/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

AST SpaceMobile (ASTS) stock ended higher today after announcing a landmark commercial deal with Verizon (VZ) establishing a framework to provide space-based cellular broadband service across the continental U.S. by 2026.

The groundbreaking alliance followed a series of successful testing milestones, including completed direct voice and video calls between standard smartphones and AST’s satellite, demonstrating the viability of its innovative technology.

Including today’s rally, ASTS stock is trading up 290% in the year to date.

What the Verizon Partnership Means for ASTS Stock

The Verizon partnership builds upon AST SpaceMobile’s existing ties with other major U.S. carriers like AT&T (T), strengthening its position in the emerging space-based cellular communications sector.

The company’s ambitious deployment plans include having 45-60 satellites in orbit by the end of 2026, with five commercial BlueBird satellites already operational.

The integration of AST’s space-based technology with VZ’s terrestrial network infrastructure aims to eliminate coverage gaps across the country, potentially revolutionizing connectivity solutions for areas with limited terrestrial infrastructure.

In short, ASTS shares soared this morning because the Verizon collaboration improves its market credibility and provides a clear path to commercialization.

Where Options Data Suggests ASTS Stock Is Headed Next

Options data from Barchart paints a volatile picture for AST SpaceMobile stock, with a wide trading range of about $51 to $114 for contracts expiring Jan. 16.

In the near term, through the end of next week, the expectation is for a 7.1% move, with the upper bound at $88.60 and then lower bound at $76.90.

Given the company’s substantial annual cash burn of about $675 million with less than $1 billion left in its reserves, the downside scenario appears more likely to materialize in ASTS stock.

The aforementioned options data suggests investors may be pricing in these financial headwinds, which continue to cast doubt on the sustainability of AST’s capital-intensive business model.

Wall Street Warns of Significant Downside in AST SpaceMobile

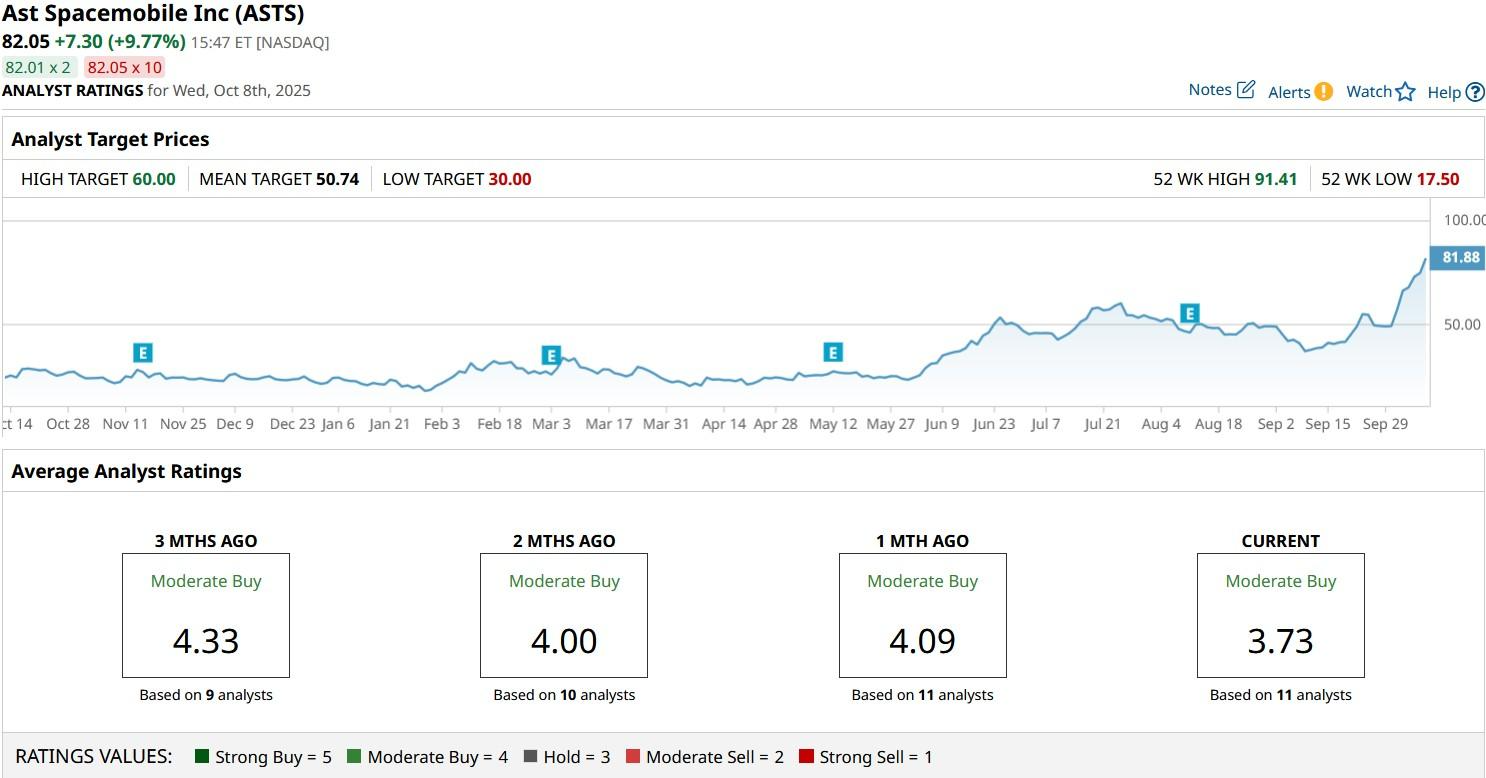

Investors should practice caution in starting a position in AST SpaceMobile shares at current levels also because they’re already trading well past the Wall Street’s highest price target.

According to Barchart, the consensus rating on ASTS shares remains at “Moderate Buy” but the mean target of roughly $51 indicates potential downside of nearly 40% from here.