests a 16.2% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Cisco%20Systems%2C%20Inc_%20magnified%20logo-by%20Pavel%20Kapysh%20via%20Shutterstock.jpg)

/NVIDIA%20Corp%20logo%20on%20phone%20and%20AI%20chip-by%20Below%20the%20Sky%20via%20Shutterstock.jpg)