Beyond Meat (BYND) shares closed down more than 36% on Monday after management announced a major debt restructuring initiative aimed at eliminating over $800 million in debt.

The restructuring includes an exchange offer for its $1.15 billion convertible notes due 2027, the El Segundo-headquartered producer of plant-based meat alternatives said in a press release on Monday.

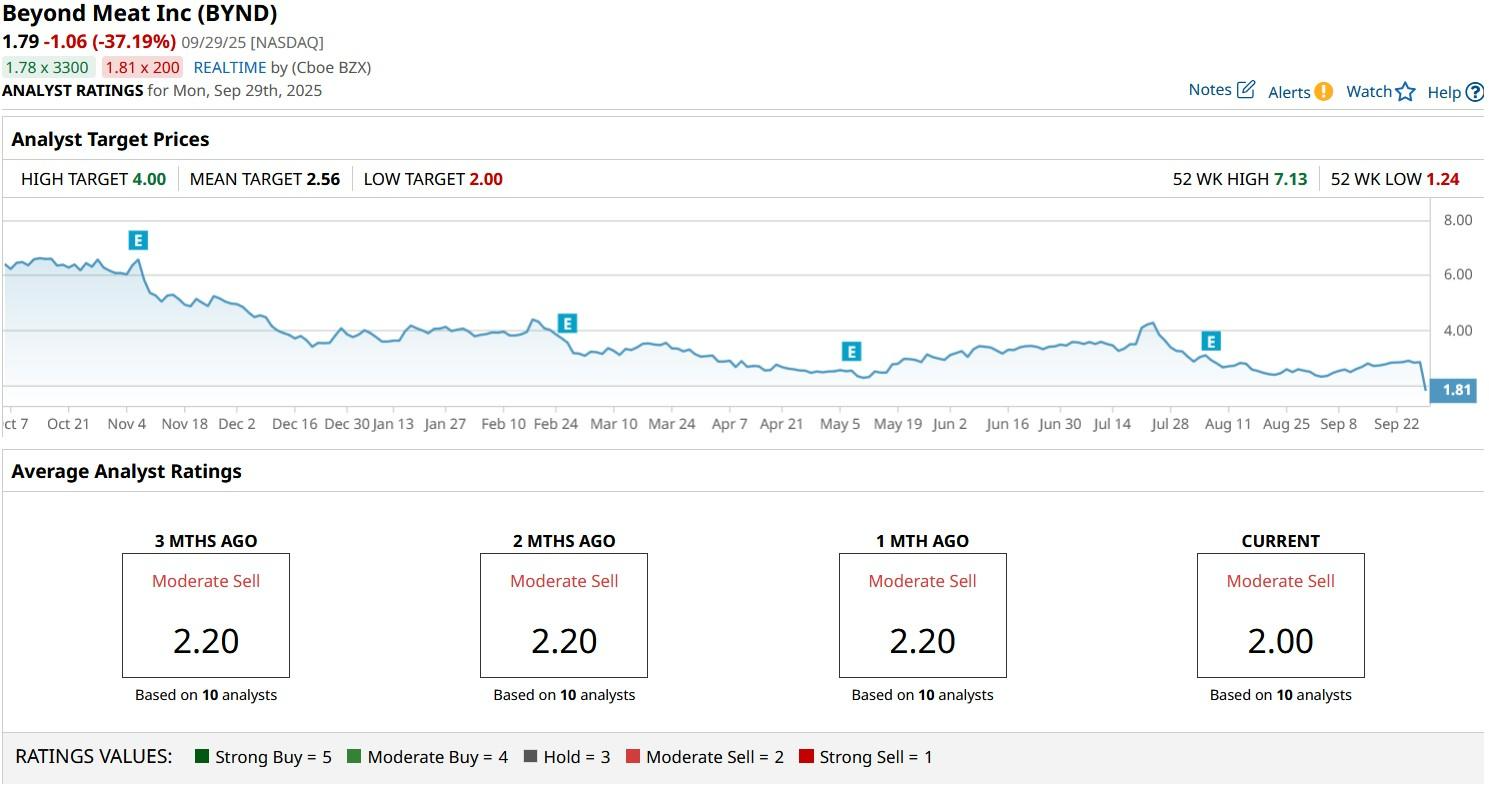

During the Monday selloff, Beyond Meat stock touched new all-time lows of $1.23.

Why Did the Restructuring Announcement Crash BYND Stock?

The debt restructuring involves issuing new 7% convertible notes due 2030 and up to 326 million of the company’s common shares.

BYND stock is responded negatively to the announced overhaul today mostly because it will result in massive shareholder dilution.

While approximately 47% of noteholders have already agreed to the exchange, the deal requires 85% participation to proceed, highlighting the complexity and uncertainty of the situation.

The new debt arrangement include a payment-in-kind feature allowing the company to pay interest with additional debt at a 9.5% annual rate instead of cash, suggesting serious concerns about cash flow.

Is It Worth Buying Beyond Meat Shares Today?

Investors should remain wary of buying the weakness in Beyond Meat shares since the company’s challenges extend beyond its debt issues.

BYND faces weak U.S. consumer demand for plant-based meat alternatives, resulting in declining revenues and wider-than-expected losses in recent quarters.

Management’s recent decision to withhold full-year guidance further indicates uncertainty about near-term business prospects.

Plus, the Nasdaq-listed firm continues to grapple with rising input costs and supply chain pressures as well.

All in all, while the debt restructuring may reduce near-term bankruptcy risk, the combination of ongoing cash burn, weak revenues, and massive shareholder dilution presents significant concerns.

Beyond Meat Remains a ‘Sell’-Rated Stock

What’s also worth mentioning is that the consensus rating on Beyond Meat stock currently sits at “Moderate Sell,” further substantiating the risks of buying the dip on Monday.

Despite the seemingly attractive valuation after the massive price decline, therefore, the investment thesis for BYND shares remains highly speculative.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)