Where Are Markets Today?

The global equity markets are set for a positive start today, with U.S. equity futures leading the way, while European markets follow suit. The S&P 500 equity futures are up by around +0.7 percent, while the Nasdaq 100 equity futures are up by around +0.9 percent, signaling widespread buying activity prior to the market opening. The European equity market indices are also trading higher, up by around +0.5 percent, albeit to a lower extent, given regional market concerns. This positive start is triggered by increasing hopes of a truce in the ongoing trade tensions between the United States and China, with both parties reporting near breakthroughs prior to a critical meeting scheduled between President Trump and President Xi Jinping later this week. Moreover, according to United States Treasury officials, the talks in Malaysia were “very constructive,” thereby signaling that the tensions could ease—at least for the time being.

Stock Market: Bullish Tone

The bullish tone in US futures is also supported by the recent ease in inflation expectations. The comments by senior advisor Kevin Hassett that “inflation is decelerating,” and that “there will be no inflation data next month,” have served to further ignite market speculation that the Fed will keep interest rates stable, or perhaps turn dovish if the economy continues to weaken. This has served to drive tech and growth-sensitive names sharply higher in pre-market action, especially in Nasdaq stocks. But market participants remain wary. The government shutdown is approaching its fourth week, and, according to Hassett, is serving to subtract “a tenth of a percent each week from US GDP growth.”

European Stock Market

The European market, too, is receiving support from the same trends in the US-China relationship, although gains are limited by regional structural concerns. With slower growth, higher and sticky inflation, and limited flexibility for monetary policy, European investor sentiment has been dented. Trade optimism, although providing support in the near term, remains closely attuned to today’s German Ifo Business Climate Index, a clear pointer for European investors in understanding the collective mindset for the European Union’s biggest economy. Disappointment in that metric can readily destroy today’s optimism. The energy-sensitive sectors, too, remain delicate in the European market, where prices continue to swing on geo-headlines, particularly in Canada and Venezuela, both identified by Trump in recent comments. “Relief rally,” that’s how we view the strong futures market advance. While it’s positive that tensions are de-escalating, it’s clear that the market has not yet fully priced a resolution. “Risk-on trade positioning is highly attuned to policy communication, macro data feeds, and geopolitical trends,” we note, and we continue to recommend that clients monitor central bank communication, particularly from the ECB and Fed, as well as U.S.-China trade talks in the days that follow. The market mood is currently tilted positive, but the big picture is still mixed, “with yesterday’s advance driven by hopes, not convictions.”

Major Indexes' Performance through Monday, 27th October 2025

- S&P 500: ~6,791.69. It is also known as US 500 among CFD brokers.

- Nasdaq Composite: ~23,204.87. It is known us US 100 CFD index among brokers.

- Dow Jones Industrial Average: ~47,207.12. It is known as US CFD 30 index among CFD brokers.

- Russell 2000: ~2,513.47

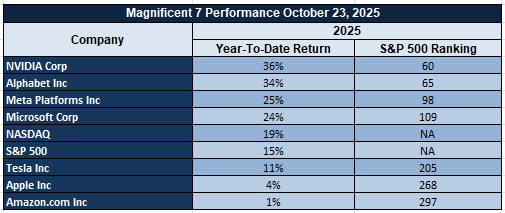

The Magnificent Seven and the S&P 500

The “Magnificent Seven,” consisting of Apple, Microsoft, Nvidia, Amazon, Meta, Alphabet, and Tesla, are again carrying an outsized burden in index gains and are also under intense scrutiny. The group has corrected hard from its recent highs, hurt by concerns of margins, regulatory tensions, and also muted growth outlooks. The weakness in the index leaders is pulling down the S&P 500 and Nasdaq Composite indexes, and it seems that without a rotation in market leaders, it will become difficult for the market to maintain its trends.

/The%20sign%20for%20Marvell%20Technology%20out%20front%20of%20a%20corporate%20office%20by%20Valeriya%20Zankovych%20via%20Shutterstock.jpg)

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Palo%20Alto%20Networks%20Inc%20HQ%20sign-by%20Sundry%20Photography%20via%20Shutterstock.jpg)